Share

Private equity is increasingly investing in businesses poised to benefit from the global energy transition due to the rapid shift towards renewable energy sources and the inherent opportunities in this evolving market. The long-term power forecast segment presents a particularly attractive investment opportunity, as it not only benefits from the macro energy transition but also increasingly incorporates favorable business model elements (i.e., subscription revenue models) and low capital expenditure requirements.

The Need for Long-Term Price Forecasts

Utilities and energy infrastructure investors rely heavily on long-term power forecasts to make informed investment decisions—and for valuing existing portfolios of assets—in an increasingly dynamic and complex energy landscape. These key drivers include:

- Government policies: To varying degrees, governments around the world are pushing decarbonization due to concerns about climate change.

- Advancements in renewable energy technology: Improved solar and wind efficiency are steadily driving costs down and altering the economics of power generation.

- Renewable energy intermittency: Power generation from sources like wind and solar can vary significantly based on weather and time of day, introducing added complexity.

- Battery storage: Intermittency and technological improvements have also made newer technologies like grid-level battery storage more viable. These systems enable excess power to be stored during peak generation times and discharged when demand is high.

- Customer demand: The rise of AI technology has the potential to significantly increase power demand, as data centers and computational infrastructures require substantial amounts of energy to support advanced processing. Simultaneously, customers are pushing for sustainable energy solutions.

- Emerging power related technologies: While solar and wind power generation as well as batteries are now largely proven technologies there are a host of other emerging technologies such as green hydrogen, enhanced geothermal systems and small modular reactors which could also significantly change power market economics.

Underlying Market Dynamics

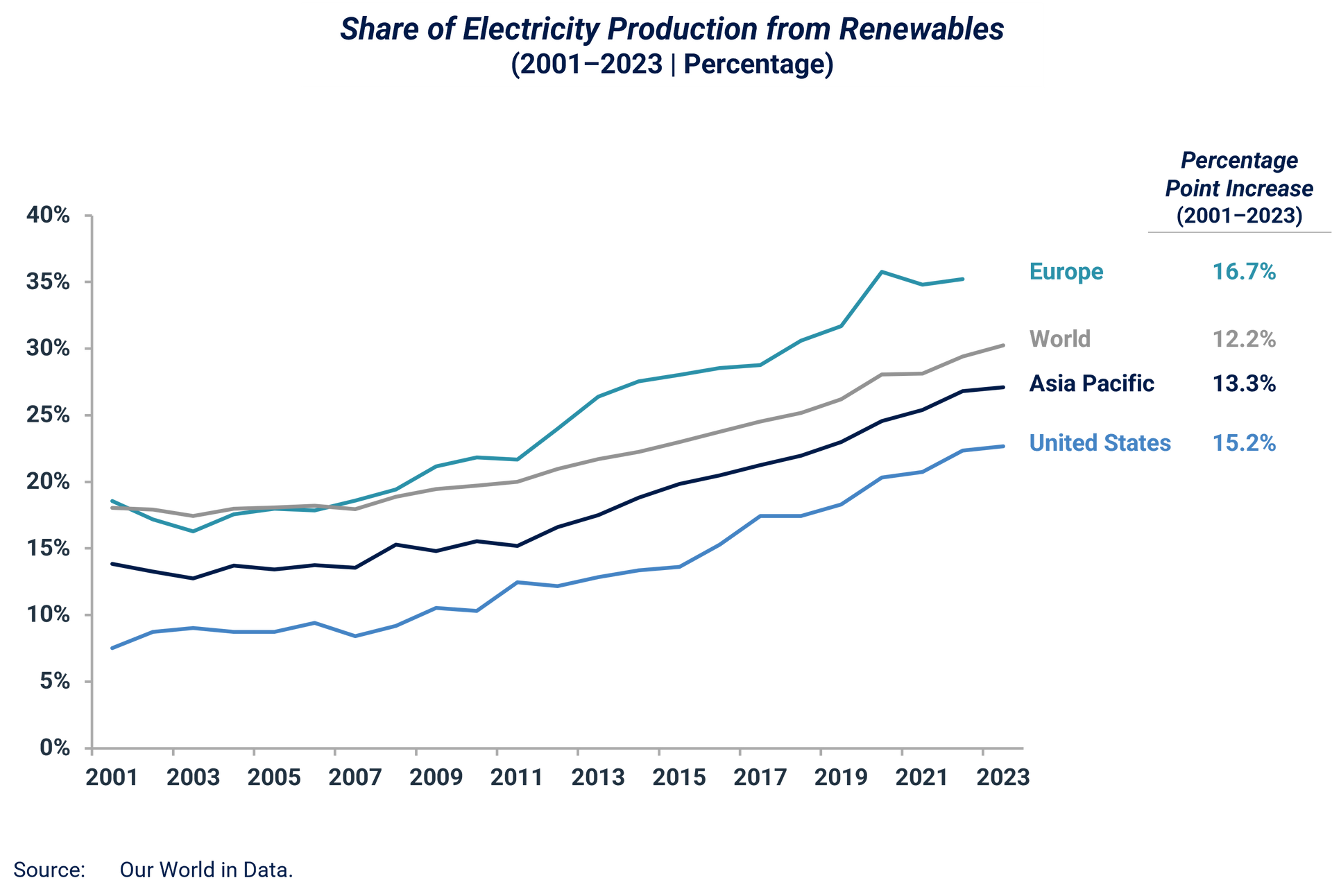

The impact of many of these drivers is reflected in the rising share of renewables across all geographies over the past two decades.

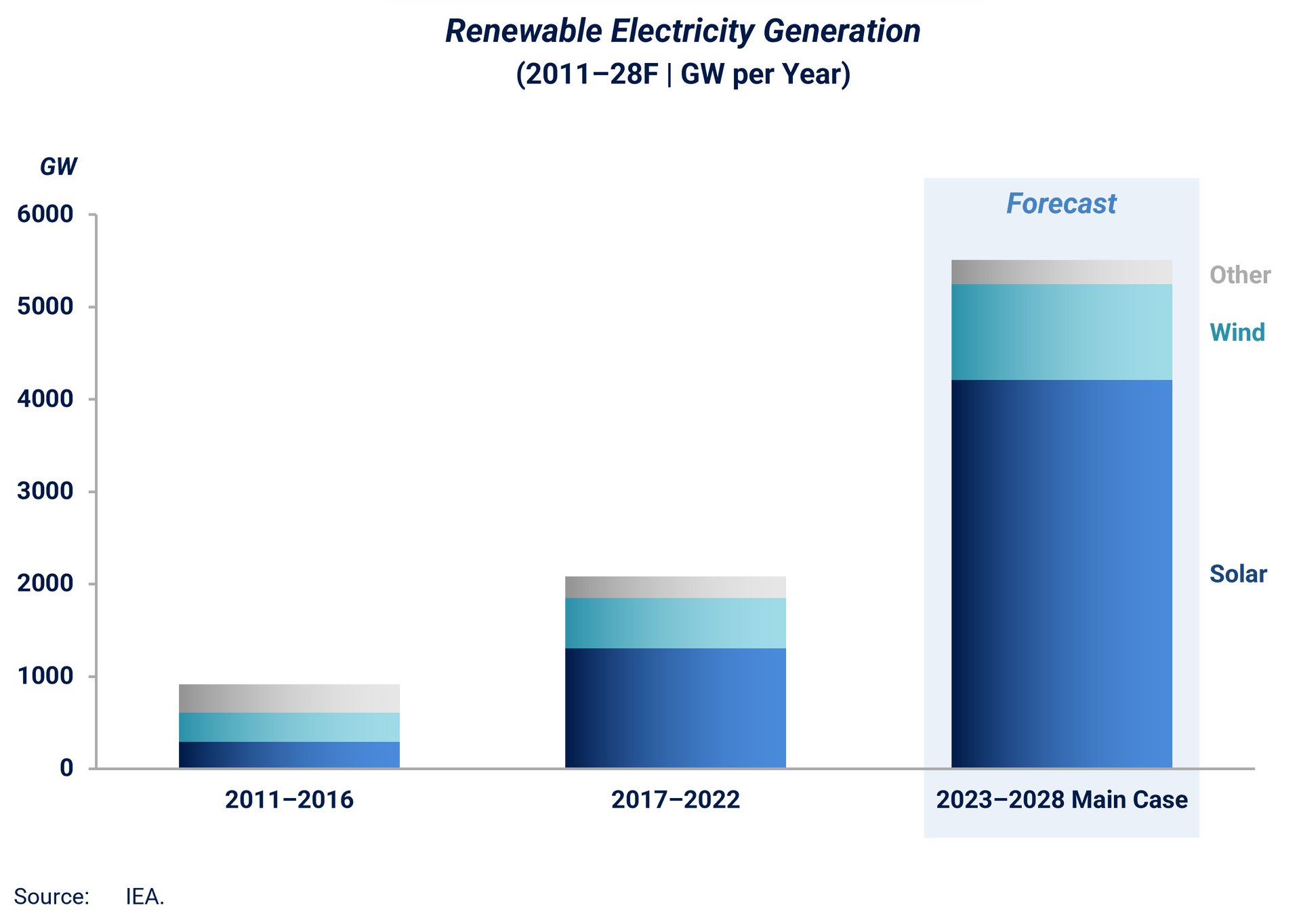

Furthermore, the International Energy Agency, which has historically (and frequently) underestimated the scale of the shift to renewables, expects this dramatic growth to continue.

Power Market Forecasting Business Models

Broadly, the need for long-term power price forecasting is served by two sets of players—with clear areas of overlap between the two:

- Model software suppliers: Utilize a power supply and demand model, enabling the customer to drive the input assumptions and scenario analyses. A leading example is Energy Exemplar which was founded in Australia but now has a global footprint and focuses on software. As such, the company does not publish forecasts themselves but rather sells access to power modelling tool called PLEXOS.

- Consultancies: Consultants who develop their own input assumptions to populate either an in-house model or a commercially available model. These consultants typically provide power price forecasts on either a bespoke project basis and/or as a subscription. Baringa and Afry (formerly Poyry) are notable European players with strong market reputations. An example of a hybrid player is Aurora Energy Research which started as consultancy with fast-growing power pricing forecast subscription business which has launched Software as a Service (SaaS) tools to that allow clients to model the overall power market and specific use cases like solar generation and battery valuation.

Key Power Forecast Purchase Criteria

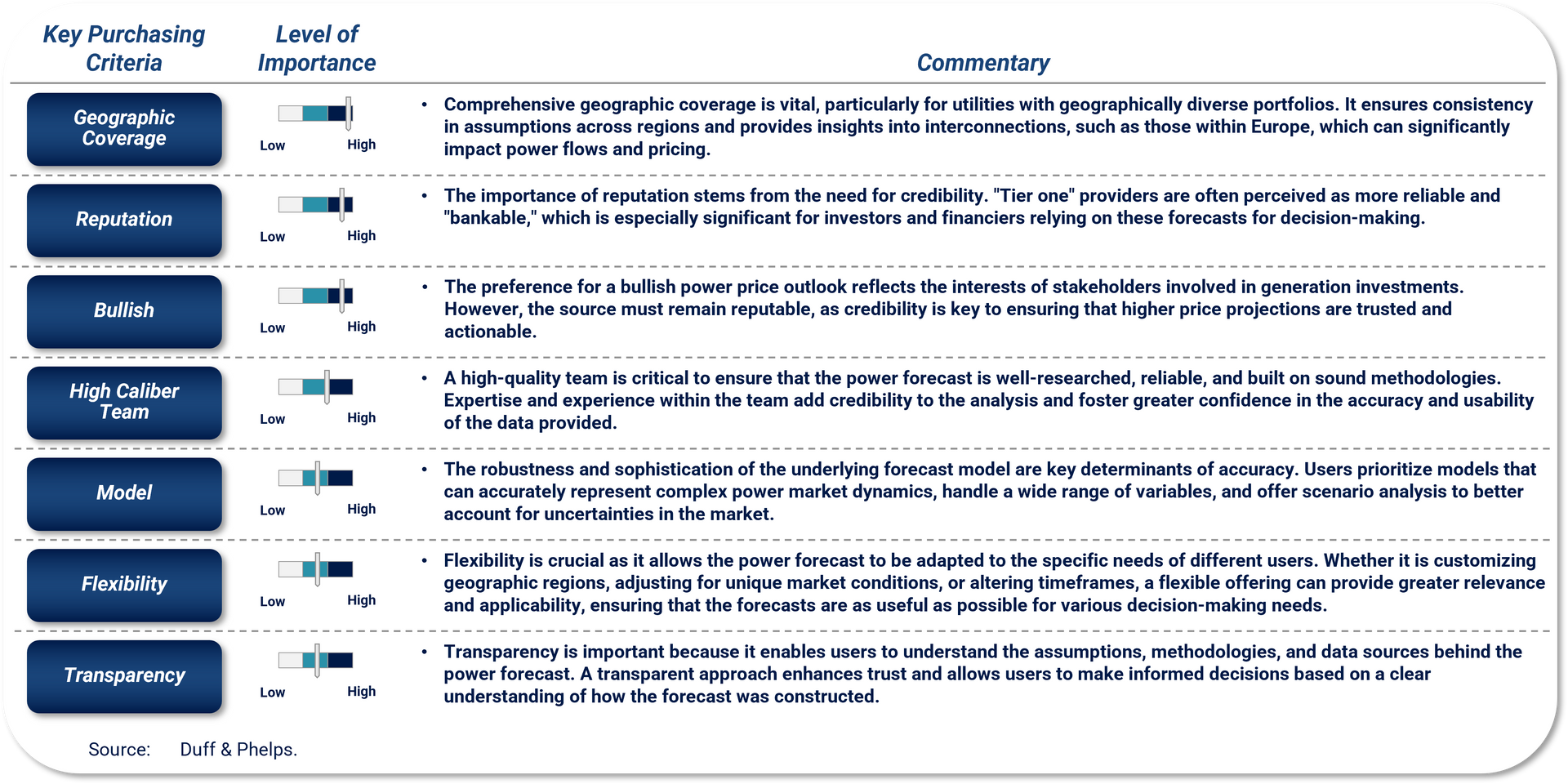

Utilities and power infrastructure investors cite geographic coverage, reputation, and being “bullish” on the market as key criteria to assess power forecast providers. Interestingly, long-term price forecast accuracy was not cited, partly in recognition of how challenging this is. But feedback suggests short-term accuracy, over a roughly12-18-month period, is reasonably important as this is considered more achievable, absent geopolitical shocks such as the Russian invasion of Ukraine.

Opportunity for the Emergence of a True Global Power Price Forecaster

There is clearly a market opportunity for a global player as geographic coverage is a key purchase criterion for utilities and power infrastructure investors, but markets are strongly country or regionally focused for the time-being. Market entry has some track record of success with both Baringa and Aurora in entering the Australian market, despite well regarded local incumbents.

Conclusion

The evolving global energy landscape, driven by the transition to renewables and rising customer demand for sustainable power, presents significant opportunities for private equity investment in the power forecasting sector. Long-term power forecasts are essential for utilities and investors when navigating an increasingly complex market shaped by technological advancements, decarbonization policies, and emerging power technologies. As power forecasting continues to mature firms with strong geographic coverage and strong reputations are best positioned to capture market share and meet the demands of an industry that is both rapidly expanding and in flux.

Stax has extensive experience in software and business information in the US and Europe. We provide assessments and risk analysis through our use of data analytics and rapid, actionable insights to aid investors in gaining the most from their capital while remaining ahead of market trends. To learn more about Stax or our services, visit www.stax.com or click here to contact us.