Share

During recent years, the payment processing solutions sector has undergone impressive expansion fueled by a multitude of factors. In 2022, the global payment processing solutions market size was valued at $46.73B and is estimated to grow to $121.34B by 2032, recording a significant CAGR of 10.1% from 2023 to 2032. The growth of e-commerce, coupled with the increasing adoption of digital payments, has played a pivotal role in shaping its trajectory. The imperative need for secure and efficient payment processing solutions has further bolstered its growth.

Moreover, as online transactions continue to surge and the world embraces a digital payment landscape, the demand for convenient and secure payment processing solutions is poised to soar.

Digital payments, including both peer-to-peer and consumer-to-business transactions, have witnessed substantial growth across all categories. This surge has predominantly favored credit and debit cards, serving as practical alternatives to cash for contact-averse consumers and aligning well with lower-value transactions, particularly in regions such as the U.S, Asia Pacific, and Europe. In Asia, however, alternative payment methods like instant and mobile payments have witnessed notable expansion, emerging as popular choices in the payment landscape.

Cash Is Out, Digital Payments Are In

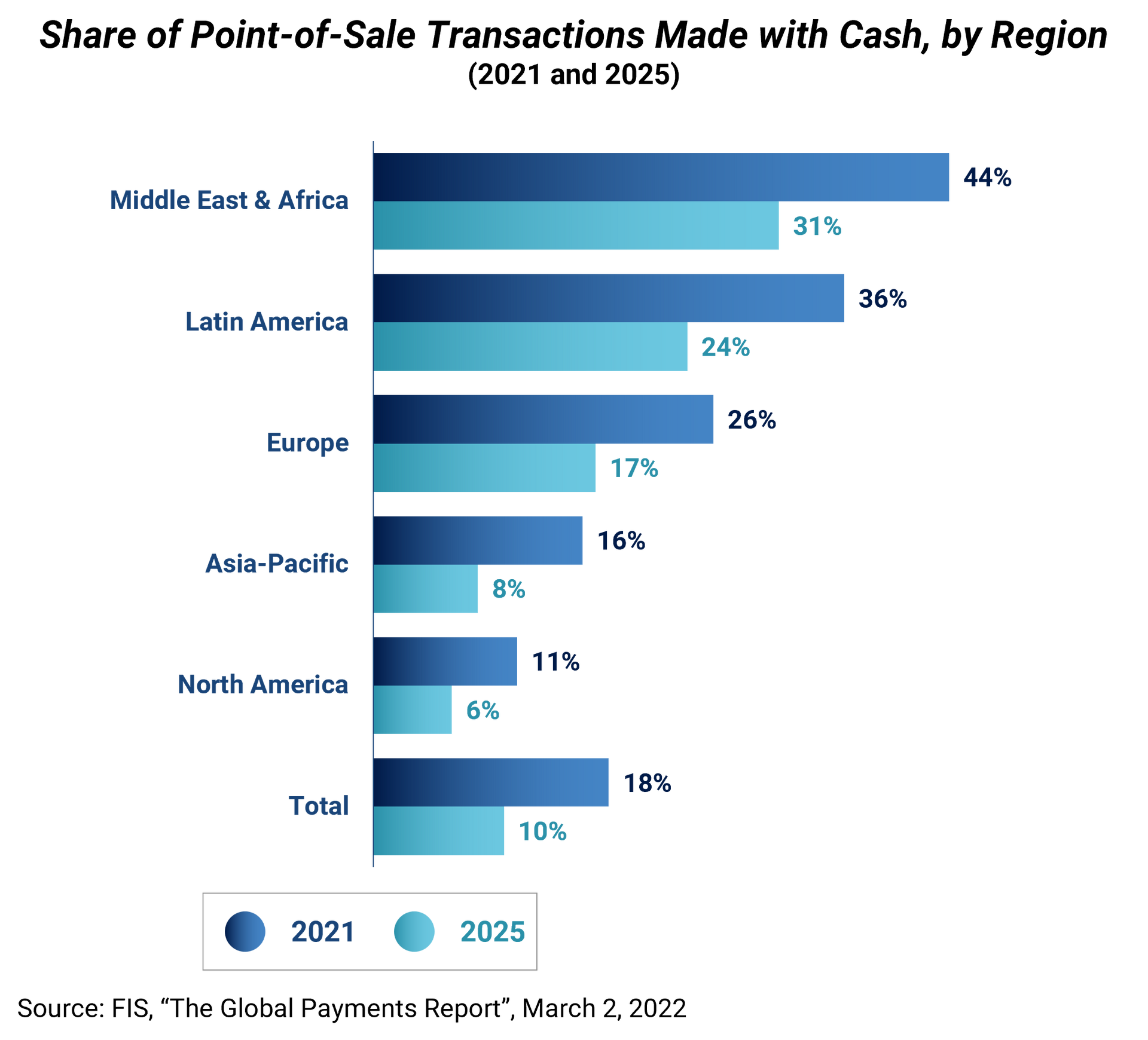

Cash usage by country has declined over time and is projected to decrease even more in the upcoming years. Cash is on the decline everywhere, accounting for at most 44% of Point-of-Sale (POS) transaction value in the Middle East & Africa and just 18% globally in 2021. Its share will drop to 10% worldwide by the end of 2025, with North America, Asia-Pacific, and Europe leading the charge away from physical money.

Digital wallets have revolutionized payment methods, leading to a decline in cash usage. These innovative tools enable users to make convenient and secure cashless transactions through portable devices such as mobile phones and smartwatches.

Alipay emerged as the world's most popular mobile payment platform in 2013, surpassing PayPal. Remarkably, Alipay remains unrivaled with an impressive user base of 1.3 billion, even after nearly a decade. WeChat Pay and Apple Pay closely follow suit, boasting substantial user counts of 900 million and 507 million respectively.

However, the mobile payment landscape has changed. While PayPal held the fourth position in 2021, it has since been overtaken by Google Pay, sliding to fifth place. Currently, Google Pay shines with 421 million active users, outpacing PayPal's 377 million by a margin of over 40 million.

The M&A Digital Payments Industry

Investors are increasing their pursuit of platforms that are capitalizing on the convergence between payments and software. There are two vectors along which companies are capitalizing on this trend.

One is that software companies are adding payment processing capabilities as an extension of their workflow, and in the process expanding their market opportunity (e.g., TAM). Secondly, payment companies are integrating payment workflow and embedding more software features and capabilities.

The right-to-win for assets in this space is based on the following factors:

- Assessing if there is a payment opportunity within a given business (or vertical).

- Determining where within the tech stack payments are most strongly aligned to address customer needs.

- Understanding which workflow (software or payments) is closest to the customer and aligned to their business interests.

Growth in the Digital Payments M&A market

The digital payments M&A space in the U.S. is experiencing rapid growth. According to a CB Insights report, the total value of digital payments M&A deals in the U.S. reached $102.4B in 2021, up from $77.5B in 2020. This represents a CAGR of 13.5% from 2017 to 2021.

Several pivotal trends are propelling the growth of the digital payments M&A landscape in the U.S.

The Future of Digital Payments

The future of the digital payments space holds promising potential. The industry is poised for sustained growth, driven by a wave of transformative technologies set to revolutionize the way consumers conduct transactions. To thrive in this dynamic landscape, businesses must adapt swiftly, offering secure and convenient payment methods.

In the short term, the industry will witness compelling trends. Blockchain technology will become increasingly prevalent in payment systems, surpassing traditional methods by delivering enhanced security and transparency. This technology will reshape the payment landscape, inspiring trust and streamlining transactions.

Furthermore, Artificial Intelligence (AI) will play an expanding role in payment processing. With its ability to automate crucial tasks like fraud detection and customer support, AI will revolutionize the efficiency and reliability of payment systems. Embracing these advancements will be instrumental in securing future success.

The journey ahead promises remarkable innovation and businesses that embrace these transformative technologies and adapt to the evolving payment landscape will position themselves as leaders in the digital payment space.

Stax provides expertise around various sectors and markets, including digital payments. To view the full scope of our services, visit www.stax.com or contact us to learn more.

Sources

- “A snapshot of cash usage around the world.” Sara Lebow, Apr. 2022.

- “Which countries are most reliant on cash and which are least reliant.” Alex Rolfe, Aug. 2022.

Read More