Share

Law firms leverage a range of solutions to enhance and optimize their business across IT, operations to legal matters. Third-party deposition services are a major part of the legal services ecosystem, and include court reporting, legal videography, interpreting services, and transcription services. These services are poised for steady topline and margin growth in the coming years, benefiting from an increasing number of cases, like-for-like pricing increases, and a shift to remote depositions.

Key Market Trends

The Covid pandemic set-in motion several trends that will benefit the market for deposition services for years to come, including rebounding case volumes and the shift to remote depositions:

A major question for the next few years is the extent to which providers are able to maintain the remote deposition as the industry standard. The signs points to yes but will be important to watch and build go-to-market strategy around it.

Market Landscape

While some risk exists due to labor supply, long-term trajectory for court reporting involves leveraging technology and has many positive benefits for service providers. Evaluating a Target’s strategy as it relates to Digital Court Reporting (DCR) and the utilization of AI is a key diligence topic.

- Number of Cases Increasing

- Underlying stability/modest growth in demand is expected to continue in the longer term.

- Covid has created a backlog of cases expected to move through the system over the next few years, creating outsized near-term opportunity for share gain as capacity remains tight.

- Like-for-Like Pricing Increases

- As labor costs have risen, court reporting services businesses have traditionally been able to transfer those cost increases to their customers.

- This is aided by the notion that absolute lowest price is not a determining factor when selecting providers (more focus on quality, accuracy, professionalism, speed).

- Shift to Remote Depositions

- The wholesale shift to remote depositions during Covid has significant opportunities for court reporting services providers on two fronts:

- De facto increasing stenographer capacity (in some cases by 50%+) by removing travel time from the equation.

- Reducing costs incurred by removing travel and location/physical space expenses.

- The latter will level the playing field for some providers who have not had a real estate/meeting space portfolio to capture that portion of the expenditure.

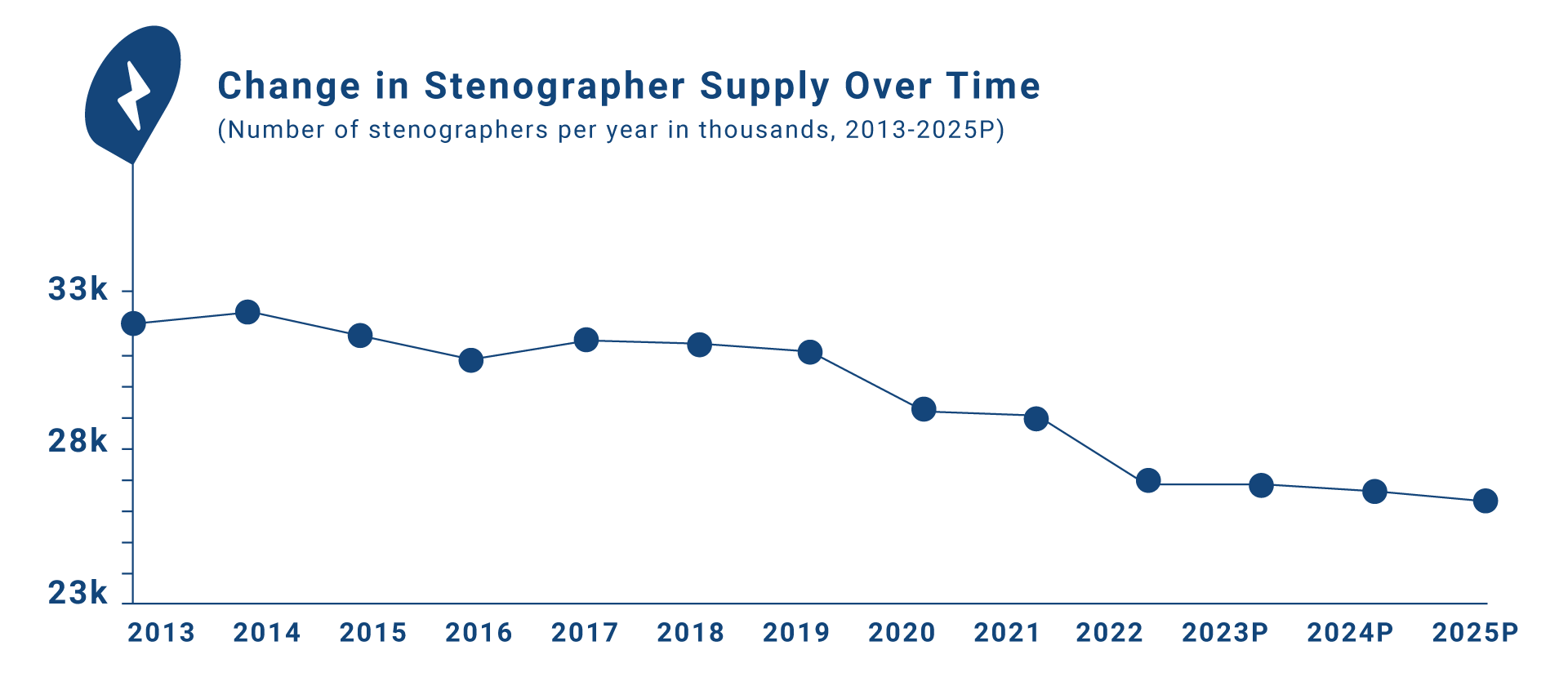

Shortage of Stenographers Over Time

There is a shortage of licensed stenographers in the U.S., with expectations this shortage will continue to grow as there are a greater portion of stenographers retiring than those entering the field.

Trend data suggests 150-250 stenographers graduate each year and upwards of 1,000 are retiring. This hasn’t been felt significantly during Covid due to courts being closed in many areas and remote depositions requiring zero travel time for court reporters. As courts reopen (with meaningful backlogs) and some shift back towards in-person, there is potential for meaningful shock to supply/demand from where it has been for the past ~3 years.

Lawyers are increasingly turning to alternate, tech-enabled court reporting solutions and remote depositions as it becomes more difficult to find licensed stenographers.

Emergence of Alternative Solutions

Digital Court Reporting

Digital court reporting allows non-licensed stenographers to join remote depositions and provide transcription services as an alternative to traditional stenographers.

- Digital court reporting provides an alternative transcription method that allows for non-licensed stenographers to cover excess demand that can’t be served by traditional stenographers.

- The digital court reporting will increase in prevalence, especially in less complex cases where firms can rely on software transcriptions to be reviewed by unlicensed stenographers.

Voice-to-Text

Voice-to-text technology is an artificial intelligence tool that can transcribe a deposition in real time through computer software rather than human labor.

- Voice-to-text is fully reliant on artificial intelligence technology to transcribe depositions; these tools are less widely used due to a higher number of mistakes.

- Furthermore, voice-to-text is often viewed as inadmissible in courts and not allowed by many court systems.

- Going forward, a pure voice-to-text solution is less likely to be highly utilized due to total reliance on software capabilities and state requirement.

Competitive Landscape

Six of the seven largest legal support providers are backed by private equity firms, which have focused on growing the businesses through M&A to expand both geographies and service lines. This has led to a diversification of providers that expand to different levels of the ecosystem and provide different trade-offs in their services.

National Providers tend to have the largest geographic reach while also offering the largest breadth of services. Additionally, they are more likely to have availability—especially on short notice. Their capacity also reaches to technological resources, which are used by national providers to assist with operations and, more specifically, remote depositions. Lastly, while their breadth of service makes them a “one-stop-shop” for clients, the quality of their individual court reporters tends to vary.

Regional/ Local Providers, on the other hand, tend to have stronger relationships between attorneys and individual court reporters. These relationships, coupled with generally lower turnover cycles, lead to increased confidence in these reporters. They may also be potentially more familiar with local courts in jurisdictions without national provider presence, further increasing this confidence. However, regional/ local providers are less likely to have availability when compared to national providers, especially for next day or same day scheduling.

Individual/ Freelance Providers are typically the most affordable providers. Their size opens up the possibility to build rapport with individual court reporters that have been utilized in the past. In addition, they are usually the cheapest of the providers as a result of their lower overhead; however, they are the least likely to have availability for scheduling and the accuracy of their transcripts can sometimes be questionable due to the lack of quality control for their court reporters.

Conclusion

Despite mounting M&A activity in the legal services market in recent years, Stax continues to see substantial runway for continued consolidation and opportunities especially for the larger platforms to further add/expand capabilities and geographic footprint. Core considerations for product/service expansion via acquisition should be on mapping the decision-making process, as disparate decision processes within organizations can create significant barriers to cross-sell, especially in the legal services markets where cross-department collaboration and information-sharing is uncommon.

Stax aims to provide actionable insights designed to create efficiencies and promote growth that will help investors get the most out of their capital. To hear more about our services and expertise, visit www.stax.com or contact us here.