Share

The financial model of higher education is under increasing strain. Traditional revenue streams—most notably tuition and federal funding—are facing mounting headwinds due to long-term demographic shifts and policy-driven shocks. As institutions navigate this volatile landscape, fundraising is emerging as a mission-critical lever for financial sustainability and strategic growth. Demand is accelerating for technology and services that can enable Advancement teams to modernize operations, scale engagement, and capture a greater share of philanthropic dollars—particularly as a massive $100+ trillion wealth transfer unfolds.

This inflection point presents investors with a unique window to act. As institutions urgently seek more effective fundraising solutions, early-mover platforms with differentiated value propositions are poised to capture outsized growth. With a large and underpenetrated addressable market, growing institutional willingness to pay, and a fragmented vendor ecosystem, the higher education fundraising solutions space offers investors a rare combination of investible themes.

Higher education is facing intensifying revenue-side pressure, driven by long-term secular trends as well as recent regulatory shocks.

Postsecondary enrollment—which drives tuition revenue—is expected to remain flat into the 2030s, largely due to demographic shifts stemming from declining birth rates. At the same time, new federal policy actions related to international students further challenge the tuition equation. Earlier this year, the US State Department temporarily paused new student visa processing as it prepared to implement stricter social media screening for applicants. While the Department has restarted processing as of mid-June, all applicants are now required to unlock their social media accounts for government review, which will likely dampen international student enrollment.

Federal funding for higher education has also become more volatile. Institutions perceived to be noncompliant with Trump administration positions—particularly on issues related to Diversity, Equity, and Inclusion (DEI) and the Israeli-Palestinian conflict—may find themselves at risk of losing federal grants and contracts. More broadly, the Trump administration’s efforts to dismantle the US Department of Education have cast doubt on the long-term stability and scale of federal funding into higher education.

In this environment, fundraising has become a strategic imperative for institutions across the higher education landscape.

In the last pre-pandemic fiscal year (FY19), revenues from gifts comprised only 11% of 4-year private, not-for-profit institutions’ revenues and less than 3% of 4-year public institutions’ revenues. With traditional revenue sources under pressure, many institutions are now scaling and accelerating their fundraising efforts, setting more ambitious targets and launching new campaigns to shore up their financial health.

This heightened focus on fundraising coincides with one of the largest wealth transfers in history. Through 2048, approximately $124 trillion in assets are set to change hands. Of that amount, around $106 trillion will be inherited by younger generations—primarily Gen X, millennials, and Gen Z—with the remaining assets designated for charitable causes. For colleges and universities, this historic shift represents a critical window of opportunity to capture philanthropic dollars and strengthen long-term financial sustainability.

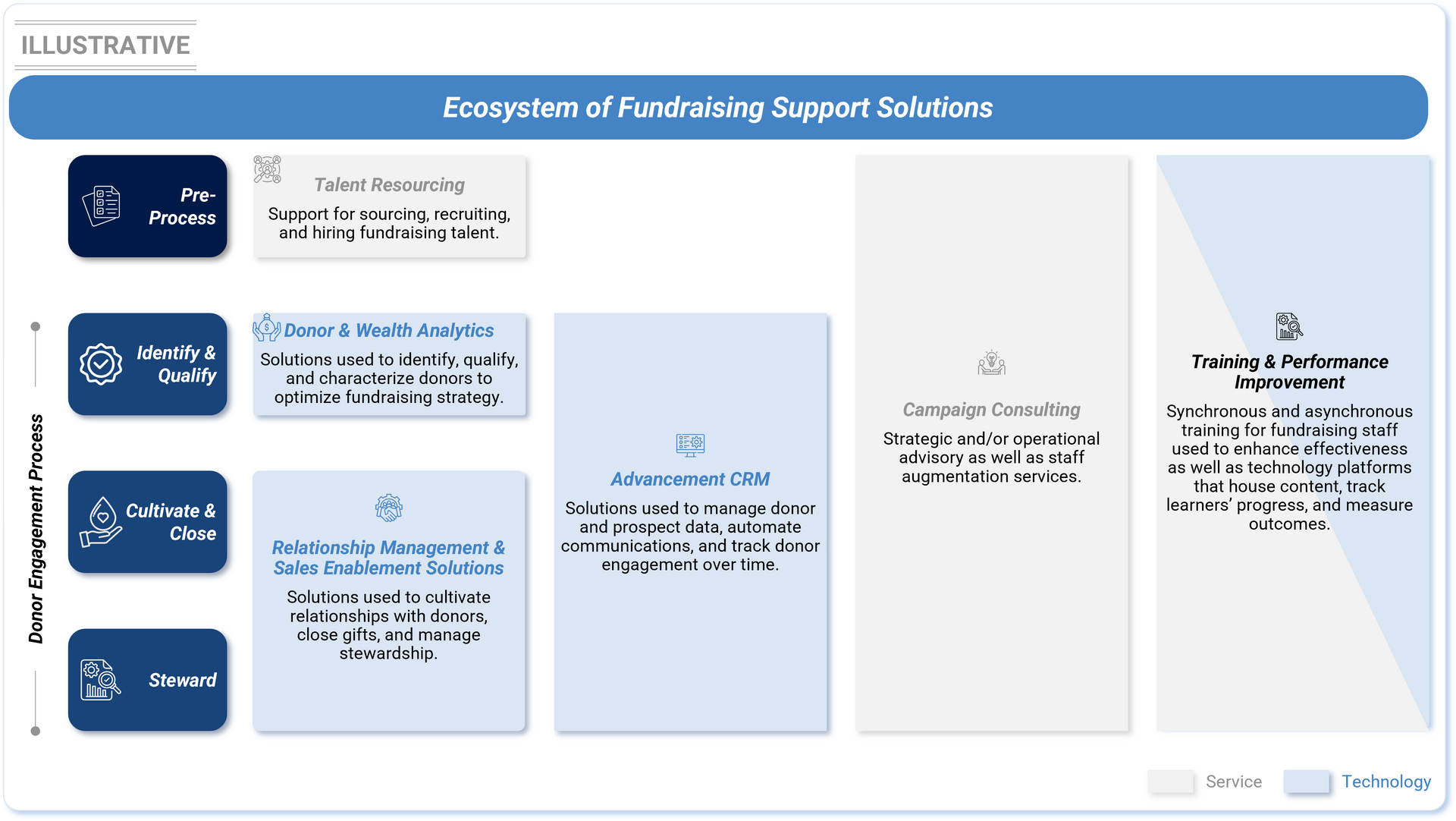

In response to growing fundraising urgency and opportunity, many institutions are making strategic investments in fundraising technology and services to enhance performance across the donor lifecycle (see figure below).

Typically, these solutions:

- Align with one or more key stages of the donor engagement process, ranging from prospect identification and cultivation to solicitation and stewardship.

- Focus on specific segments of the donor base and Advancement Office: some solutions are designed to support annual giving programs targeting smaller-dollar donors at scale, while others focus on the nuanced needs of major and principal giving teams working with high-net-worth (HNW) and ultra-high-net-worth (UHNW) individuals.

Stax-Highlighted Investible Themes

Overall, several dynamics are converging to create a highly attractive investment profile for the higher education fundraising technology and services space:

- First, macroeconomic and sector-specific forces—namely stagnant postsecondary enrollment, federal regulatory shocks, and the massive intergenerational wealth transfer—are creating strong tailwinds for institutional fundraising. As Advancement Offices face mounting pressure to deliver, there is growing willingness to pay for solutions that enhance fundraising workflows and outcomes, driving net-new adoption across the sector.

- Second, beyond higher education’s “mega fundraisers”—the most selective and well-endowed institutions—most colleges and universities remain significantly under-optimized in the Advancement Office. Outdated technology, manual processes, and under-resourced teams continue to hamper operational efficiency and effectiveness. As a result, there is ample unpenetrated whitespace across the sector into which fundraising solutions can scale—particularly with the support of private equity investment.

- Third, while institutions increasingly seek holistic solutions that can streamline donor engagement end-to-end, the market remains fragmented. There are few, if any, scaled platforms that address the full donor lifecycle—from discovery to stewardship—despite strong demand for integrated, cost-effective, and easy-to-use solutions. This fragmentation presents compelling opportunities for private equity-led consolidation, either through platform build-ups or tuck-in acquisitions.

- Finally, the space offers robust exit opportunities. Both technology and services assets in the fundraising ecosystem are well-positioned for acquisition by strategic buyers, ranging from EdTech platforms expanding into fundraising management to horizontal ERP and CRM providers seeking to deepen their presence in fundraising and/or higher education.

Conclusion

The current climate has elevated fundraising from a supporting function to a strategic imperative across higher education. Institutions are increasingly looking to modernize and scale their Advancement capabilities, creating strong demand for purpose-built technology and services as well as attractive opportunities for private equity investors. Overall, platforms that can deliver measurable impact, scale intelligently, and meet institutions where they are in their transformation journey are best positioned for growth.

To learn more about Stax and our EdTech expertise, visit www.stax.com or click here to contact us directly.