Share

The oil & gas (O&G) industry once again faces the familiar challenge of navigating deflationary pricing. Global demand growth is losing momentum, driven by macroeconomic headwinds and tariff uncertainties weigh on global oil demand. While regulatory shifts—such as rolling back environmental rules, expanding access to federal drilling land, and slowing the advancement of renewable energy—were intended to stimulate upstream activity, these measures have not counteracted the downward pressure on oil prices.

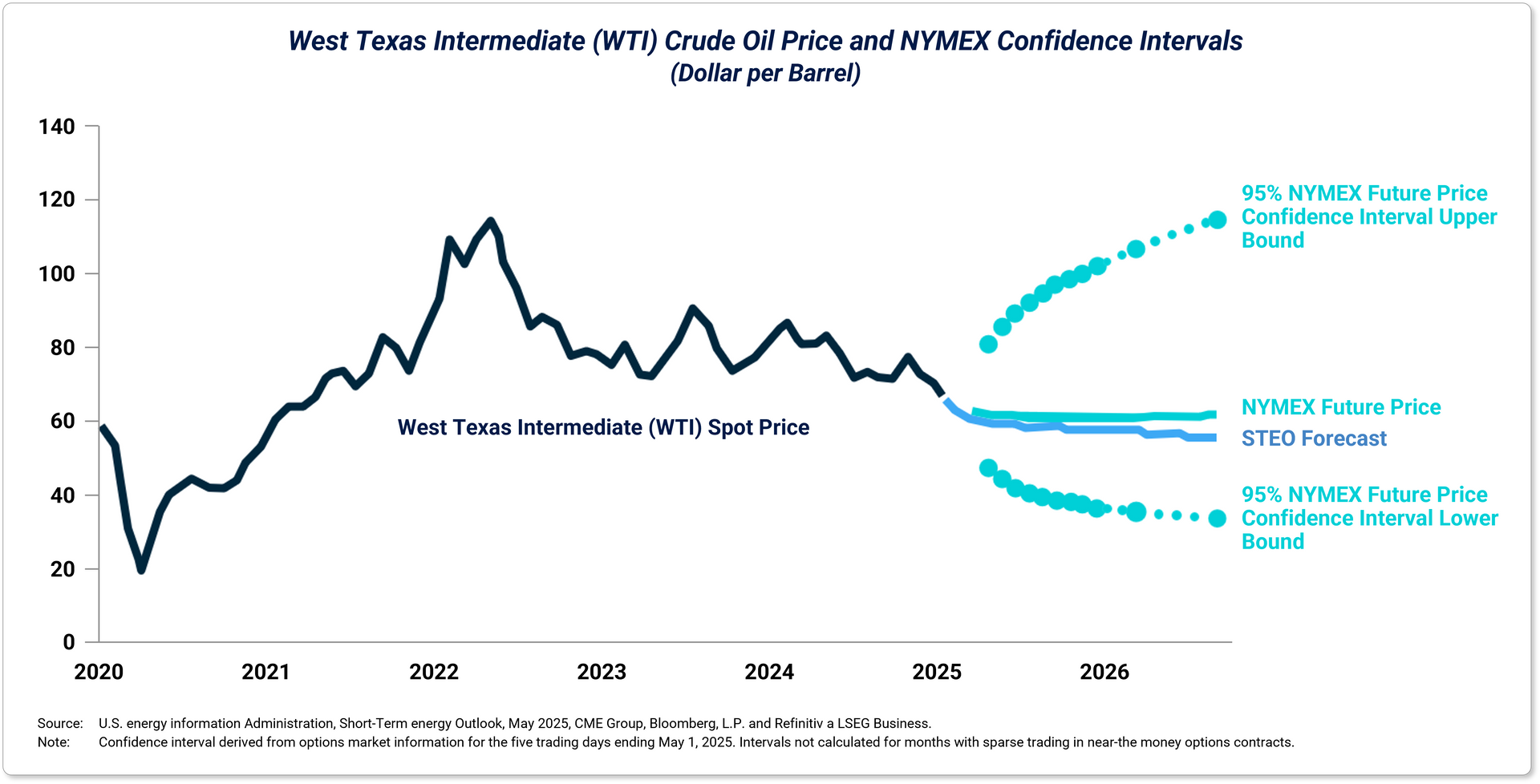

According to the US Energy Information Administration‘s (EIA), West Texas Intermediate (WTI) crude oil prices are projected to decline from $70 per barrel in 2025, to as low as $60 in 2026 due to global oversupply and slowing demand growth.

Operators are also growing increasingly cautious. Economic uncertainty and the potential cost burden of tariffs are affecting companies' investment decisions. Oil producers are scaling back new drilling projects and prioritizing cost reductions over new investment. In this environment, many operators are turning to software investments that automate workflows and streamline headcount.

Continued Digital Transformation to Drive Operational Efficiency

Digitization and intelligent automation of operator workflows are accelerating, driven by a set of structural forces that are reshaping the oil and gas industry:

- Workforce transitions: The graying of the workforce is leading to the retirement of experienced operators and engineers, increasing the risk of lost institutional knowledge. At the same time, newer hires are increasingly tech-savvy and expect their workplaces to provide modern, intuitive digital tools.

- Labor shortages are pressuring operations: A shrinking labor pool has made it more difficult to hire and retain field service personnel. In response, operators are increasingly adopting workflow automation and remote monitoring solutions to improve asset visibility and enhance the efficiency of limited field resources.

- Evolving demand for integration: Operators now require scalable, interoperable software platforms that can enhance decision-making, optimize resource utilization, and ensure compliance with growing regulatory requirements.

As in prior periods of price deflation, the cyclical nature of oil and gas has tightened capital budgets, limiting some IT investments. However, digital transformation has not paused. Software solutions with demonstrable ROI—particularly those that support automation, real-time monitoring, and advanced analytics—are gaining traction as operators seek to improve uptime and lower cost-per-barrel.

A key trend to watch is whether oil prices remain above ~$65, a breakeven threshold for many producers. A sustained drop below that level may prompt renewed budget tightening and force operators to defer or abandon non-essential digital initiatives.

Strong Activity Upstream: Notable Momentum in Digital Oilfield Transformation

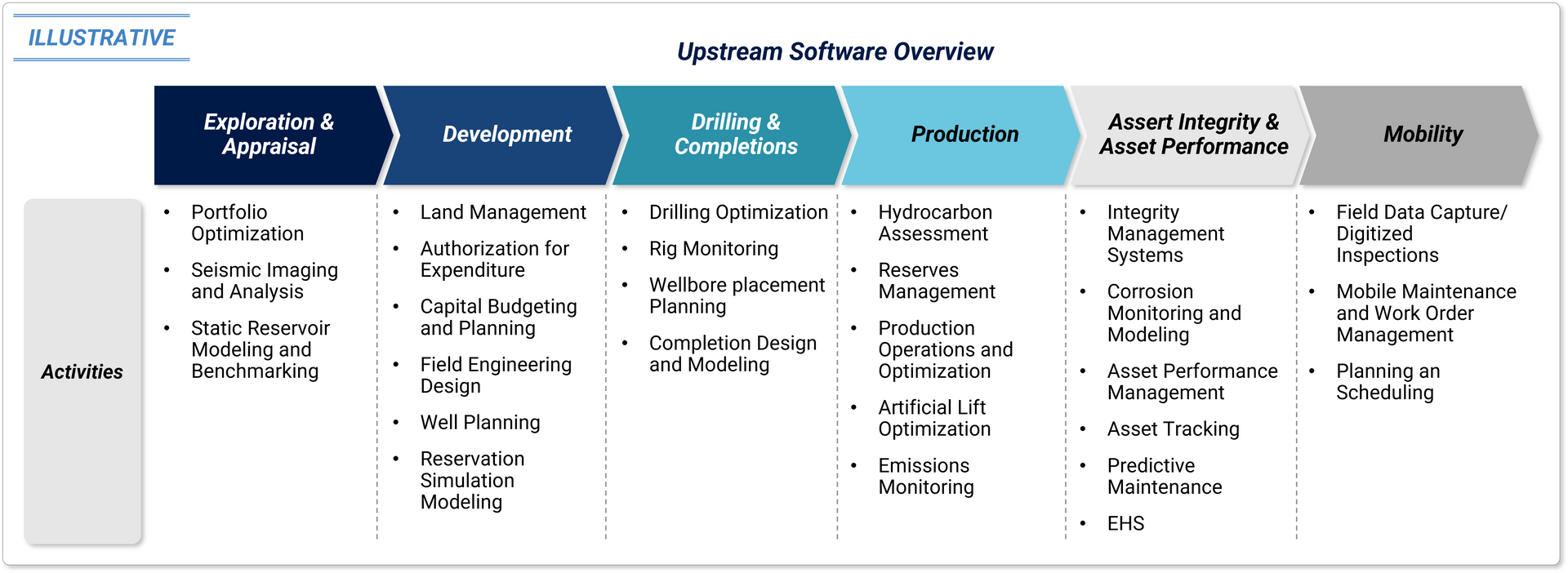

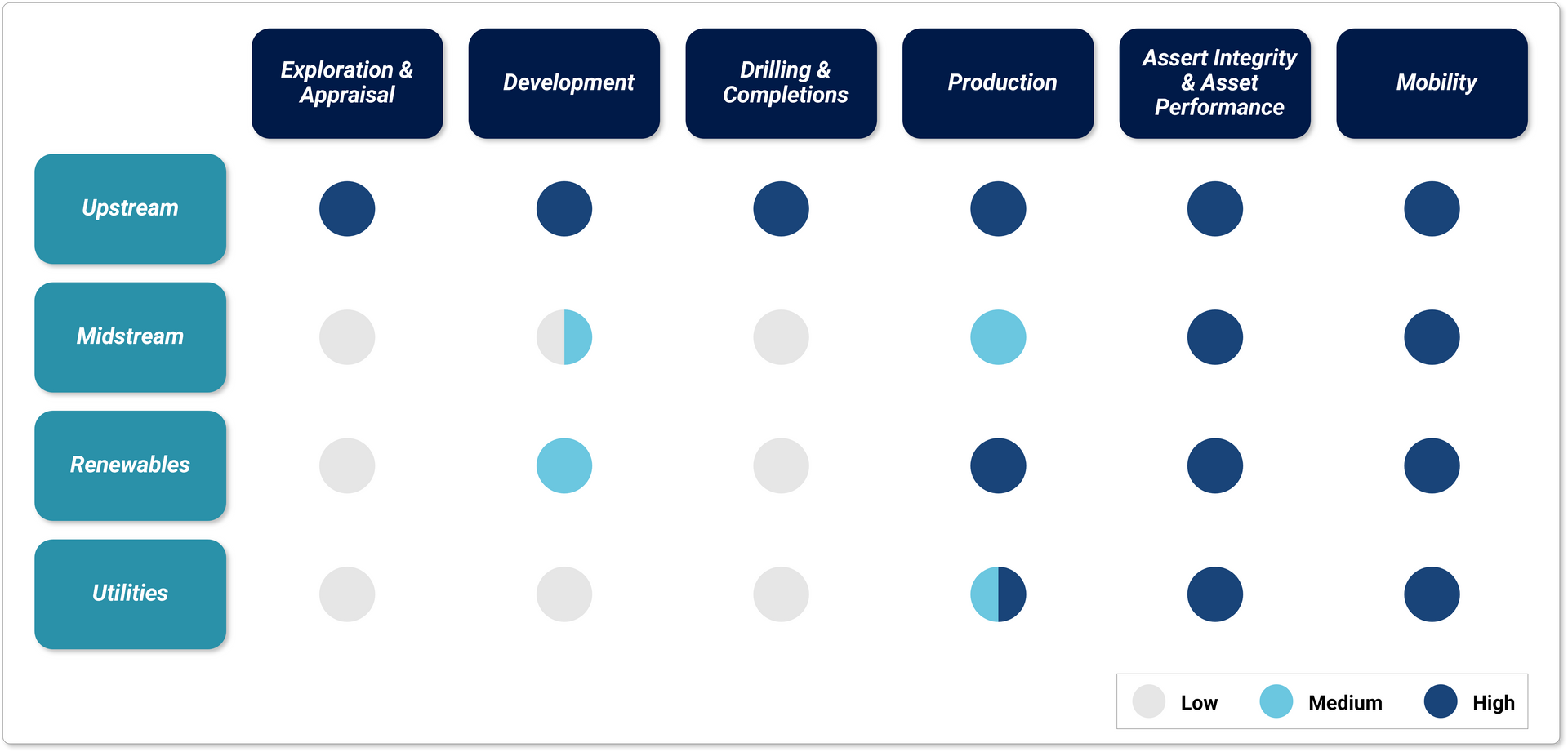

Upstream O&G operators are increasingly pursuing end-to-end digital platforms to streamline production and operational workflows. Mounting cost pressures are consequently driving a shift toward vendor consolidation as buyers seek integrated solutions that reduce complexity and total cost of ownership. Due to this, Stax anticipates continued consolidation among software providers aiming to expand their end-to-end capabilities. We are also seeing growing interest in Asset Integrity & Performance Management and Mobility solutions.

Asset integrity and performance management software is gaining investor attention driven by aging infrastructure and the growing demand for predictive maintenance. This market remains underpenetrated, with many operators still relying on spreadsheets and manual processes—highlighting significant whitespace for scalable, cloud-based adoption.

As larger O&G operators expand their portfolio and evolve into broader energy companies, asset management software that supports renewable assets are becoming more critical. Platforms capable of managing the operational complexity of wind, solar, and carbon capture assets—alongside hydrocarbon assets—are well positioned to benefit from the energy transition underway at these larger companies.

Operators are increasingly focused on unifying surveillance, maintenance, and operations—bridging field-level execution with corporate decision-making to enable more agile responses to operational risk and production variability.

At the same time, mobility solutions are no longer limited to basic field data capture. They’ve become essential platforms for incident tracking, asset condition monitoring, and compliance management.

Concurrently, vendors are increasingly converging workflows such as maintenance scheduling, asset integrity, and mobile workforce management to deliver unified solutions. These cross-sector capabilities are opening new opportunities for software providers to serve a broader slice of the energy value chain.

Market Outlook:

Despite commodity price pressures, digital transformation in O&G remains a strategic priority. Structural labor shortages, rising asset complexity, and cost-reduction pressures are accelerating adoption of integrated software platforms that drive efficiency and enhance decision-making.

Operators are prioritizing solutions that offer clear, measurable ROI, while vendors with end-to-end capabilities are especially well positioned. Digital transformation is not pausing—it’s evolving. The next wave of winners in the energy software space will be those that help operators unlock ROI today while also enabling the transition to integrated, lower-carbon operations tomorrow.

About Grant Thornton Stax

When it comes to understanding the viability of a market for investment, Grant Thornton Stax is where value is created. Our approach, centered around providing data-driven and actionable insights, enables clients to make informed decisions that lead to providing the most competitive returns. Grant Thornton Stax team brings deep experience across the energy sector, with a strong track record in energy services, utilities, oil & gas, and energy technology and data providers—including platforms like Quorum, P2 (now part of IFS), among others. To learn more about Grant Thornton Stax and our services, visit www.stax.com or click here to contact us.