Share

Healthcare M&A Activity: Q1 2023 Overview

The healthcare industry has seen an increase in M&A activity in Q1 2023, with 15 announced transactions, just below the post-pandemic high of 17 in Q4 2022. During Q1 2023, the average size of the seller in announced transactions remained high at $827M, just below the historic high of $852M reached in 2022, indicating that the trend towards larger transaction sizes continued.

The total transacted revenue for the quarter was $12.4B, just below the Q1 record of $12.7B set in 2018. One significant mega-merger was announced in Q1 2023 between Presbyterian Health Services and UnityPoint Health. The trend towards cross-regional partnerships is expected to continue and intensify in the future. Additionally, for-profit health systems are focusing on portfolio realignment efforts, with several significant hospital sales in Q1 2023.

Private Equity Investment in Healthcare Technology

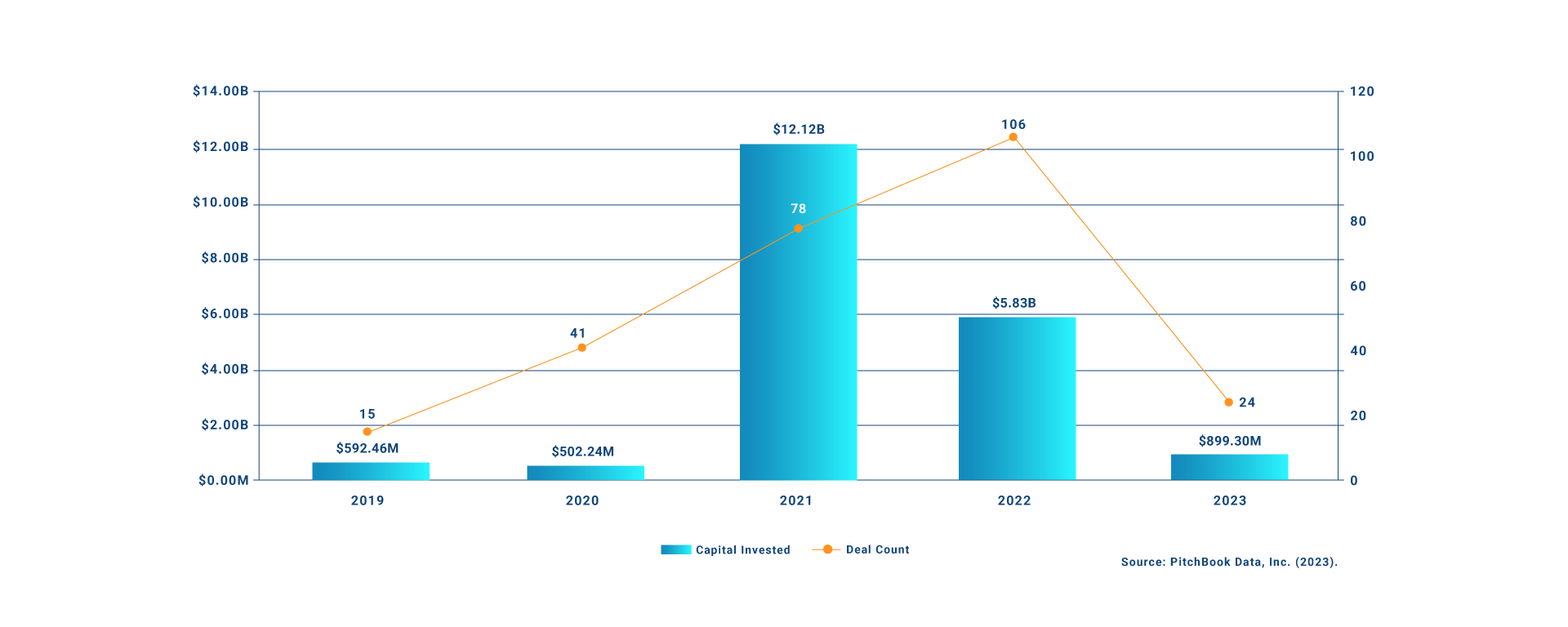

Pitchbook data on investments made by private equity firms in healthcare technology companies over the past 12 years highlights the potential of this sector in the U.S. The capital invested has increased significantly over the years, with $592.46M invested in 2019, followed by $502.24M in 2020. However, the surge in investment began in 2021, with $12.12B invested in 78 deals, a significant increase from the previous years.

In 2022, although the total investment amount decreased to $5.83B, the number of deals increased to 106. This trend is expected to continue in 2023, with an expected investment amount of $899.30M in 24 deals within the first 4–months of 2023.

This data suggests that healthcare technology companies have immense potential and are an attractive investment opportunity for PE firms, as the sector continues to grow and evolve.

Why Healthcare and Healthcare Technology Companies are Attractive Investments

Healthcare and healthcare technology companies are attractive investment opportunities for several reasons. The healthcare industry is one of the largest and fastest-growing sectors in the world−with a growing demand for innovative technologies that can improve patient outcomes and reduce costs. Covid highlighted the need for advanced healthcare technologies, such as telemedicine and remote monitoring, which have seen increased adoption in recent years. These companies also benefit from long-term revenue streams, as healthcare is a necessity and demand for these services is not expected to decline anytime soon.

Furthermore, healthcare technology companies have the potential for significant returns on investment, as they can provide investors with exposure to a large and growing market with high barriers to entry.

Challenges in Evaluating Healthcare Investments

Evaluating healthcare investments can be a complex process due to several factors. First, the healthcare industry is heavily regulated, and adhering to these regulations can be intricate and time-consuming, which increases the due diligence necessary. Second, healthcare investments necessitate specialized knowledge and expertise in medical and scientific fields, making it challenging for investors without this background to accurately assess the potential of these investments.

Moreover, healthcare investments often demand substantial upfront capital expenditures, such as research and development costs, which can be hard to appraise in terms of ROI. The long-term nature of many healthcare investments and external factors, such as government policy and emergence of new diseases, further complicates this process.

Lastly, the rapidly changing healthcare landscape and the introduction of modern technologies and treatment methods make it difficult to forecast which investments will yield the best returns. Consequently, investing in healthcare necessitates careful consideration and specialized knowledge, making it a challenging sector for evaluating investments.

The Role of Management Consultants in Healthcare Investments

Overall, management consultants can add significant value to the investment process in healthcare by providing specialized knowledge, expertise, and insights that help investors overcome the challenges of screening investments in this complex and rapidly evolving sector.

Sources

- M&A Quarterly Activity Report Q1 2023, Kaufman Hall, 2023

- Investing in Healthcare: What You Should Know, Investopedia, 2008

- Here are stocks with excellent vital signs in the health-care sector, CNBC, 2022

- How to invest in healthcare stocks and the benefits of doing so, Business Insider, 2022

- Pitchbook Data