Share

Field Service Management (FSM) software enables businesses to coordinate field operations using tools for scheduling, dispatch, and task tracking in lieu of whiteboards, spreadsheets, and ad hoc communications—offering a structured system that increases visibility, reduces delays, and standardized workflows. For firms that adopt them, the impact is tangible: fewer missed appointments, faster invoicing, better workforce utilization, and more consistent customer experience. Over time, these systems have evolved their capabilities to enable mobile payments, digital compliance reporting, and data-driven decision-making.

Private equity investment interest in the UK FSM software landscape has intensified over the past two years, creating momentum in a historically fragmented market. In 2024, Simpro Group—backed by KKR—acquired BigChange, a Leeds-based mobile workforce platform, to deepen its UK footprint. Joblogic, headquartered in Birmingham, acquired Protean Software and Clik Limited in 2023, strengthening its position as a consolidator. Around the same time, Kerridge Commercial Systems added Klipboard to its offering, while Kester Capital backed Re-flow in early 2025.

Key FSM Software Market Growth Drivers

1. Increasing FSM software adoption

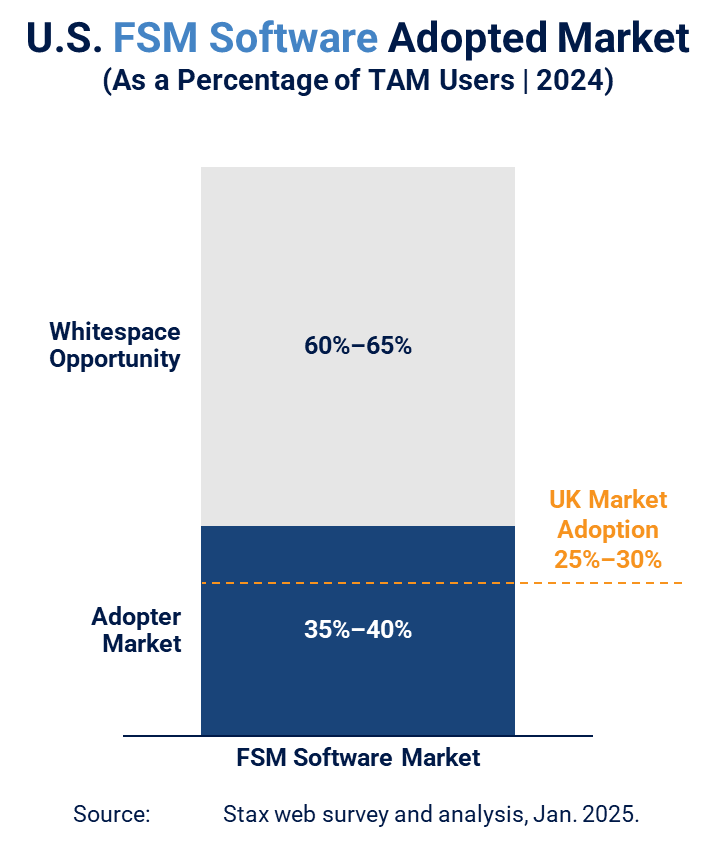

FSM software adoption in the UK continues to trail the US, with only 25-30% of addressable users estimated to be utilizing purpose-built platforms, compared to 35-40% in the US (Stax, 2024). Adoption has been particularly slow among small and mid-sized firms, where many operators continue to rely on spreadsheets and manual coordination—not just due to operational traditions but also limited budgets and competing priorities. However, the UK is beginning to show early signs of the same professionalization and digitization trends that have driven adoption in the US.

2. Mobile Enablement

Smartphones and tablets are now standard in the field. Through FSM apps, technicians receive job updates, complete reports, and capture signatures—all while remaining on-site. Companies using mobile FSM tools report faster job completion and improved customer satisfaction (Market Research Future, 2023).

“The most important thing is mobility and being nimble. A solution needs to go on an iPad or any mobile platform and say, ‘service is done'.”

– Office manager, FSM operator

3. Rising Compliance Demands

In sectors like construction and compliance-driven services (fire and life safety or water hygiene) audit trails and documentation are no longer optional. FSM platforms that digitize inspection forms and audit trails help firms stay contract-ready without increasing overhead.

Under the UK’s Building Safety Act 2022, firms managing high-risk buildings must provide digital audit trails and real-time compliance documentation. As these standards tighten, digital compliance features are shifting from optional to essential.

4. AI Opportunities

The emergence of AI in FSM remains incremental rather than disruptive—particularly because this segment ultimately depends on physical service delivery. Most real-world applications focus on enhancing workflows rather than replacing them.

Leading platforms are embedding AI to enhance existing workflows (i.e., scheduling, job triage, and dispatch and improving customer responsiveness and support) and the most successful of those platforms will be those that use AI to reduce friction, improve utilization, and elevate the role of technicians.

That said, expectations should remain grounded. As one business development lead put it:

“Everyone talks about AI, but when it comes down to it, you still need someone to physically go to the property. AI can help triage, but it’s not replacing visits any time soon.”

–Business Development Director, FSM Software Vendor

5. Internet of Things (IoT)-enabled Asset Monitoring

IoT integration is beginning to reshape how field service businesses think about preventative maintenance and service delivery. Sensors embedded in equipment and infrastructure—typically by IoT providers—generate real-time condition data. FSM platforms, in turn, integrate with these systems via APIs or middleware to receive alerts, create service tickets automatically, and schedule maintenance without manual input.

Adoption is still limited, but early users have reported improvements in consistency and cost control (IDC, 2024). Over time, as IoT becomes more accessible and embedded in vertical workflows, it is expected to drive a shift from reactive to predictive service models—changing both customer expectations and platform requirements.

Growth & Expansion

UK FSM vendors face multiple paths to growth—vertical expansion within the UK, geographic growth into Europe, or entry into the US. Vertical expansion across similar professional trades that share similar characteristics (e.g., from HVAC to plumbing) often requires minimal product change. Geographic expansion into Europe or the US is attractive but requires local sales investment and significant go-to-market resources to succeed in either.

Tied closely to geographic expansion is the need to align with regional payment preferences which provides a meaningful stream for FSM platforms. In the US, FSM vendors frequently monetize payments through credit cards and ACH fees. In contrast, the UK and broader Europe lean more heavily on bank-to-bank (A2A) transfers and digital wallets. Understanding these regional payment infrastructures—and embedding them effectively into platform workflows—will be critical to capturing the full value of embedded payments as FSM platforms scale internationally.

Conclusion

The UK FSM software market presents a compelling high-growth opportunity, but investors should prioritize platforms not only gaining share today but are also positioned to lead the next phase of market development—characterized by consolidation, workflow integration, and deeper use of automation, analytics, and compliance capabilities.

Simpro, Joblogic, Totalmobile, and Re-flow each demonstrate elements of this evolution, whether through international expansion, product modularity, regulatory readiness and depth, increasing penetration of embedded payments, or consolidation. Platforms that can scale across borders while supporting local compliance and service delivery models will be well placed to define the next generation of FSM software.

Grant Thornton Stax brings deep experience across FSM and field operations software. Visit www.stax.com or click here to learn how we help investors identify scalable and high-performing assets.