Share

From total market to segmentation

At Stax, our private equity clients often ask us to estimate the total addressable market (TAM) for a business’s products or services. This is a critical number to show the long-term potential of the business, and if our estimates are too small, we have helped investors make the difficult decision to walk away from a deal. But even for large TAMs, we help our clients with some of the nearer-term decisions (sometimes called Serviceable Addressable Market or Serviceable Obtainable Market). One excellent tool to estimate the business’s current opportunity in the market is through market segmentation.

Simple vs. complex segmentations

Market segmentation can be done in some obvious ways. For example, for apparel companies, you are likely familiar with different brands that target customers of different age and gender. If you sell baby’s shoes, you will estimate your market based on the number of children, or expected birth rates, rather than estimating your market based on the entire U.S. population (babies are a segment of the overall U.S. population). These kinds of simple demographic segmentations are so important that we probably wouldn’t even consider the total U.S. shoe market when we consider the size of the market for babies’ shoes.

But other segmentations are more subtle.

There are many other ways to describe difference among the U.S. population than just through demographics. Other ways we segment consumers are by channel preferences (retail vs. online), price vs. quality tradeoffs, comfort vs. style, purchasing for yourself or as gifts for others, and product characteristics (e.g., colors, logos, etc.). At times, we want to understand multiple attributes all at once: how many people are there in the market that buy high-quality items online for themselves that feature luxury logos? If there are not enough individuals that fit those parameters, how many people have three of those four characteristics?

Segmentation methods

Sometimes, we know exactly how we want to segment the market. We know that we only sell to a specific kind of customer, and we want to calculate how much that specific demographic likes to spend. In these cases, we don’t need any complicated analysis. We can survey the U.S. population, ask them the specific qualifying questions, and count the number of people that qualify for our “rules-based” segmentation. This works best when we have a customer with “necessary and sufficient” conditions.

Other times, we don’t know who the target customer is, we only have some guesses. For example, we could know that our customers are price sensitive, but we don’t know how to measure that against their style preferences. In cases like these, it can help to gather a large amount of data about customers through a survey, including whether they are our customers or not, then build a statistical model to find the best predictors of our customers. These models will help us clearly identify small pockets of the market that are the best for the business: the 1-2% of customers that have the specific preferences that makeup 30-40% of revenue.

Our most common method of segmentation is more general than both rules-based segmentation and predictive models. We often use an unsupervised learning method called “cluster analysis” to generate market segments. Cluster analysis is a machine learning method that finds “natural” groups within the market by finding associations among all the major characteristics of people in the market. For example, if people who favor a specific style also favor a specific channel (online vs. retail), cluster analysis will recognize this correlation and generate that segment for us.

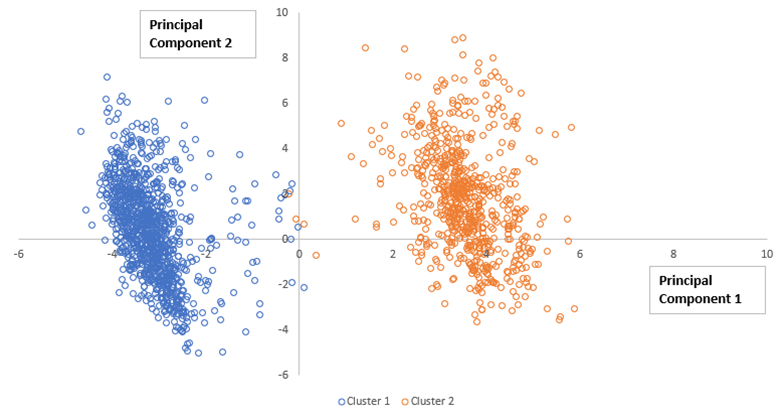

That may sound simple and unnecessary for a complicated machine learning model but consider this: we usually have more than two characteristics that we care about at once, sometimes 20 or 30. Once you consider all the combinations of these characteristics, it should be clear that we can’t manually check all the combinations. Further, cluster analysis helps us calculate a specific “center” for each cluster so that we can assign each person in the market to a specific cluster, even if they look like they are in between two different groups.

Figure 1. Principal component analysis helps to show multidimensional clusters on a standard x-y axis.

Results

Market segmentations like these can help with valuation and strategic decisions post-acquisition. For example, we worked with an apparel company where we found a sufficiently large TAM. Our market segmentation helped show two ways the business could grow: through a smaller “fashion-forward” segment that had higher spend per customer, or through a larger “function-focused” segment that made up through lower average spend through sheer volume. Our analysis showed that the fashion-forward segment was larger (and more satisfied among current customers), helping the investors recognize an opportunity to grow a specific high-margin customer segment. Without this segmentation, we would have known enough that the business was healthy, but we would not have understood the specifics of the future opportunity.

Read More