Share

Champagne and sparkling wines have long been considered a staple of celebratory occasions and a great gift on those occasions. For some people this creates a chance to wheel out their expertise and for others it creates angst, wondering what tastes best and what will make the right impression. Unfortunately, we’ve been trained to think about quality in terms of price, deciding based largely on “what’s the right amount to spend?”

A Stax Event: Good Wine, Data, People

Knowledge, as we all know, is power. Having good data creates great substance for discussion and decisions. Back in the late 90s when Stax had our first office party, Mark Bremer, our president, who likes both good wine and good data, decided we should have a Stax wine tasting in our own unique Stax way: some good wines and a bit of data to add to the discussion — with good people. We all enjoyed this approach. Over time, Stax has had a few parties, and our analytics team has expanded, as have the data sets one can access — including publicly available databases and social media that we can track down and analyze at a granular level. In parallel, our fact-loving client base has grown.

Price/Quality Analysis for Sparkling Wine

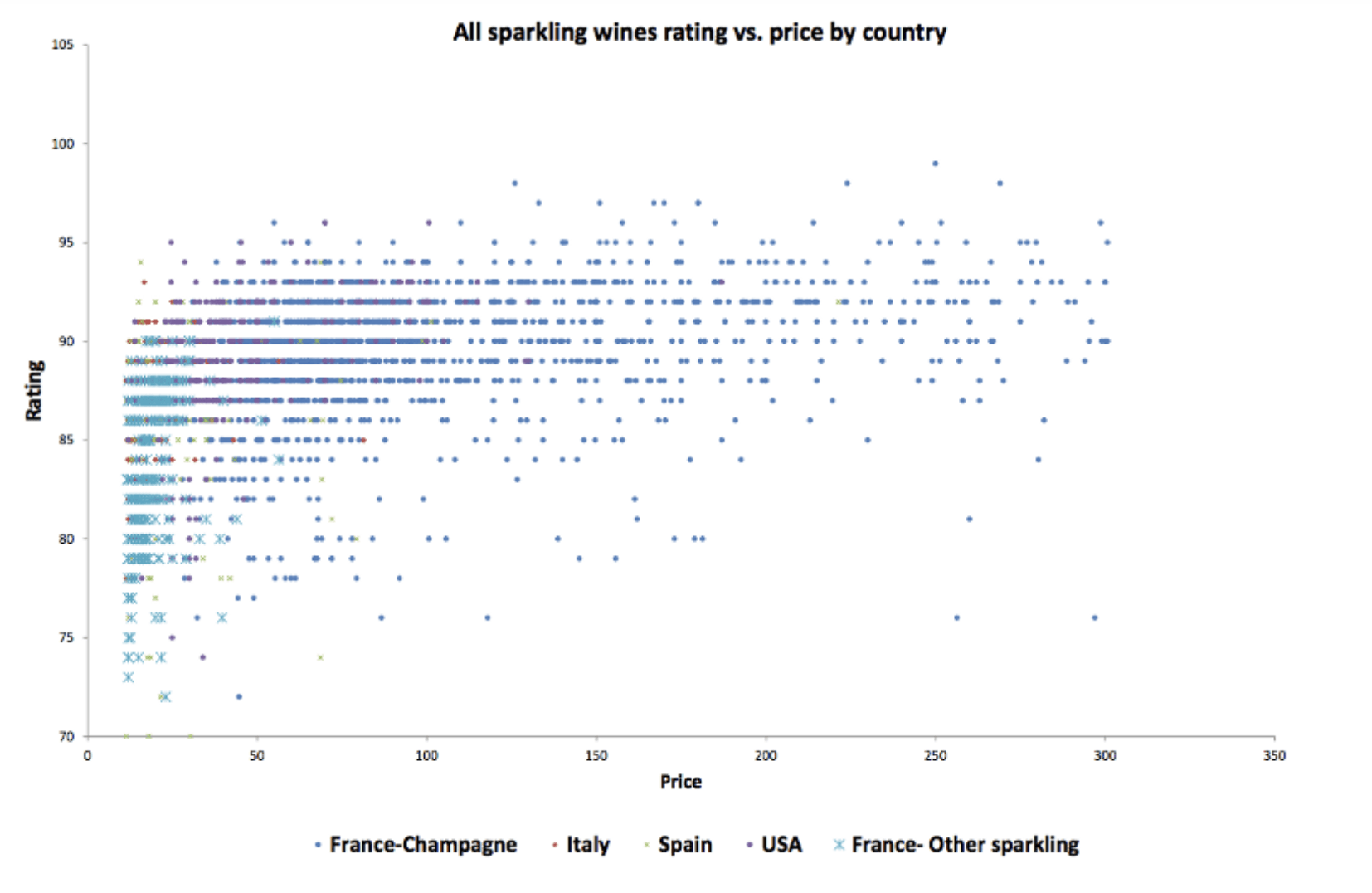

We asked our data analytics team to capture quality and price data on almost 3,000 Champagnes and sparkling wines (2,971 from France, Italy, Spain, and the U.S.), and analyze this data to generate insights. Our team compared critics’ “quality” scores to prices, looked at price differences by region, and also examined how much a critic will change their rating of a wine over a period of time.

The results provide insights about how much you should pay for “quality,” and also regional branding value — which may come into play if you want to impress. For the business minded amongst us, this process shows how gathering and analyzing publicly available data can be used in R&D to understand purchase patterns in markets. This analysis also highlights a way to quantify brand value, and how well some regions and associations are doing in building brand in the food industry and luxury categories.

The Champagne we all know and love comes exclusively from the Champagne region of France. It is the most famous sparkling wine in the world, and its average price is higher than that of any other sparkling wine. The stratospheric prices of high-end Champagnes are legendary, but even eliminating those anomalies to look only at bottles selling for $400 or less, Champagnes on average sell for around three times the price of other sparkling wines. This speaks to the great brand control exercised by one specific region, which leads handsomely in terms of consumer quality perception.

We see that price anomalies are plentiful, perhaps even more so than with non-sparkling Pinot Noirs — another varietal we’ve analyzed. For example, prices for Champagnes with a critics’ rating of 76 — at the lower end of the spectrum that we tracked — ranged from $32 to $126. At the opposite extreme, prices for Champagnes with a critics’ rating of 98 ranged from $126 to $1,185 — a price differential of more than nine times for the same rating. These ranges also illustrate that Champagne with a rating of 76 or 98 can be had for $126! Which would you prefer to buy?

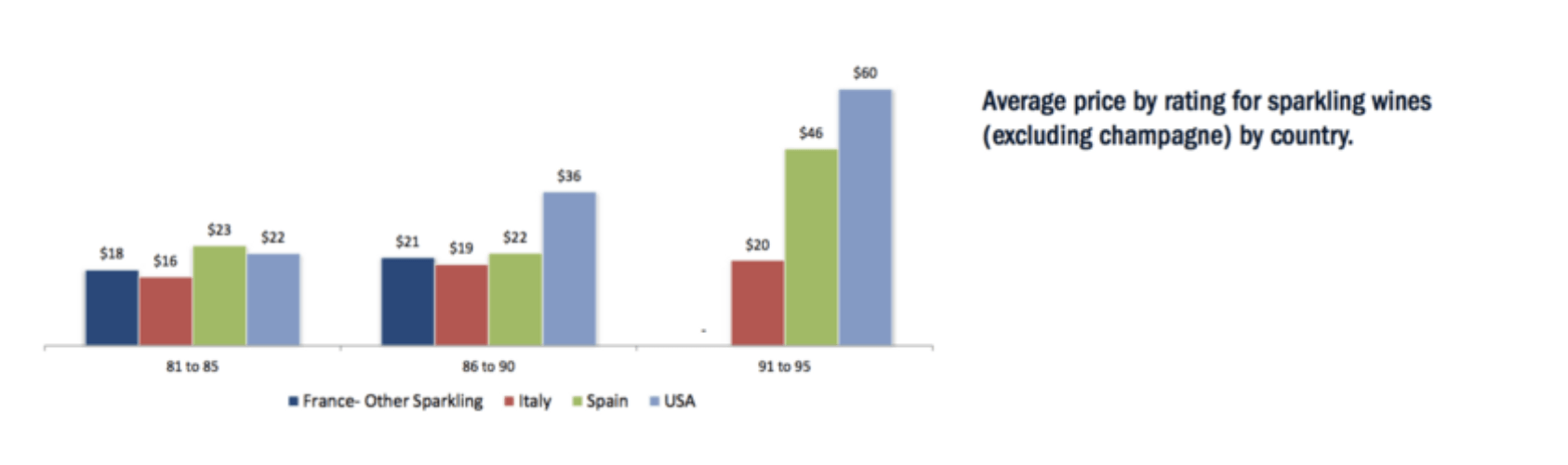

Critic ratings would suggest that price does not define the value in flavor. The premium you would pay for a lower-rated Champagne over a similarly rated sparkler is larger than at the high end of the rating scale. The premium you would pay for Champagne decreases from ~4x to ~3.3x to ~ 2x at the 81–85, 86–90 and 91–95 rating levels respectively. Now, how much is that brand value of giving a Champagne worth? It probably depends on the recipient and whether you’ll share it or not. There are also flavor profiles that are different by region which you should really take into account, because if you’re going to drink it — your preference matters over any brand.

What Bubbles to the Top

The good news is that you don’t have to spend at the top range of price to get a great bottle. There are great buys for less than $50 in both Champagne and other sparkling wines. The data shows that price does not always mean quality, but once you hit a certain price level within each category, you should expect at least a reasonably high-quality bottle.

If you don’t have your heart set on buying Champagne and are simply looking for a bubbly that’s rated highly, there are great deals to be had. Overall, European sparkling wines tend to be of better value than American ones and the recent changes in currency values may push this further.

Favorites like Asti and Prosecco from Italy provide the best bubbly for the buck based on our analysis. In fact, in 2013, Prosecco replaced Champagne as the world’s most popular sparkling wine, selling 307 million bottles globally versus 304 million bottles of Champagne sold globally. Spanish sparkling wines like Cava and other French sparklers like Crémant are also good bargains among the medium-rated range of vintages.

Recommendations

- Know who you are buying for and why you are buying. If you’re giving a gift and the person prefers brand names, you may want a high-priced brand to make a statement. But if you are buying for yourself or for a less brand-conscious friend and quality is what you’re after, you can often find good options at more wallet-friendly prices.

- Have in mind the taste you like. Make sure you read the notes about a varietal or ask your wine merchant about the taste and flavor you like. This analysis is based solely on critic scores and nothing in the data suggests that you will like what critics like. Track the flavors you like to make better decisions going forward.

- Think about the price-quality tradeoff. If you are unable to delve into vintage-specific ratings, shopping among lower-priced offerings from prime vintage years (e.g., 1990 or 1996 for Champagne) should get you a good price-quality tradeoff. Consider Italy. In terms of price and rating, sparklers from Italy seem to give the best value for money spent.

- Learn from the French. If you want to take a marketing lesson on the perceived value of a branded luxury item, this analysis provides some good data points to support the idea that the French do well with this category, which American producers can and are learning from.

Best Buys

Now we could write about the “best buys,” but based on our experience and analysis, three truths hold higher than scoring or price:

If you’re buying for yourself, it’s all about your taste. We tried four of the “best” sparkling wines based on price: quality scores, and the flavors were completely different; some we enjoyed thoroughly and some were just not our taste. Unless you are buying a gift for a critic, your taste preference matters more than theirs. The beautiful thing about having some knowledge is that you can test and learn and find out what you like. Share good beverages with good people. What matters more than anything is the person you are drinking with — whether it’s Champagne, sparkling wine, or a glass of water. There’s always a silver lining: value can be found. If you don’t like who you have to share the drink with so much, you might as well have a decent bottle without breaking the bank, which this analysis shows is not hard to do.