Share

Moderator: Jackie Williams, Director of Research, Farragut Square Group

Presenters:

- Bill Dombi, President, National Association for Home Care & Hospice (NAHC)

- Jeremy Wall, Managing Director, Stax – a global strategy consulting firm

- Hope Amsterdam, Senior Analyst for Home Health and Hospice Engagements, Farragut Square Group

Overview of the U.S. Home Health and Hospice Market & Investment Landscape

The home health market has recovered from Covid, is growing revenue and market share, and has tailwinds that are boosting demand. Patients and payers prefer that care be delivered at home versus higher-cost sites of care such as hospitals and nursing homes. These market dynamics result in home health attracting significant investor interest, with strong transaction volume and skyrocketing transaction value due to major transactions. Investors include private equity firms, payers, and health systems—all of whom want to own home care assets to strengthen their position throughout the continuum of care.

The most significant challenges involve navigating the staffing shortage, which is creating wage pressures, and the regulatory environment, which affects reimbursement.

Context

During a recent webinar, Bill Dombi, one of the home care and hospice industry’s foremost leaders, joined experts from Stax and Farragut Square Group to share their outlook on the home health and hospice sectors. They assessed challenges and opportunities, along with the legislative and regulatory outlook.

Key Takeaways and Trends in Home Health and Hospice

There has been a profound shift in the home health market as a result of Covid.

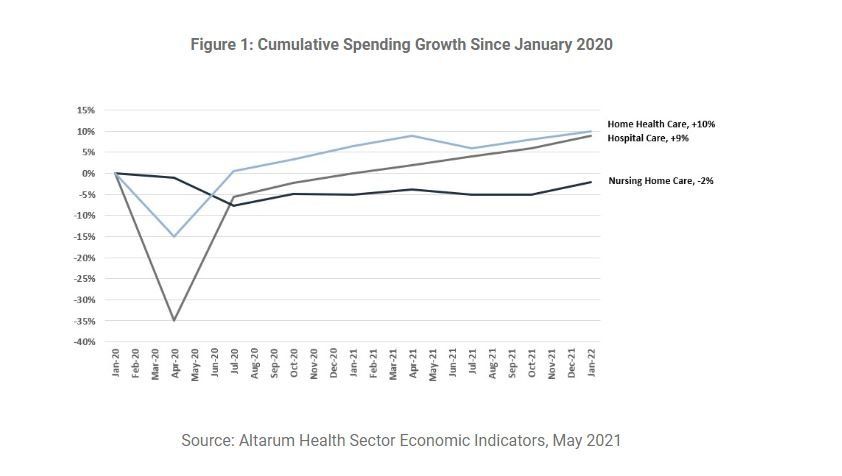

In the second quarter of 2020, the home health care market dipped significantly but recovered quickly. Today, cumulative home care revenue is about 10% above the pre-pandemic level. Meanwhile, the nursing home care market has been slower to rebound, with revenue in early 2022 about 2% below pre-pandemic level. Home health care is taking market share from the nursing home sector.

Stax believes a fundamental shift has occurred in the preferences of patients and payers. In looking ahead, Stax expects the current trends to continue.

“We expect this to continue to play out in the same fashion that it has over the last couple of years.”

– Jeremy Wall, Managing Director, Stax

The home health market has attracted significant investor interest.

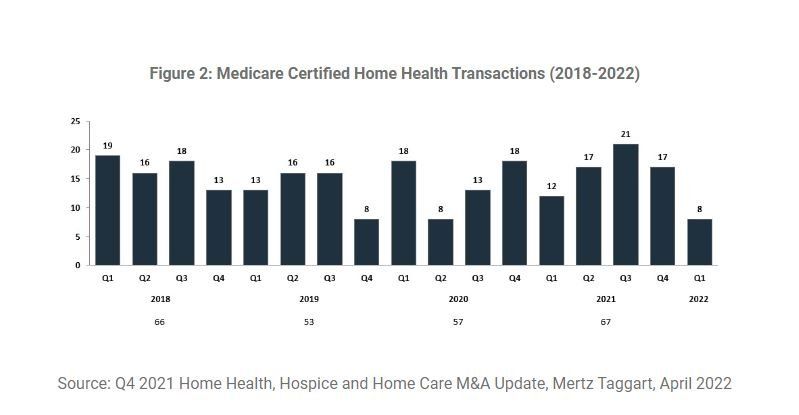

Looking back to 2018, there has been a steady number of Medicare Certified Home Health Transactions. While the number of transactions dipped in Q4 of 2019 and Q2 of 2020, the number of transactions in 2021 was the highest in the last four years, with 67 transactions.

Also, not only are there a significant number of transactions, but the transaction value has skyrocketed, with three of the largest transactions in the history of the home health sector. This includes transactions by United Health and Humana. Mr. Dombi observed that payers are investing in home care services because they see it enhancing their value.

Dombi said, “This is maybe a sign or a recognition by United and Humana that they should increase their use of home health.” He continued, “I’m reading United and Humana’s actions as a sign that payers are looking more closely at the value of home health.” Mr. Dombi views this as an opportunity to create partnerships between home health agencies and managed care.

“This may spell a different time period relative to consolidation, because the buyer becomes more centralized, and the buyer does not want to deal with the inefficiencies of hundreds of different providers in its network . . . what’s keeping people’s eyes wide open [in this sector] is the combination of consolidation with the growth in Medicare Advantage and Medicaid managed care.”

– Bill Dombi, President, National Association for Home Health & Hospice

Home health benefits from positive tailwinds.

There are several tailwinds that are benefitting the home care sector and attracting investors. These tailwinds include the macro shift away from facilities and various sites of care to more personalized home care services. Driving increased demand for home care is that most patients prefer to be cared for in their home. Mr. Wall said Stax doesn’t see those preferences changing anytime soon. Also, payers are creating tailwinds by accommodating patient preferences for home care and by wanting patients to be cared for in lower-acuity, lower-cost settings.

Also, as legislation increases the mandated staffing ratios in other care settings, this will drive up costs in those settings and, in comparison, will make home care even more attractive.

In addition, Mr. Dombi noted that a major trend is for healthcare is to be “patient centered.” Nothing is more patient centered than being cared for in one’s own home. Other macro trends focus on social determinants of health and equity, which are best dealt with by caring for patients in their homes. Thus, these major trends favor home care, which provide further tailwinds in support of home care.

Staffing is the leading challenge in the home care sector.

“Demand is greater than the supply we have in the workforce,” said Mr. Dombi. As is the case throughout healthcare, acquiring and retaining skilled labor is the industry’s most significant challenge. In the short term, strategies for managing workforce issues include incurring overtime (76%), as well as relying on managers to work open shifts (42%) and relying on agency workers or temporary staff (41%).

On a longer-term basis, important strategies include:

- Providing workers with greater flexibility.

- Improving the image of and respect for home health workers so it is considered “top of the profession” employment for nurses and others.

- Expanding the workforce by partnering with local schools for education and training programs.

- Increasing the efficiency and productivity of home care workers. This includes utilizing technology to improve planning and routing, to get the right people in the right places at the right time. It can also include using telehealth where possible to minimize downtime and driving.

- Leveraging technology to improve recruiting, onboarding, scheduling, training, and workforce management.

- Modifying the scope of practice so that some tasks currently being done by nurses can be delegated to home care aides.

- Reforming immigration to allow more immigrants to enter the country and the workforce, which will take bringing all key stakeholders together.

“Long term we need to expand the workforce and increase the efficiency of the workforce that exists today.”

– Jeremy Wall, Managing Director, Stax

There is a great deal of regulatory activity affecting home care, and a fair bit of uncertainty.

On January 1, 2020, CMS implemented the Patient-Driven Groupings Model (PDGM). This shifted paying for services based on volume to payment based on an episodic, payment-driven model, taking into account characteristics such as timing, the referral source, the principal diagnosis, and functional impairment. This new model has 432 different and unique case mix groups. As a result of this model, CMS has said the number of home care visits per episode has decreased by 12% from 2017 to 2020.

Farragut Square Group expects that CMS will conclude that payments under PDGM were too high and will propose a case mix adjustment for 2023, where base payment rates will likely be reduced. The adjustment could be a decrease of 4-6%. However, any case mix adjustment would be offset by the statutory update.

“We do expect CMS will propose a case mix adjustment, similar in structure to the way it proposed the SNF case mix adjustment . . . we believe base payment rates [for home care] will likely be reduced.”

– Hope Amsterdam, Senior Analyst for Home Health and Hospice Engagements, Farragut Square Group

Mr. Dombi commented that the transition from the old to the new model is required to be budget neutral in 2020 and for six years thereafter. As part of this transition, there is a threat that some reconciliation will be required; averting that is a top priority for NAHC. However, in responding to the possibility of a case mix adjustment, Mr. Dombi said it is within the realm of possibilities that CMS will actually conclude that home health was underpaid, not overpaid.

Also noteworthy is the Review Choice Demonstration, which impacts home health in Illinois, Ohio, North Carolina, Florida, and Texas. This Demonstration is an attempt by CMS to review claims in real time to prevent waste, fraud, and abuse within the home health sector. Home health agencies in those states can select one of three review choices: a pre-claim review, a post-payment review, or a minimum review with a 25% payment reduction.

In Mr. Dombi’s view, based on communicating with home health leaders in the states where the Demonstration is underway, the initial rollout has been disruptive and has required a greater deal of work for home health agencies and their staff, but, in general, “the benefits outweigh the burdens.”

Conclusion

Tailwinds will continue to increase demand for home care services, which will continue to make this an attractive sector for a wide range of investors, including private equity, managed care, and health systems. To take advantage of these tailwinds, home health agencies will continue to focus on solving staffing challenges — by demonstrating creativity in recruiting and retaining talent and by leveraging technology to improve efficiency. Home health leaders also need to stay abreast of regulation and legislation, which can be disruptive and can negatively impact revenue.

About

National Association for Home Care & Hospice (NAHC)

The National Association for Home Care & Hospice (NAHC) is the largest and most respected professional association representing the interests of chronically ill, disabled, and dying Americans of all ages and the caregivers who provide them with in-home health and hospice services. We are a trade association that represents the nation’s 33,000 home care and hospice organizations.

Stax – a global strategy consulting firm

Stax is a global management consulting firm serving corporate and private equity clients across a broad range of industries including healthcare, technology, business services, industrial, consumer/retail, and education. The firm partners with clients to provide data-driven, actionable insights designed to drive growth, enhance profits, increase value, and make better investment decisions.

Farragut helps private equity sponsors, bankers and lenders, and portfolio companies with reimbursement and policy analysis for diligence of healthcare services providers across the healthcare continuum. Our expertise spans Medicare, Medicaid, Commercial Payor, MA, Managed Medicaid, TRICARE, and Workers’ Compensation analysis. Farragut is engaged on buy-side as well as sell-side efforts, and for pre- and post-acquisition diligences. Additionally, we provide medical audit and compliance program reviews for sponsors who either currently own or are looking to buy physician practice platforms and home health agencies.