Share

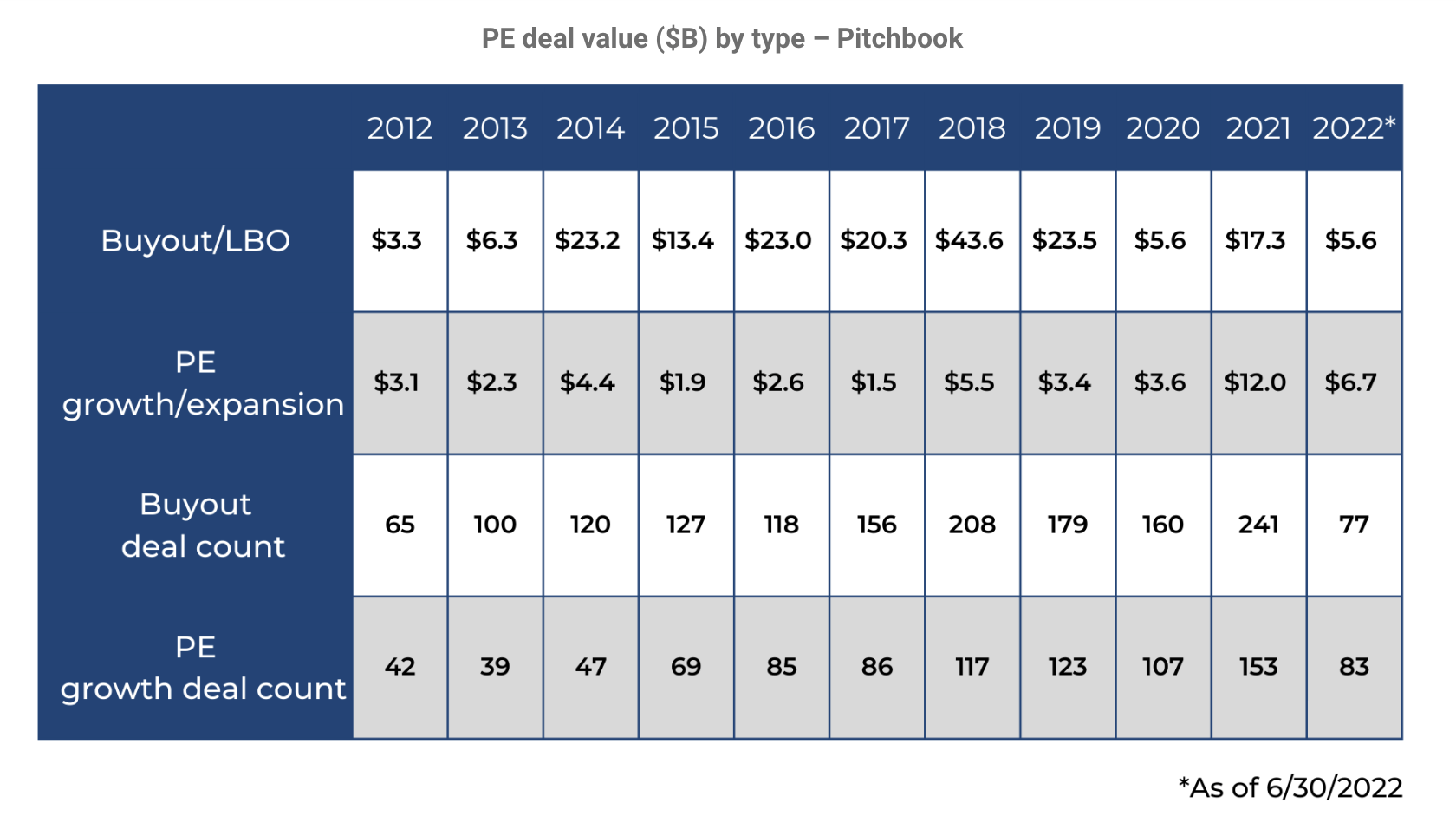

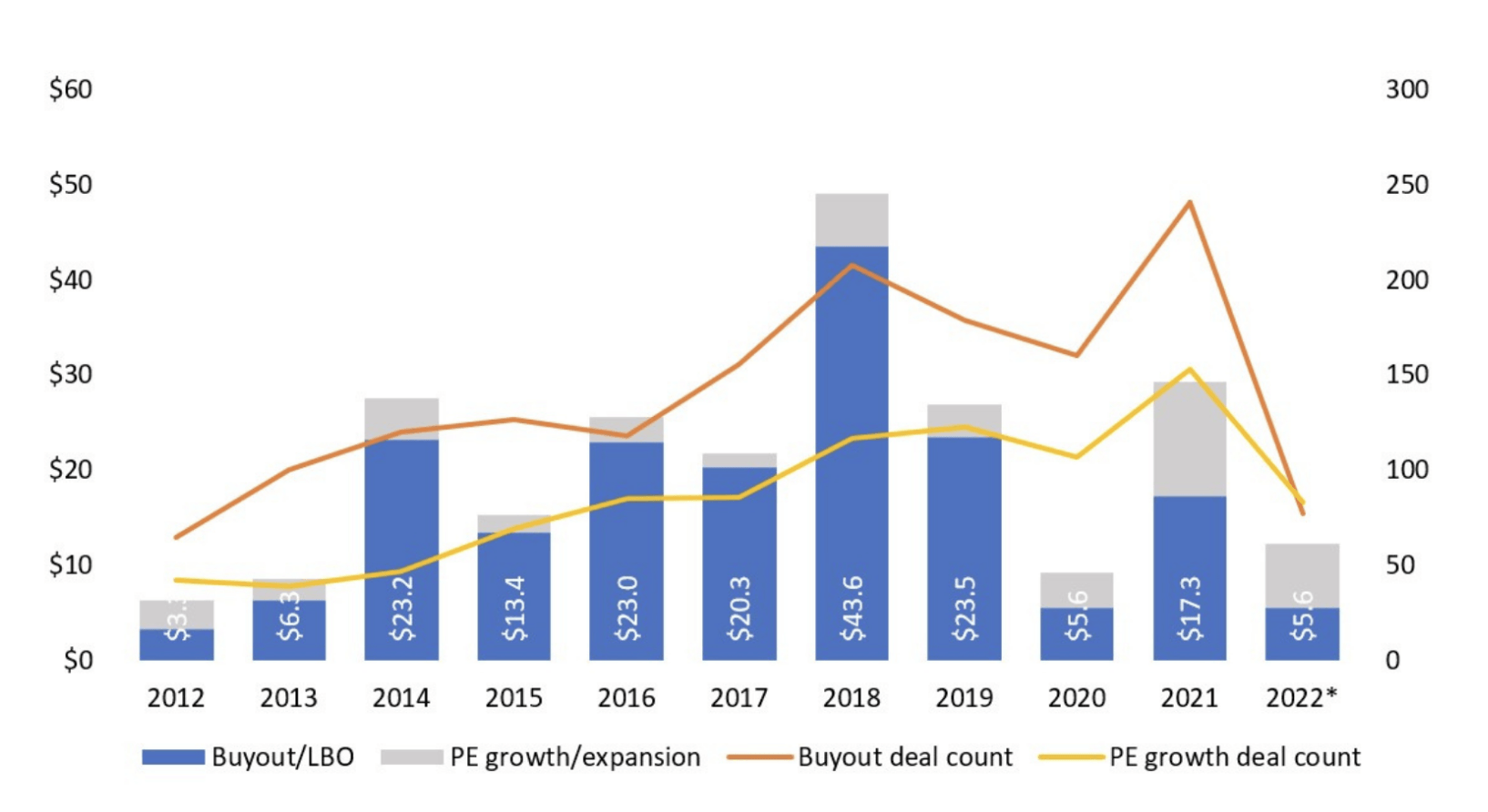

To no surprise, current market conditions have been wreaking havoc on the fintech space. Valuations are lower, fewer companies are completing financial rounds, and diligence processes are stretching out and requiring more time. However, there are segments within fintech that continue to draw interest among private equity investors. Through the first half of 2022, deal value is above levels seen in 2020. We see there are investors taking a longer investment horizon that extends beyond the current market cycle and are still finding investment opportunities.

Notably, digitization of payment workflows is a powerful and durable secular trend which will continue to evolve over multiple years and decades in various ways.

Vertical software solutions and evolving payment trends

Businesses’ adoption of verticalized solutions has been long established, but trends remain favorable. Software companies have expanded their business management capabilities including payments as a core business need. Additionally, the application of payments differs by end-market which reinforces the need for a vertical offering.

For example:

- Salons seek to utilize a single solution that enables clients to book and pay for appointments

- HVAC and plumbing companies want a solution that enables them to initiate and track a work order and enable technicians to accept payments upon completion of a job

Legal payment solutions ensure practices are aligned with compliance (e.g., ABA, IOLTA) guidelines; and non-profit organizations (e.g., religious, education, charitable) often lack the sufficient internal resources and seek to utilize a single solution to streamline and automate tasks such as managing the member base, fostering communication, and accepting on-time and recurring donations.

Vertical software companies that can embed fintech capabilities such as payments into their platform solutions will be more insulated from current market dynamics. Even as slowing or contracting transaction volumes reduce companies’ take rates in a recessionary market, these fintech companies can continue to monetize customers via recurring monthly subscription of the software platform.

Adoption of digital payments in B2B settings is lagging

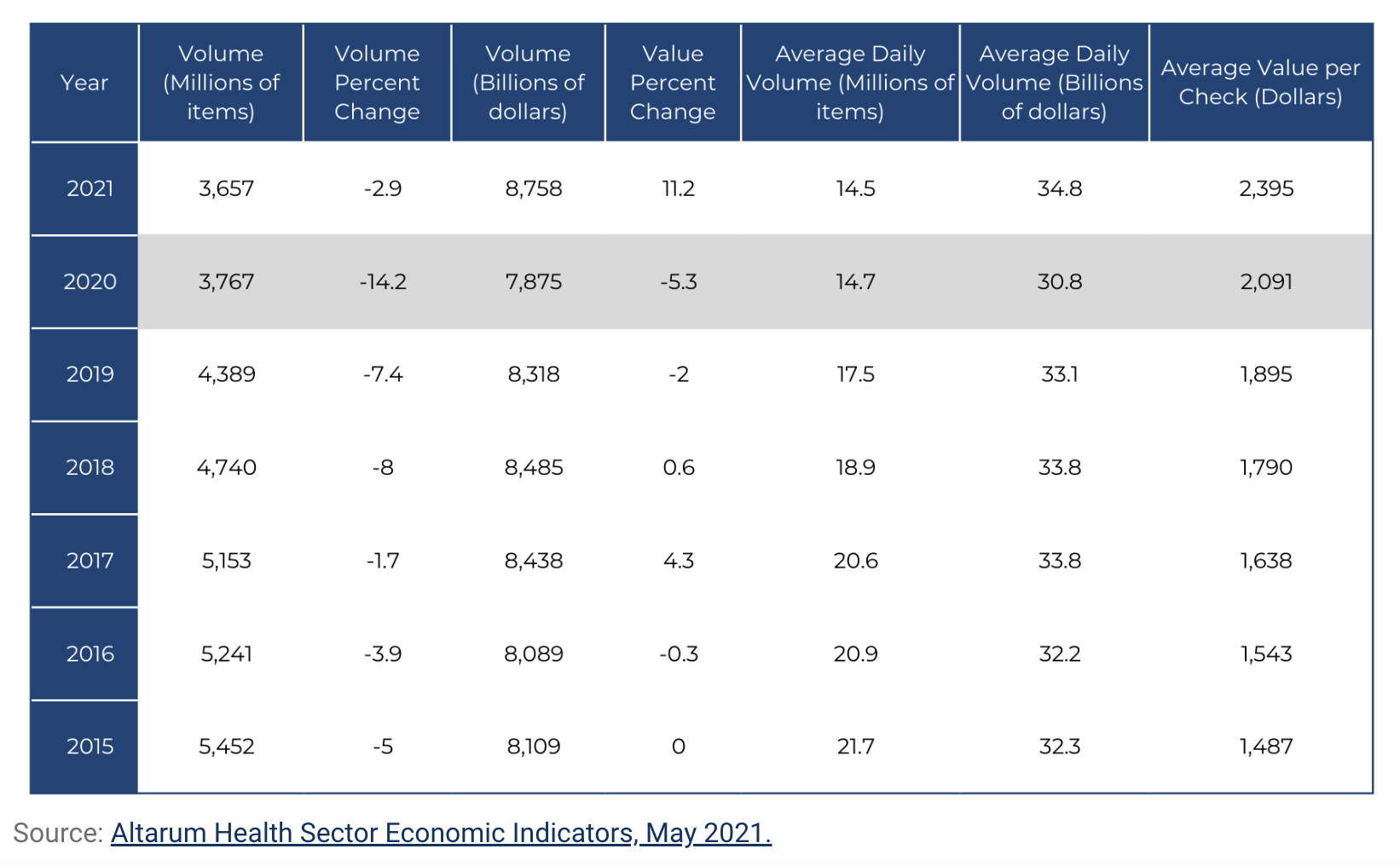

Overall, businesses are still slow to transition away from checks. While the pandemic helped accelerate adoption of Business-to-Consumer (B2C) and Person-to-Person (P2P) payments, adoption of digital payments in B2B settings is still lagging. Industry estimates believe commercial checks still comprise ~40%-50% of B2B payments. Furthermore, while the volume of commercial checks written continues to decline, the value of the commercial checks processed have not been impacted.

Volume of Commercial Checks Written and the Value of the Commercial Checks Processed Over Time

The long-term secular theme of payment digitization remains in place within B2B settings. There are continued opportunities for businesses to digitize accounts receivable (AR) and accounts payable (AP) workflows and enable digital payments. Companies that have adopted automated bill payment solutions (e.g., Coupa, Tipalti, High Radius, AvidXchange, Bill.com) recognize the benefits of increased operational efficiency, reduction in headcount and overhead, and greater accuracy in processing invoices which leads to better management of cash-flows. Furthermore, business demand for these solutions may increase in the current inflationary environment as businesses can adopt these solutions to help reduce costs and increase operational efficiencies.

How Covid impacted payroll and benefits

Americans are struggling with financial health. Without question, the pandemic has helped disrupt the well-being and financial livelihood of many Americans. Today, close to two-thirds of the U.S. population — approximately 157 million adults — are believed to be living paycheck to paycheck. Furthermore, more than half of Americans report being unable to cover an unexpected $1,000 bill with savings.

These dynamics have helped drive the adoption and rollout of on-demand pay or earned wage access solutions within the workplace, enabling workers to access as work hours are accrued, departing from the conventional weekly or bi-weekly pay periods. The pandemic initially served as a catalyst as employers sought out low-cost ways to support furloughed employees and/or employees experiencing personal financial stress. Today, in a tight labor market, earned wage access is used as a recruitment tool to make employers more attractive to candidates; particularly in end-markets facing labor shortages (e.g., retail, hospitality, food services) as pay frequency is viewed as a benefit that employees evaluate when considering employment options.

ECommerce driving the need for mass payments

ECommerce continues to increase as a proportion of overall retail sales, now estimated to comprise ~22% of all retail sales in 2022, reaching ~27% by 2026E. Commensurate with the growth in eCommerce has been a proliferation of online marketplaces, enabling consumers to purchase from multiple merchants or sub-merchants. Online marketplaces account for more than two-thirds of global eCommerce sales.

As these marketplaces grow revenues and add more merchants, so too does the need of disbursements to partners. Mass payment solutions are addressing this pain point automating the payments to partners as well as the onboarding, vetting, and validation of merchants. Mass payments have also found other applications and use in end-markets such as adtech/martech, creatives, and among a gig-based workforce.

About the author: Palash Misra is a Director at

Stax. He has extensive experience on a global and domestic level in corporate and strategy consulting roles, with a strong background in both strategic synthesis and implementation.