Share

A diversifying U.S. population, continued end-consumer preferences for food experimentation, and cooking at home provide strong tailwinds for the growth of international

foods in the U.S. market. Stax has helped investors find brands and portfolios that align with the changing trends and demand in the market.

Demographic Shift

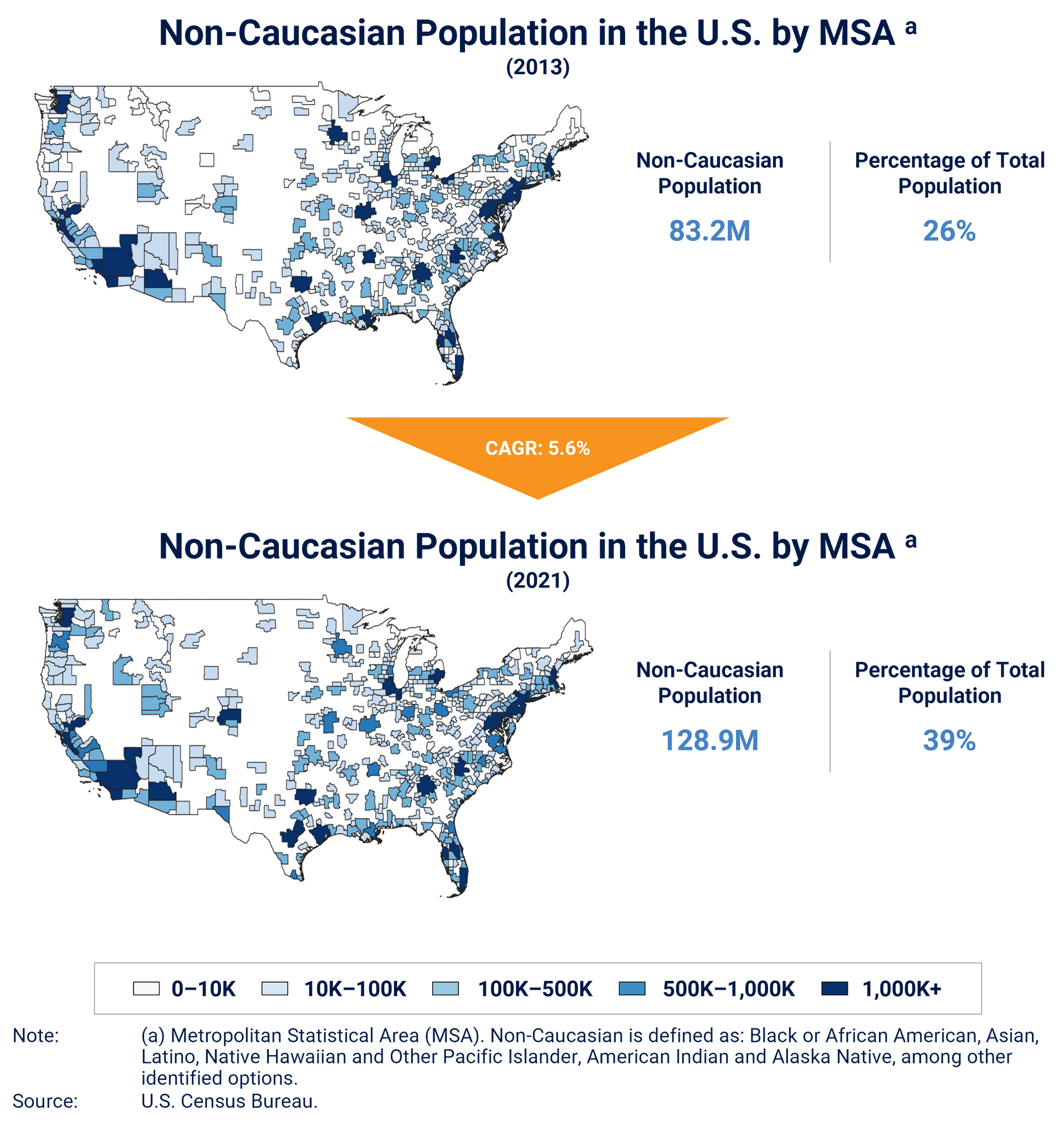

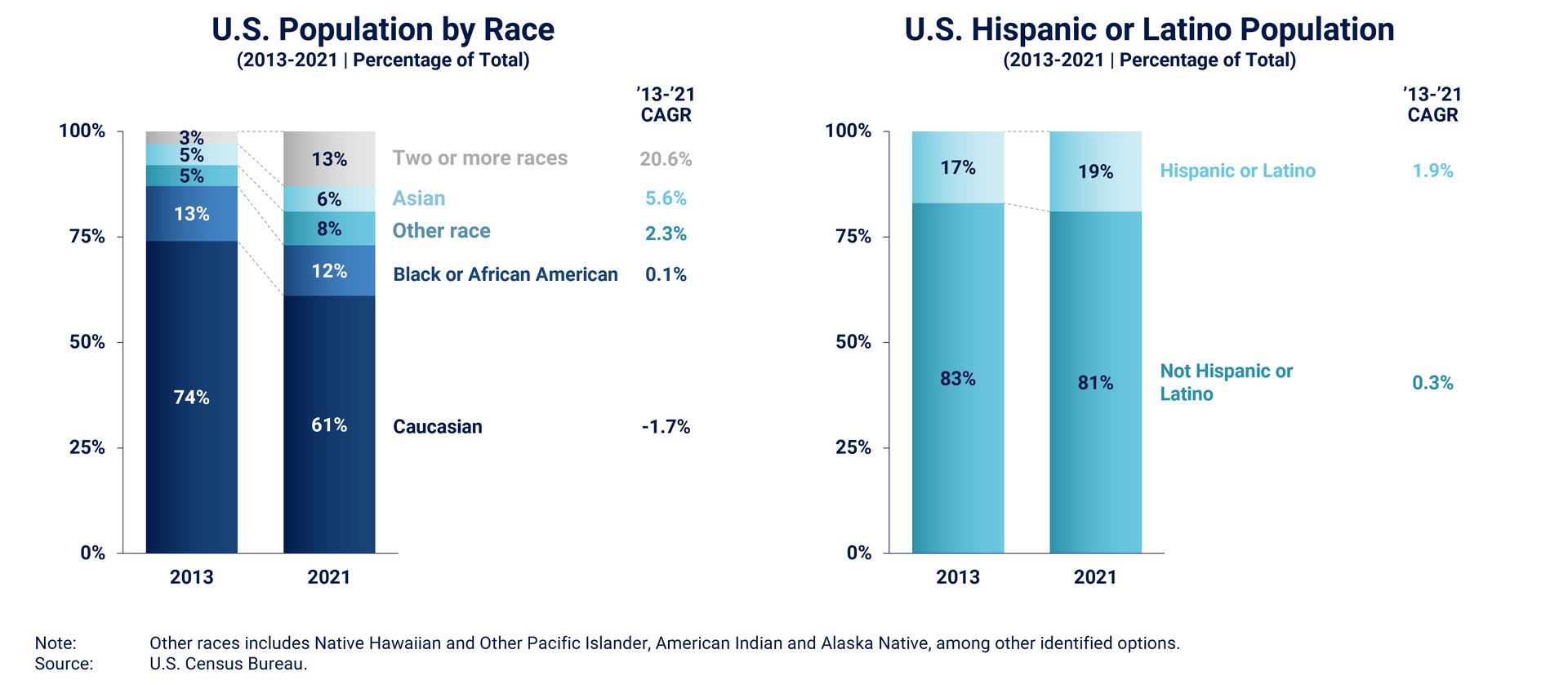

As the U.S. population continues to evolve and multi-cultural populations grow and have more buying power, there will be increased consumption and demand for international food products. According to the U.S. census, the national population is diversifying rapidly. Since 2013, the share of the Caucasian population has decreased from 74% to 61% in 2021, driven by continued growth among Asian and Hispanic populations.

From 2013 to 2021, the U.S. non-Caucasian population grew at a CAGR of nearly 6%, creating an attractive investment market for international foods.

The shift in demographics in the U.S. has resulted in more experimentation and adoption of international foods among a broad base of end-consumers. International foods are ripe for investment and relatively nascent for investors, with private equity starting to build investment theses in attractive segments of international foods.

Increased Food Experimentation

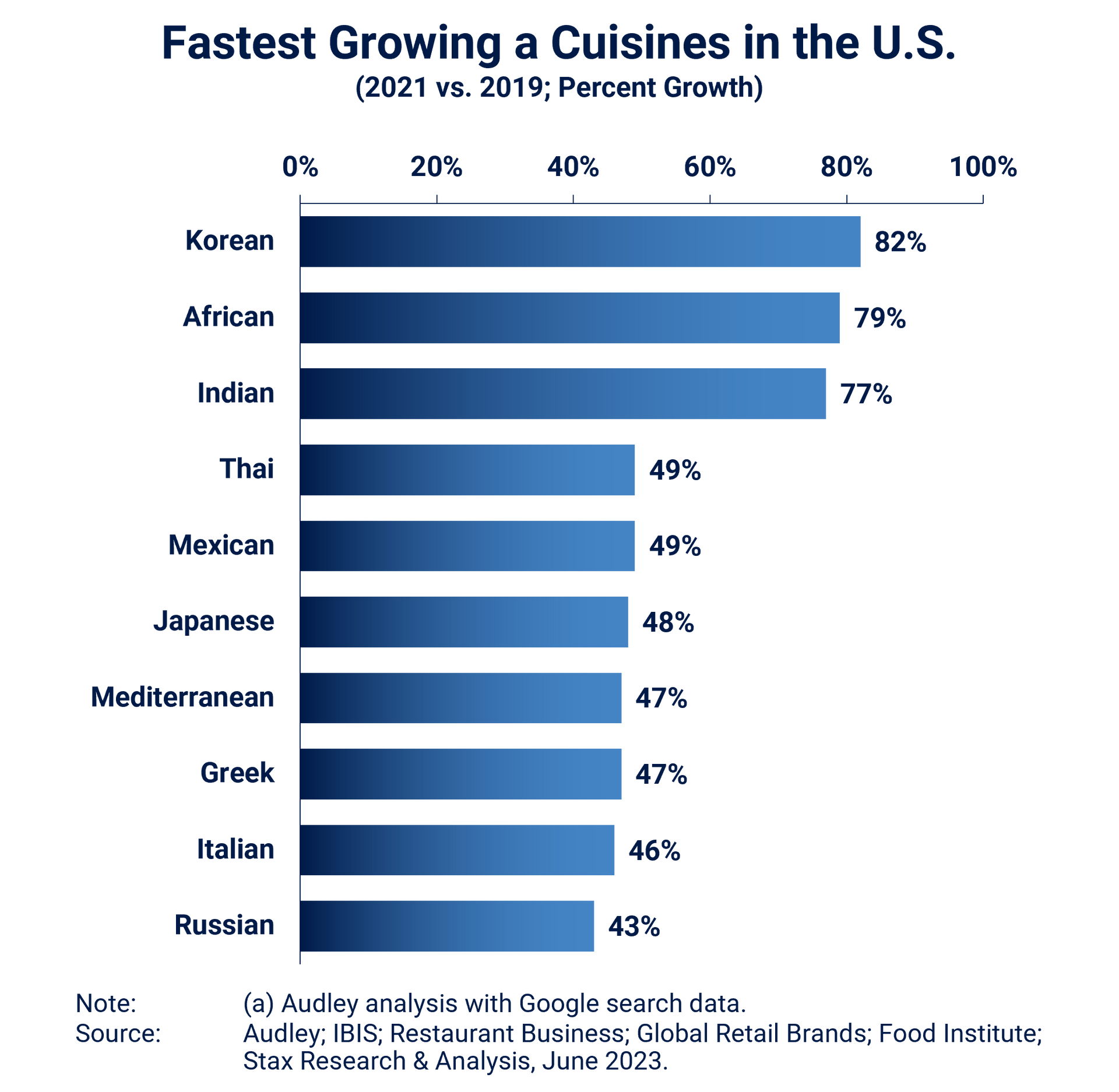

Social media and the globalization of trends have prompted end-consumers to experiment with new cuisines, driving growth for international products. The percentage of end-consumers likely to try a new type of cuisine increased since 2020, as end-consumers sought to expand their meal repertoire during lockdown.

This trend is expected to sustain and become increasingly popular among the younger generations. As of 2020, millennials are the most likely to experiment with new cuisines (69%), followed by Gen X (65% most likely to experiment).

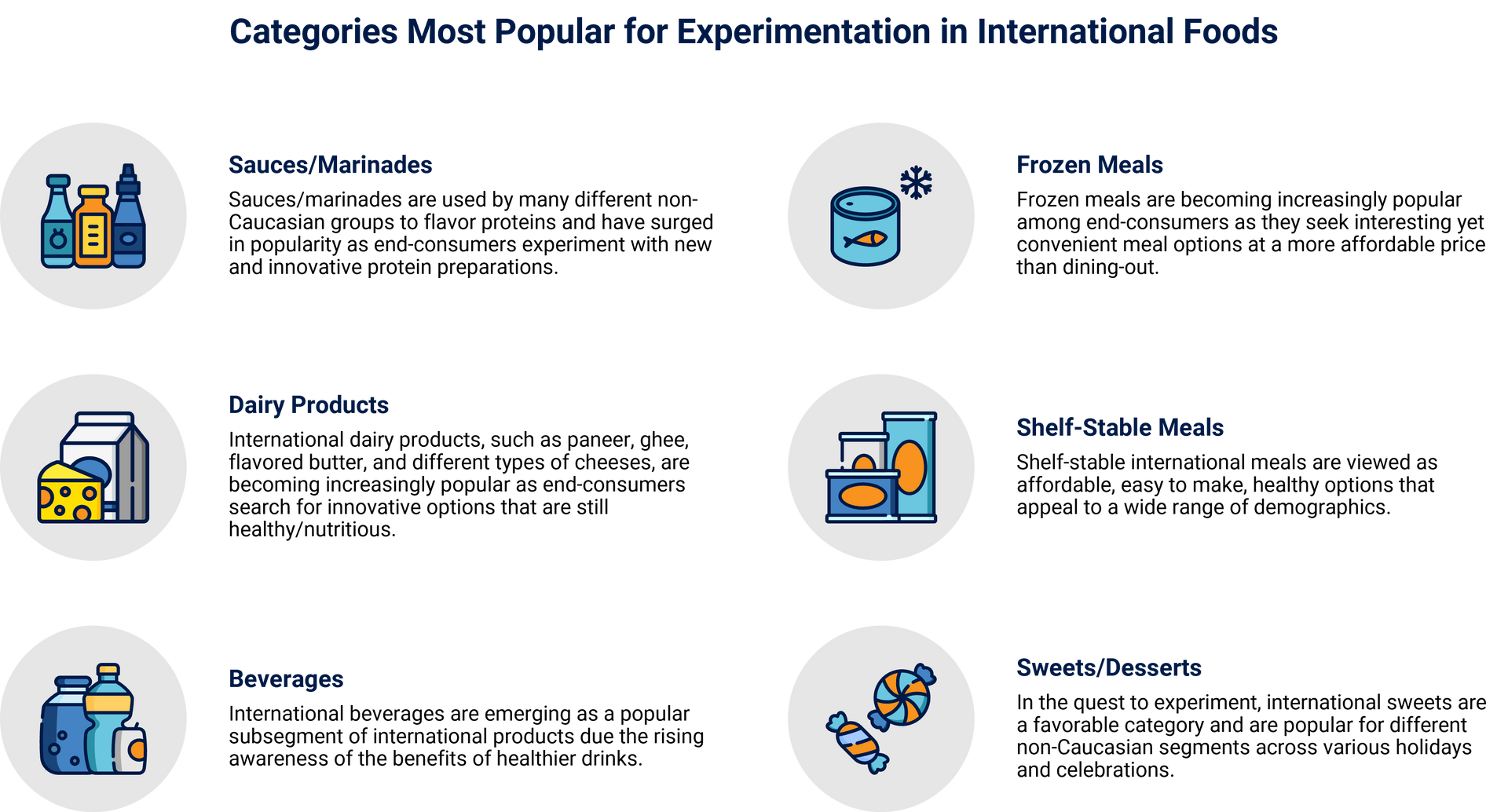

There is a growing preference for international cuisines across the U.S., driven by end-consumers desire to explore more flavor profiles/options. Companies are launching brands and products to align with the growing demand for different types of international foods.

Additionally, end-consumers are expanding their food palates as they try foods from different cultures, making international foods popular.

According to Technomic’s Global Food and Beverage Report, 27% of end-consumers stated that they are eating more unique types of global foods and beverages compared to two years prior. This inclination towards international foods comes from end-consumers looking to explore new flavors. 41% of survey respondents stated that they are looking for something different while 37% stated that they wanted to discover new flavors.

Preferences for Cooking at Home

Due to Covid, there was an observed rise in home meal preparation, with 92% of families planning to continue to eat at home at the same frequency post Covid. Cooking at home is likely to continue because of inflationary pressures and a potential recession, as end-consumers continue to feel uncertain about the economic climate. End-consumers will want to mimic food menus they typically find dining out, and restaurants are expected to continue to expand their menus with international foods, creating a tailwind for experimentation for diverse food items.

Retail Landscape and Adoption

Supermarkets and other food retailers are having to respond to the growing popularity of international foods and are considering a broader assortment to meet the demands of their customers and remain competitive. According to end-consumer work done in 2022, ~50% of end-consumers believe that there are now more international food products available at their supermarkets/food stores compared to five years ago.

In addition, more than 35% of respondents stated that they would like to see supermarkets/food stores offer even more international food products, presenting broad market opportunity for international food brands to expand and grow in the U.S. retail market. Adoption of international foods in mainstream channels is dependent upon the retailer’s local demographics—i.e., retailers will conduct a demographic analysis to gauge the demand for ethnic products before deciding to source the product(s).

Historically, international food products were given limited placement in the “international grocery aisle.” Retailers are moving towards retiring the international aisle, which is expected to expand the retailer’s shelf space allocation for international foods.

Drivers of International Foods Adoption Among Mainstream Channels

New Customer Attraction: Retailers that offer a diverse range of food products can attract a larger customer base, increasing the number of new customers shopping at their stores.

Increase Share of Wallet with Current Customers: Increased end-consumer demand for different types of international foods is pushing mainstream retailers to expand their offerings. These retailers are looking to increase the number of trips end-consumers make while also increasing their overall basket size (average spend on a trip).

Staying Competitive:

Fragmentation in the market requires mainstream retailers to continuously find ways to attract new customers and limit their shoppers from spending at multiple retailers in the area to meet their shopping needs.

Investment Channels & Deal Landscape

Private equity has been investing in segments across the value chain, with strong continued interest in investing up the value chain in co-manufacturers/private label manufacturers for international foods and specialty distributors. In addition, investors are seeking growing end-consumer brands that are authentically serving international foods.

Stax has helped investors evaluate potential investments across the value chain. Some select examples include:

About Stax

Stax has engaged with companies across the

food & beverage

ecosystem including various product segments, value chain stakeholders, and sales channels. We have a dedicated team of experts with extensive industry experience across the food & beverage industry as well as

Software and Technology,

Business Services, and many other

industries. To learn more about Stax and our expertise, visit

www.stax.com

or

click here to contact us.

Read More