Share

Within the cybersecurity landscape, the fraud detection and prevention market are dedicated to detecting, mitigating, and preventing fraudulent activities and financial crimes. This sector has experienced remarkable growth in recent years, driven by the increasingly sophisticated tactics of fraudsters and the expanding realm of digital transactions. Over the years, the Fraud Detection and Prevention (FDP) market has evolved from looking at historical data to stopping frauds in the present or even before it happens.

The main types of fraud detection and prevention include check fraud, identity fraud, internet /online fraud, investment fraud, payment fraud, insurance fraud, and miscellaneous fraud types like mortgage fraud, insider fraud, and mobile fraud. FDP encompasses a diverse array of technologies, tools, and services designed to detect and combat various types of fraud.

Addressable areas of FDP

The increasing implementation of online applications and mobile banking services has resulted in an unexpected number of bogus websites and mobile apps. There has been a surge in fraudulent websites and online applications in industries such as retail and e-commerce, manufacturing, and healthcare. These websites and applications bear a resemblance to retail shops and home delivery services, deceiving customers into completing fraudulent online transactions.

Additionally, with the advent of technology, hackers have become more sophisticated and can identify and exploit vulnerabilities. The volume of data is increasing day-by-day with the increase in transactions. This results in enterprises taking proactive measures to eliminate potential losses from cybersecurity frauds. Key verticals such as finance and healthcare are recognizing the limitations of traditional strategies, as these technologies are susceptible to cybersecurity threats which result in data and revenue losses. Malware, viruses, phishing, counterfeit cards are some of the attacks faced by e-payment platforms.

Market Growth Trends

According to a report from Fortune Business Insights, the global fraud detection and prevention market is anticipated to reach a substantial size of USD 129.17B by 2029. This growth is expected to at a CAGR of 22.8% during the forecast period (2022-2029).

The expansion of the FDP market can be attributed to several key factors. These include the widespread adoption of digital technologies and the Internet of Things (IoT) across a spectrum of industries, a significant upsurge in revenue losses and chargebacks stemming from fraudulent activities, and the increasing acceptance of fraud analytics and risk-based authentication solutions as effective tools to counteract fraud. These prevailing trends have led to the demand for fraud prevention solutions−thereby enabling businesses to safeguard their operations and mitigate the associated risks related to financial losses and damage to their reputation, ultimately enhancing value for their shareholders.

Growth in the Digital Payments M&A Market

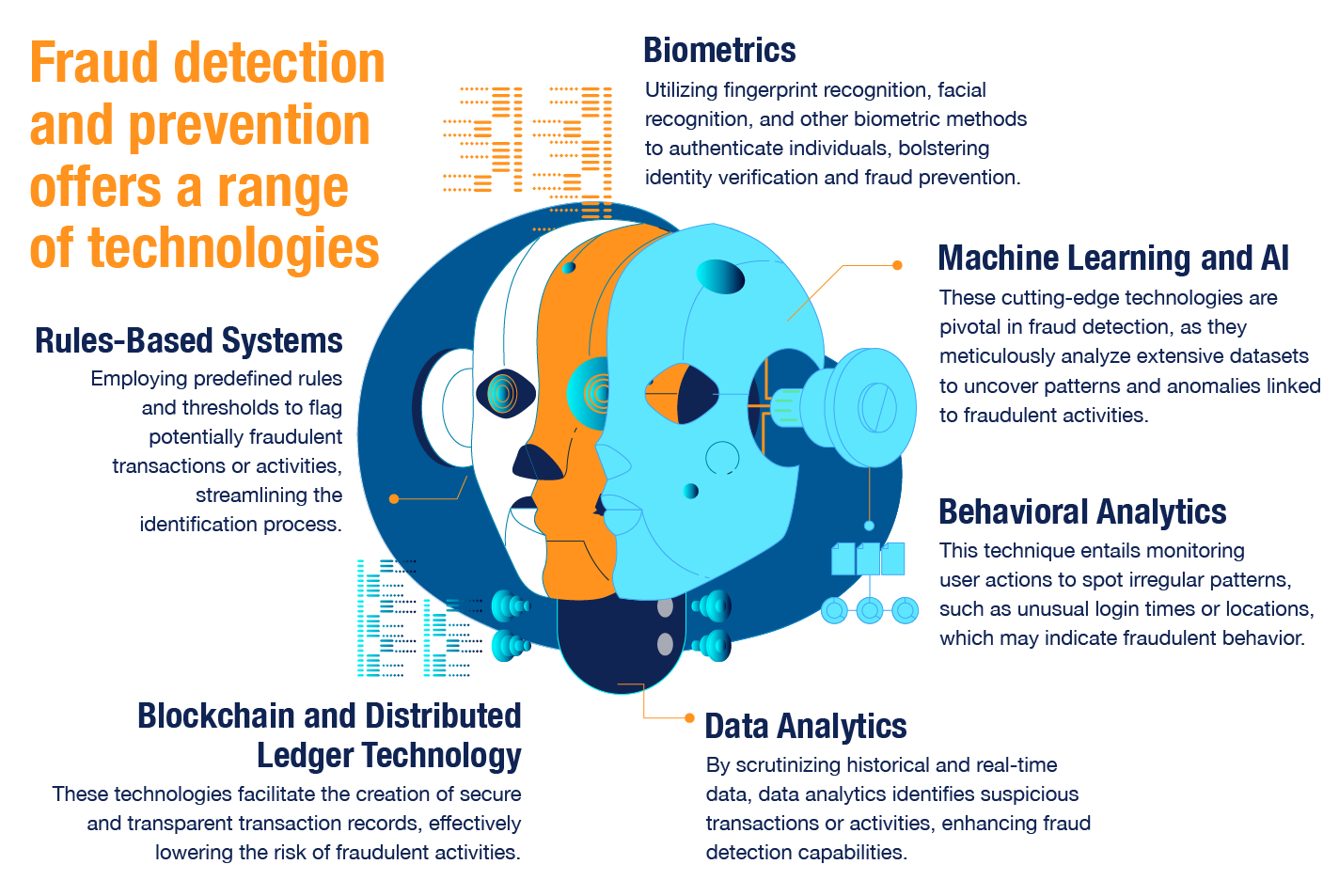

The fraud detection and prevention market offer a range of technologies and approaches, including:

Conclusion

The increase of e-commerce, digital banking, and online services has led to a heightened demand for fraud detection and prevention solutions. Companies and institutions across diverse sectors are actively investing in these technologies and services to safeguard their financial assets, preserve their reputation, and maintain customer trust. As fraudsters persistently refine their strategies, the FDP market will persist in its efforts to evolve and innovate, staying one step ahead of emerging threats.

Sources

- Fortune Business Insights. “Fraud Detection and Prevention Market Size [2022-2029] Exhibits 22.8% CAGR to Reach USD 129.17 Billion by 2029.” Yahoo! Finance, Dec. 3, 2022.

- Negru, Simona. “Mergers & Acquisitions in the Fraud Prevention Space – the Last 12 Months Overview.” LinkedIn, Dec. 10, 2020.

- MarketsandMarkets. “Fraud Detection and Prevention Market Worth $66.6 Billion by 2028 - Exclusive Report by MarketsandMarketsTM.” Bloomberg.com, May 25, 2023.

Read More