Share

Overview

Optimal decisions are made when leveraging the best information. Management teams require information services capable of collating, analyzing, and articulating insights to enhance decision-making. This demand is on the rise, particularly due to the proliferation of new data and content, the velocity of technological change, increasing economic uncertainty, new consumer behaviors, and geopolitical risks. All of these factors contribute to a heightened level of complexity.

To address these challenges, there is a growing need for transparency within management teams which is driving demand for information services.

Market Landscape and Business Models

The competitive landscape for information services is made up of traditional, content-focused players, and tech-forward offerings that leverage content as part of their broader software/workflow solution.

Traditional players in this segment collect, create, and publish data and content for businesses and professionals. The incumbents typically have a pure-play focus on data and content (e.g., Lefebvre Sarrut, Law Business Research) while several also extend their offerings with conferences and live events (e.g., Informa, PEI Media).

Tech-focused players (e.g., Argus Media, Wolters Kluwer, LexisNexis) have enhanced their offerings, pivoting solutions from information gathering to integrating into mission-critical workflows. These software providers enjoy close to zero churn, unlike content-only players who experience higher churn rates.

Overall, the global market is dominated by a handful of conglomerates, though regional leaders are prevalent across certain sub-sectors. The market is consolidating, with smaller players either being acquired by an incumbent seeking to fast track their development or by larger disruptors seeking access to new markets and/or product expansion (OAG/Infare) and building out their platforms.

Barriers to entry exist, such as incumbent brand recognition and access to capital for investment. However, the complacency by some providers has opened the door for disruptors (With Intelligence, Hanson Wade) to build best-in-class solutions.

Business models operating in the Information Services sector involve a combination of subscriptions, media, advertising income, and events. The sector is generally characterized by high margins, although segment differences are present. B2B data and content generates the highest margin, followed by software—delivering a slightly lower margin due to continuous updates, while print margins are the lowest.

Event margins are mixed. Must-attend conferences command premium pricing via exclusivity, but new events can fail to gain traction to become profitable.

The Solutions

Players in this space can be divided into two groups: vertical-focused providers targeting a specific vertical group and application-based solutions offering sector-agnostic applications:

Investment Considerations

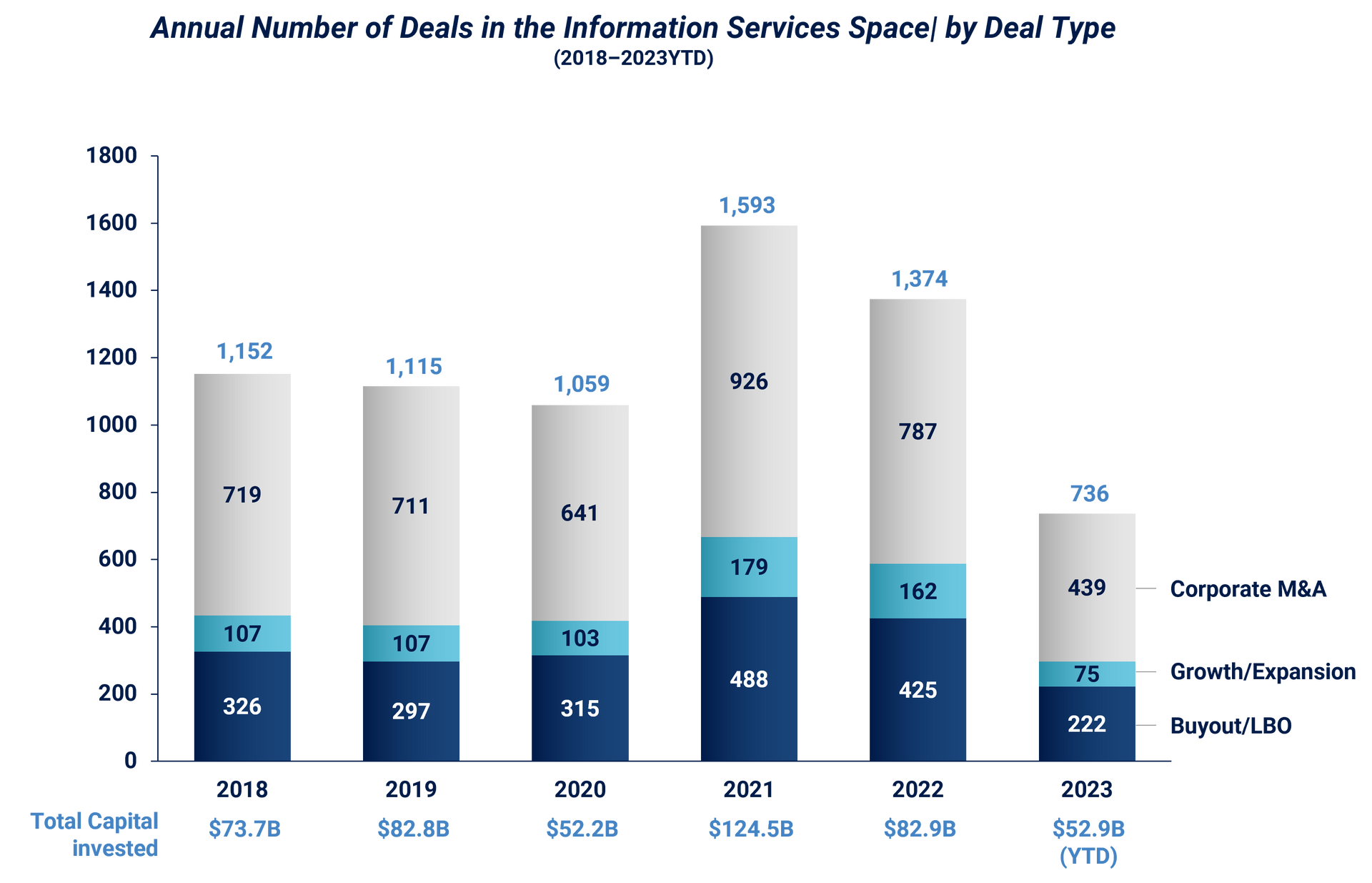

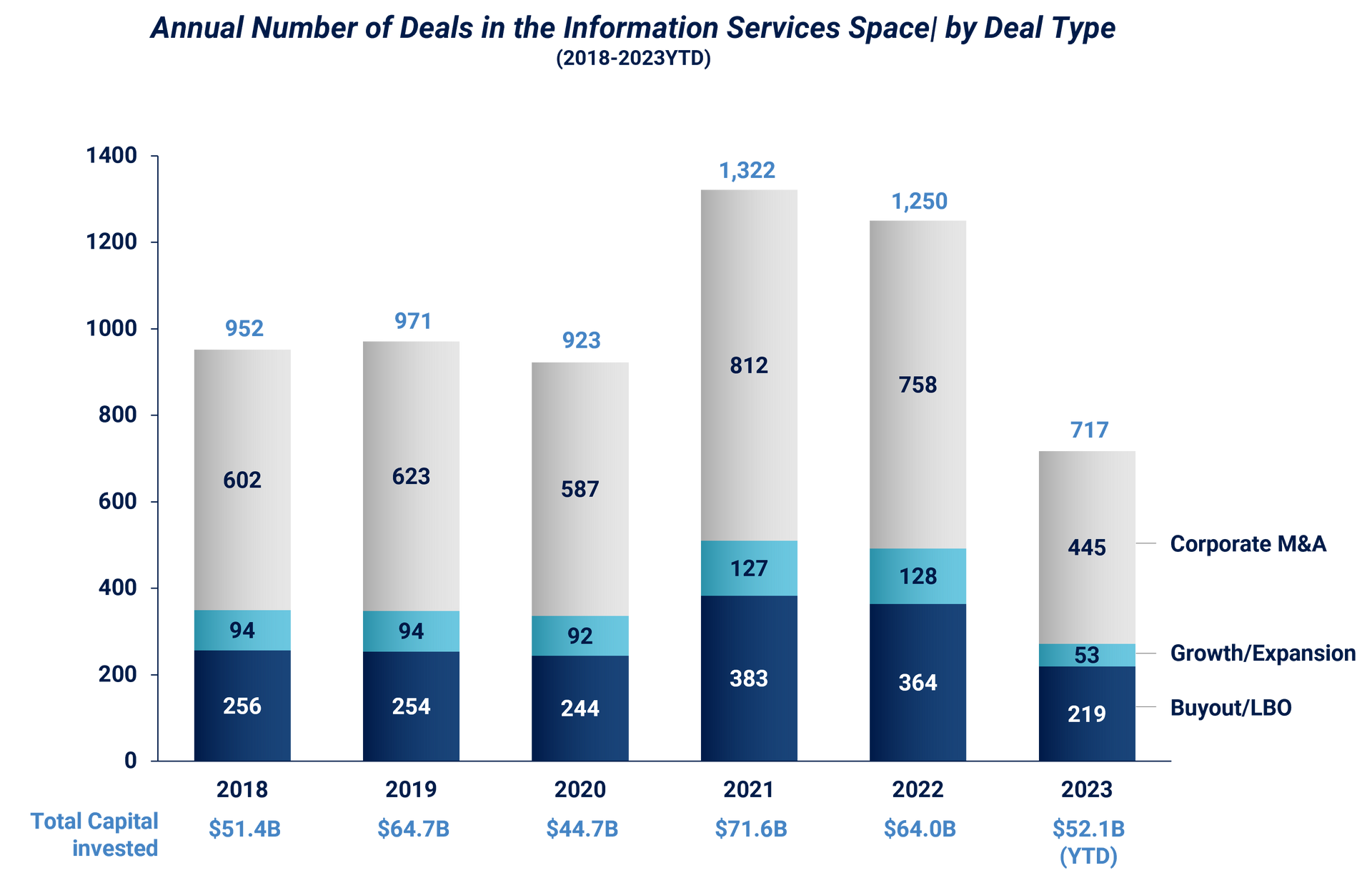

Information Services is an attractive sector for private equity, presenting opportunities in both the Mid-Market and Large Cap. Such opportunities will benefit from value creation through both scale-up growth and bolt-on consolidation. Additionally, the sector enjoys favorable conditions for natural, potential exit opportunities to large strategic corporates.

Private Equity has been active over the past few years, and this trend is anticipated to persist in both the U.S. and U.K.

As investors look to make informed decisions, several considerations are particularly relevant for Information Service assets:

- Embedded Software Solutions: These solutions integrated into a customer’s workflows tend to yield high ARR and promote customer stickiness.

- Unique Data or Information: Assets with exclusive, mission-critical data or information sets that are challenging to replicate often command premium pricing.

- Resilient Customer Sectors: Companies serving customers that operate in resilient end-sectors (e.g., Financial Services, Energy) tend to carry lower potential risks.

- AI Disruption Potential: Companies where AI can disrupt or enhance operations, particularly in contention creation or data analytics, can add significant value and create a competitive advantage.

A final consideration is where the company is on its journey, and your potential exit strategy—the plans you implement during ownership and the positioning of the company for exit will differ depending on if you are planning to exit to PE or exit to corporates.

Stax provides consulting services for both value creation and exit planning, with a focus on capital generation and asset maturity across a variety of industries. To learn more about Stax, visit www.stax.com or click here to contact us directly.