Share

Summary Perspectives

- Industrial automation is top-of-mind for manufacturers and logistics companies, especially given the prevailing labor shortage and escalating material and labor expenses.

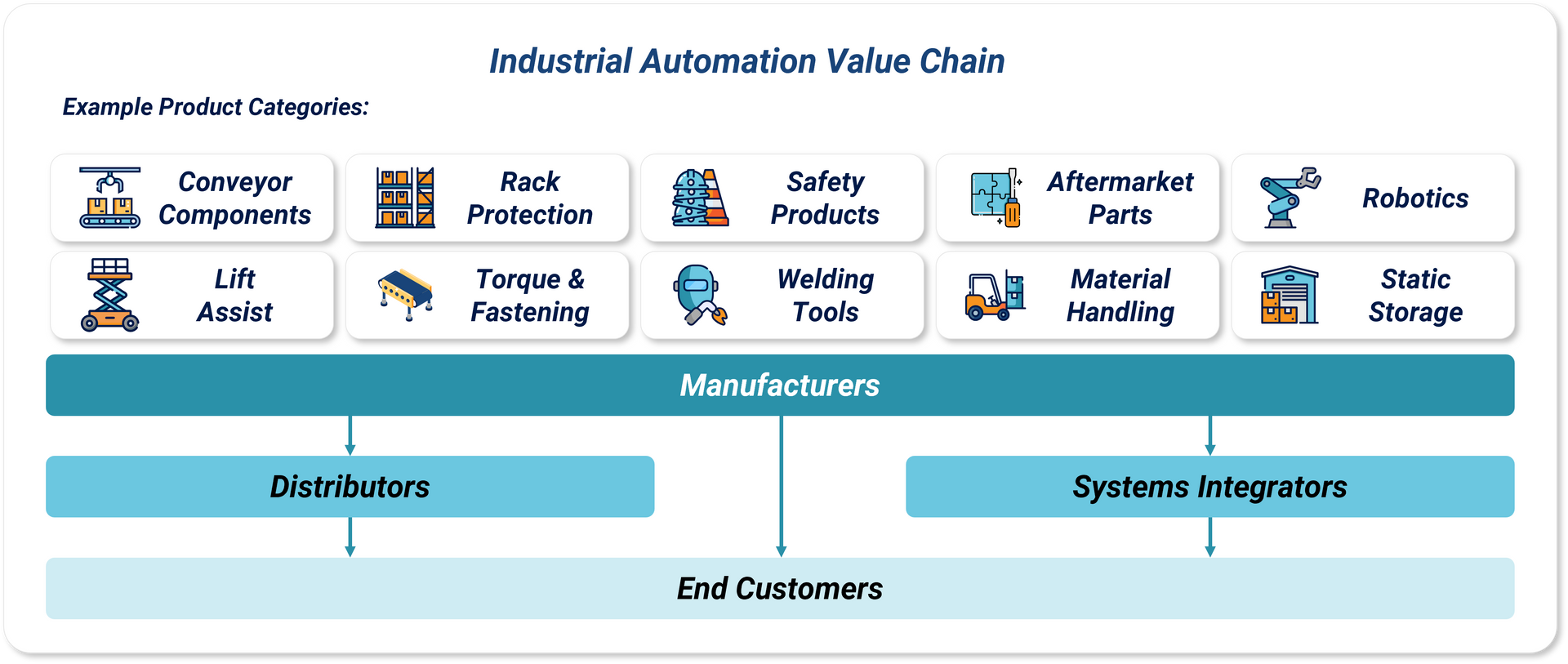

- Key market players, such as Robotics Manufacturers, Distributors, and Systems Integrators (SIs), have been widening their offerings to meet evolving demand, causing a surge in mergers and acquisitions. Consolidation across the value chain is intensifying, and players are now having to compete with current and former partners, in addition to their prior competitive sets.

- As the market continues to evolve, some industrial automation vendors are emerging as winners while others face increasing challenges.

Drivers of Market Growth

Industrial automation has witnessed strong growth over the last several years, driven by developments on both the demand and supply sides:

- Demand has been accelerated by labor shortages and rising costs of labor and materials, pushing firms to seek solutions to help safeguard their bottom-line.

- At the same time, industrial automation providers have made technological advancements that offer an increasingly attractive value proposition and proven ROI to customers, presenting a clear and justifiable solution to meet their needs.

Together, these dynamics have led to a market where players are continually seeking to add value to better align with and compete for a growing customer base.

Shifts in the Value Chain & Competitive Dynamics

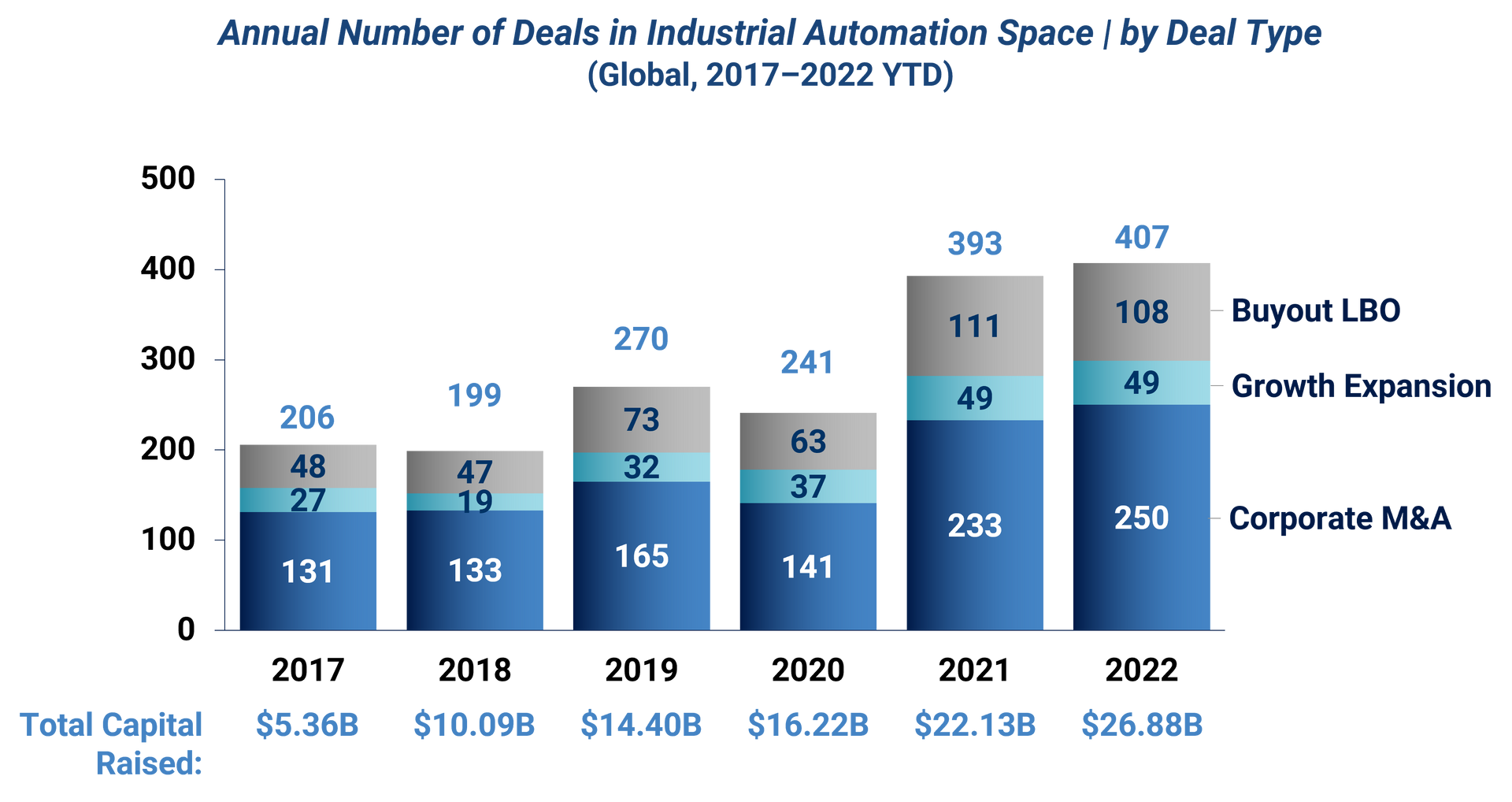

M&A activity has been on the rise as industrial automation providers seek to further differentiate in a highly fragmented market.

In addition to deepening existing capabilities, market players have made acquisitions across the value chain to extend their reach.

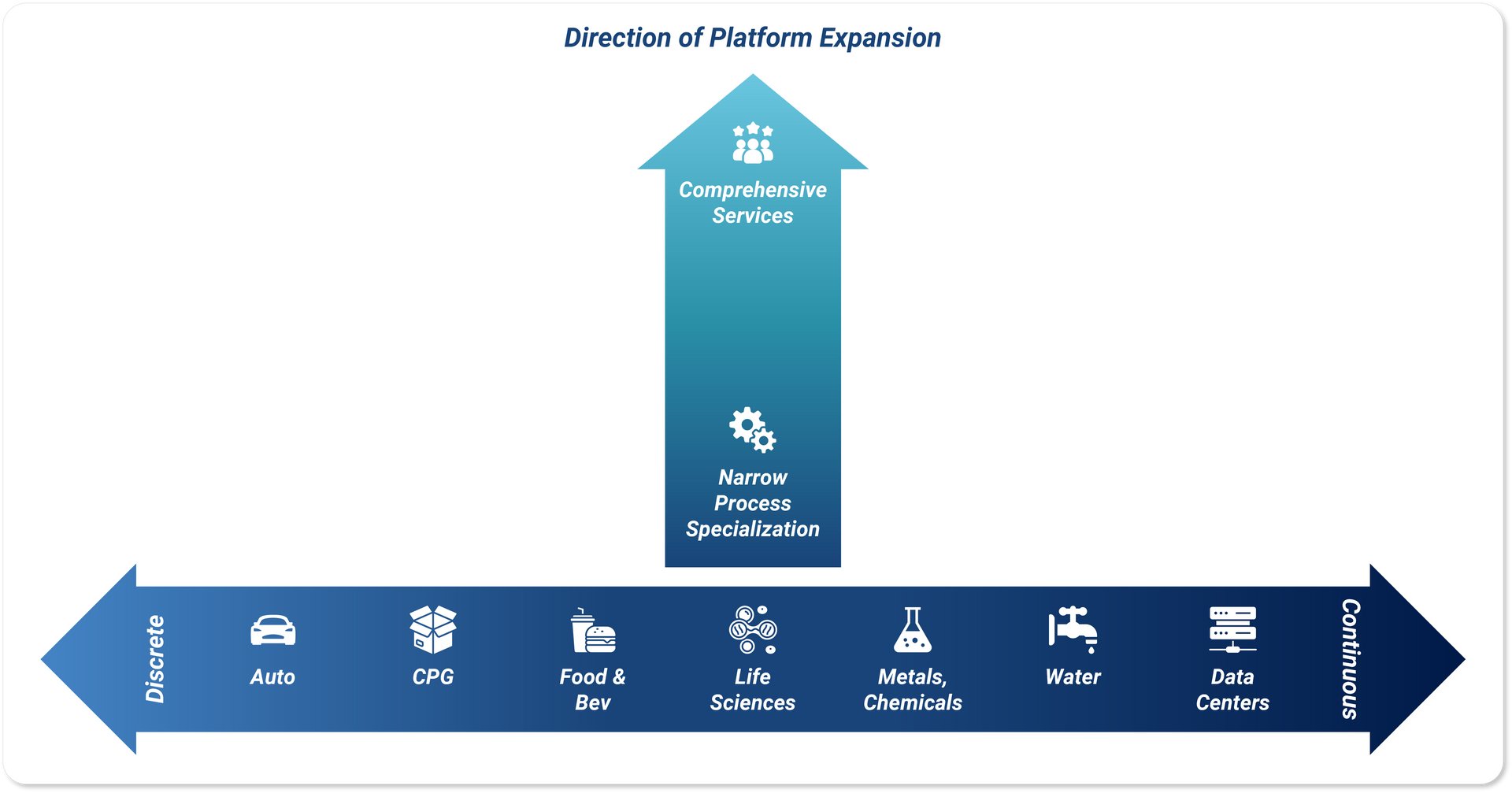

For example, large robotic manufacturers like Rockwell continue to retain sizeable integration businesses targeted at global accounts; SIs are moving closer to technology providers as they seek to differentiate from other SIs and large robotic manufacturers; and, while distributors provide more discrete equipment (e.g., material handling solutions) and products, they are also seeking to add valued-added services like integration capabilities and/or training and inspection services.

As a result, the role of key market participants (Systems Integrators (SIs), Components Manufacturers, Distributors, etc.) is increasingly converging.

Outlook & Implications

Further consolidation of the market is expected as key market players seek to differentiate and expand in relevance.

To make well-informed investment decisions in this expansive and dynamic industry, a comprehensive evaluation of vendor positioning, right-to-win, and defensibility is paramount to alleviating core concerns as well as helping to ensure an asset’s growth plan is strategically aligned to the market’s trajectory and/or pockets of opportunity.

Stax is positioned to address these investment considerations through a combination of industry experience and data-driven insights to aid in decision-making.

To hear more about our services and expertise, visit www.stax.com or contact us here.

Read More