Share

The accounting services market in the

U.K.

is expanding, and non-Big Four firms are experiencing faster revenue growth. The Big Four, which do not focus on mid-size/ small companies, face constraints due to their already high market share and regulation limits; meanwhile, smaller and mid-market accounting firms are capturing more of this growth momentum by offering greater partner attention and

customized advisory expertise

to win work.

Stax has observed an increase in consolidation in the U.K. accounting services sector by private equity investments and a trend is emerging from smaller firms merging “upwards” to build mid-market firms. Smaller accountancies need to scale to manage the increasing cost of compliance, increasing price pressure (due to higher awareness of market prices), risk of disruption from Financial Management Software providers such as QuickBooks, as well as higher use of digitalization in audit processes.

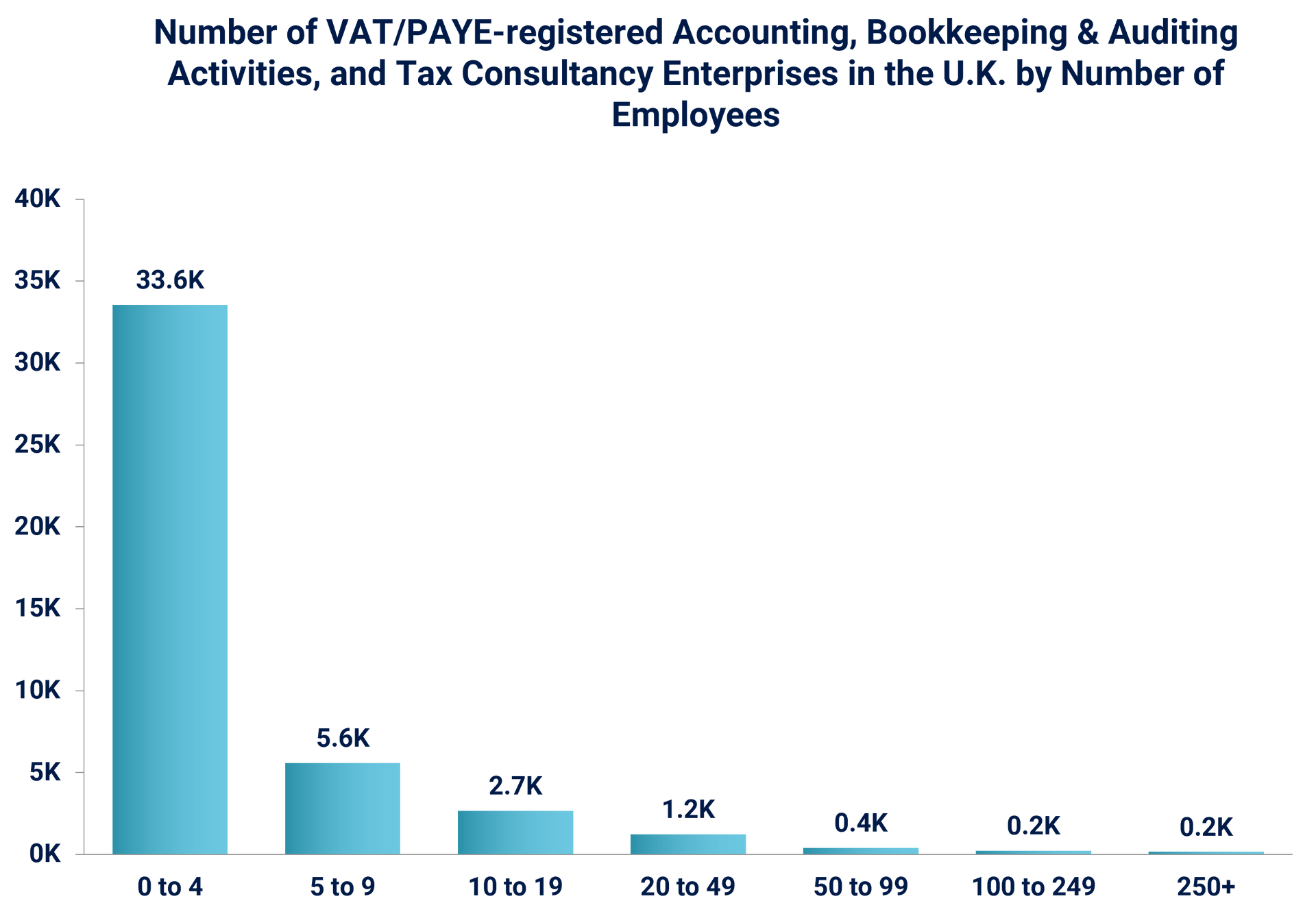

The U.K. accounting services industry is primed for further consolidation given its fragmentation among small and mid-sized firms, limited brand awareness in the mid-market, and an aging partner group nearing retirement. Approximately 90% of accounting firms have nine or fewer employees, highlighting the potential for further consolidation.

A vast number of local and regional accounting firms operate independently of the Big Four and their near competitors (e.g., BDO, Grant Thorton, RSM, etc). Most of these firms are founder-owned and managed by partners seeking an exit opportunity. These partners now have a strong incentive to sell through M&A, giving them liquidity and retirement income.

Furthermore, there is growing interest in consolidation among progressive medium-sized firms looking to rapidly gain market share and capabilities through acquisitions. The timing aligns for many local practitioners to consider selling to eager consolidators. Additionally, larger firms also have an opportunity to acquire specialized smaller firms to bridge capability gaps.

Building a Mid-Market U.K. Accountancy Platform: Four Strategies for Success

1. Establish a comprehensive, nationally recognized mid-market accounting service provider

Involves rapid expansion through acquisitions to establish a comprehensive national mid-market accountancy firm offering a full range of services. This strategy ensures extensive geographic coverage and enhances a national brand presence. However, it carries execution risks in integrating multiple firms into one cohesive organization.

2. Develop a specialized, vertically focused accountancy firm

Focuses on acquisitions and organic expansion within specific industry verticals such as healthcare, technology, financial services, etc. fostering strong specialty expertise and relationships within the selected vertical. This strategy, however, presents concentration risks, necessitating careful selection of a sector resilient to economic volatility.

3. Establish a product-centric firm with a focused approach

Primary focus is on establishing dominance in specialized service segments such as tax, insolvency, M&A advisory, etc. Usually, mid-size companies want a one-stop shop, so this reduces the addressable market. This strategy involves acquiring expertise and marketing efforts to excel in delivering these specific services. For example, acquiring specialized firms to become the leading provider of outsourced small business tax services.

4. Implement a strategic approach centered on regional concentration

Concentrates on acquiring firms within a certain geographic area to become the dominant regional player. Utilizes local brand recognition and relationships to expand are leveraged across a regional footprint (e.g., the largest accounting firm in the Southwest).

Bolt-on transactions within the accounting services market require careful consideration to ensure successful integration. These transactions should account for various factors, including geographic location, potential for service expansion, the composition of the client base, and, notably, alignment in ways of working and company culture.

The success of these bolt-on transactions not only hinges on strategic compatibility but also on fostering a shared organizational ethos that promotes collaboration, efficiency, and a cohesive work environment. Given that accounting services are inherently people-centric businesses, achieving synergies heavily relies on establishing common ground in work ethic and values.

Recognizing the significance of these elements is vital for maximizing the benefits and long-term success of such transactions within the dynamic landscape of the accounting services industry.

Developing a U.K. mid-market accountancy platform stands to gain significant advantages from operational synergies and sustained growth, propelled by escalating regulatory requirements, technological advancements, and heightened demand for advisory services.

Evolving Accounting Standards

The dynamic nature of accounting standards drives process complexity and supports greater investment in audit, tax, and other services to ensure compliance.

The U.K. accounting standards are going through major changes as rules converge with international norms. For example, the move from FRS 101 to U.K. GAAP to align the U.K.’s accounting standards with international norms, particularly with IFRS (International Financial Reporting Standards).

Changes in standards will require businesses to conduct comprehensive impact assessments to understand how new standards will affect their financial reporting, and, given the complexity, engage with professional advisors, including accountants and auditors.

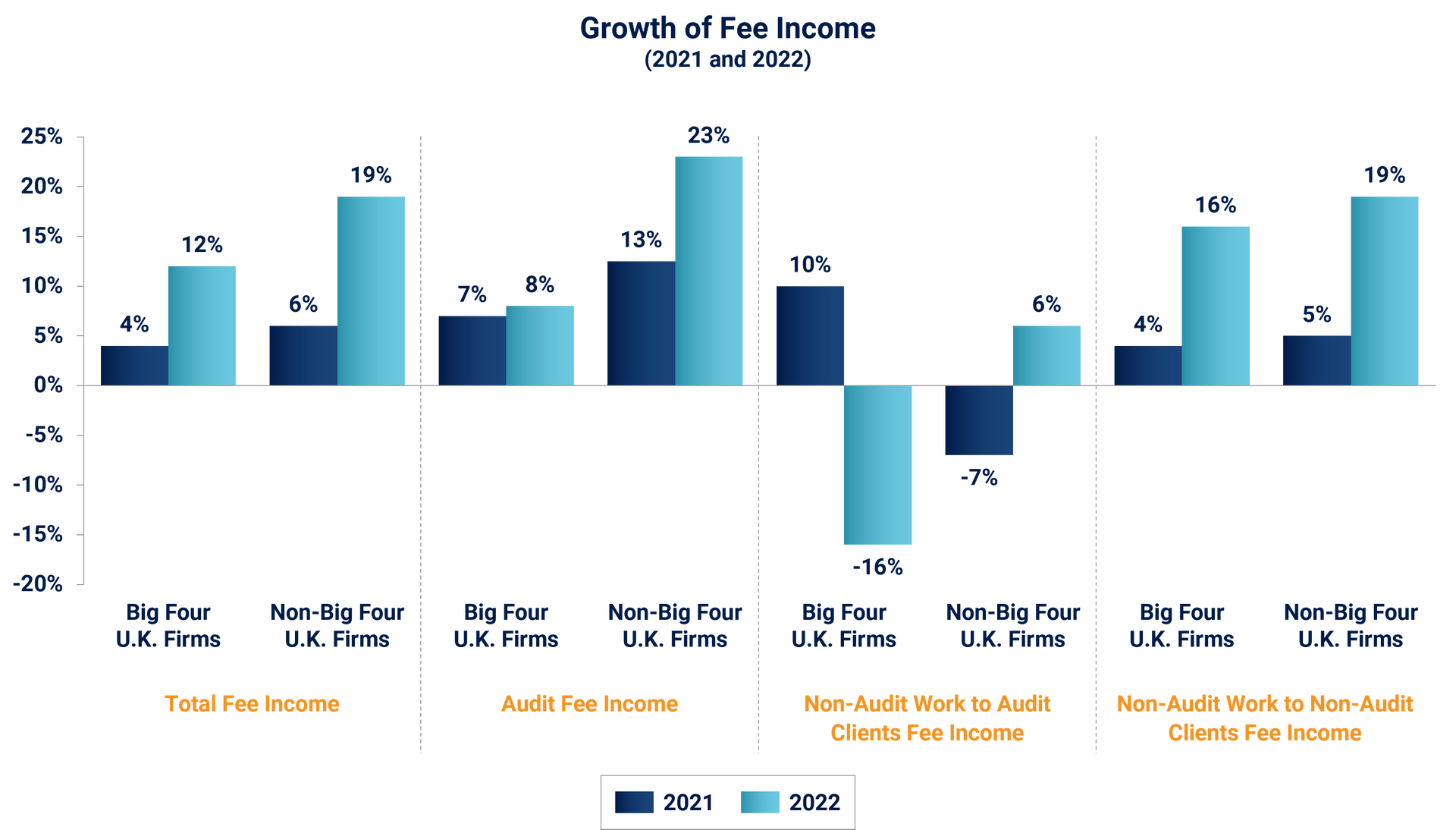

The long-standing reputation of the Big Four ensures their market leadership. However, smaller firms are successfully repositioning based on focus and agility, resulting in a gradual rebalancing in the competitive landscape even as the overall market expands.

Growth in Non-Traditional Services

Accounting firms in the U.K. have expanded their service lines well beyond the core auditing functions. This includes growth in areas like technology consulting, cybersecurity, HR advisory, and environmental/sustainability services.

Firms are positioning themselves as strategic business advisors, not just financial compliance partners. Key drivers of this trend are client demand for value-added services and the need for accounting firms to diversify revenue streams.

The Big Four are at the forefront of moving into new non-audit service domains based on their expertise, resources, and client relationships. However, mid-tier and smaller specialty firms are also developing niche advisory capabilities around topics like data analytics and strategic planning. The scope of offerings enables more touchpoints and deeper partnerships with clients.

Overall, the growth in non-traditional services reflects accounting firms' focus on value-added advisory capabilities amid an evolving business landscape.

Increasing Use of Office of the CFO Technology

The market traction of “fractional CFO” providers emphasizes the changing role of outsourcing, with companies turning to business advisory services to add value via deeper subject matter expertise, in addition to traditional cost savings:

According to Deloitte’s 2022 global outsourcing survey, 52% of business and technology leaders reported they were outsourcing back-office functions and an even higher portion of professional services such as Finance (51%), Tax (61%) and Legal (64%) were being outsourced to external service providers.

Conclusion

When it comes to understanding the viability of a market for investment, Stax is where value is created. Our approach, centered around providing data-driven and actionable insights, enables clients to make informed decisions that lead to providing the most competitive returns. To learn more, visit our website

www.stax.com

or

contact us here.