Share

Continued Prioritization of Digital

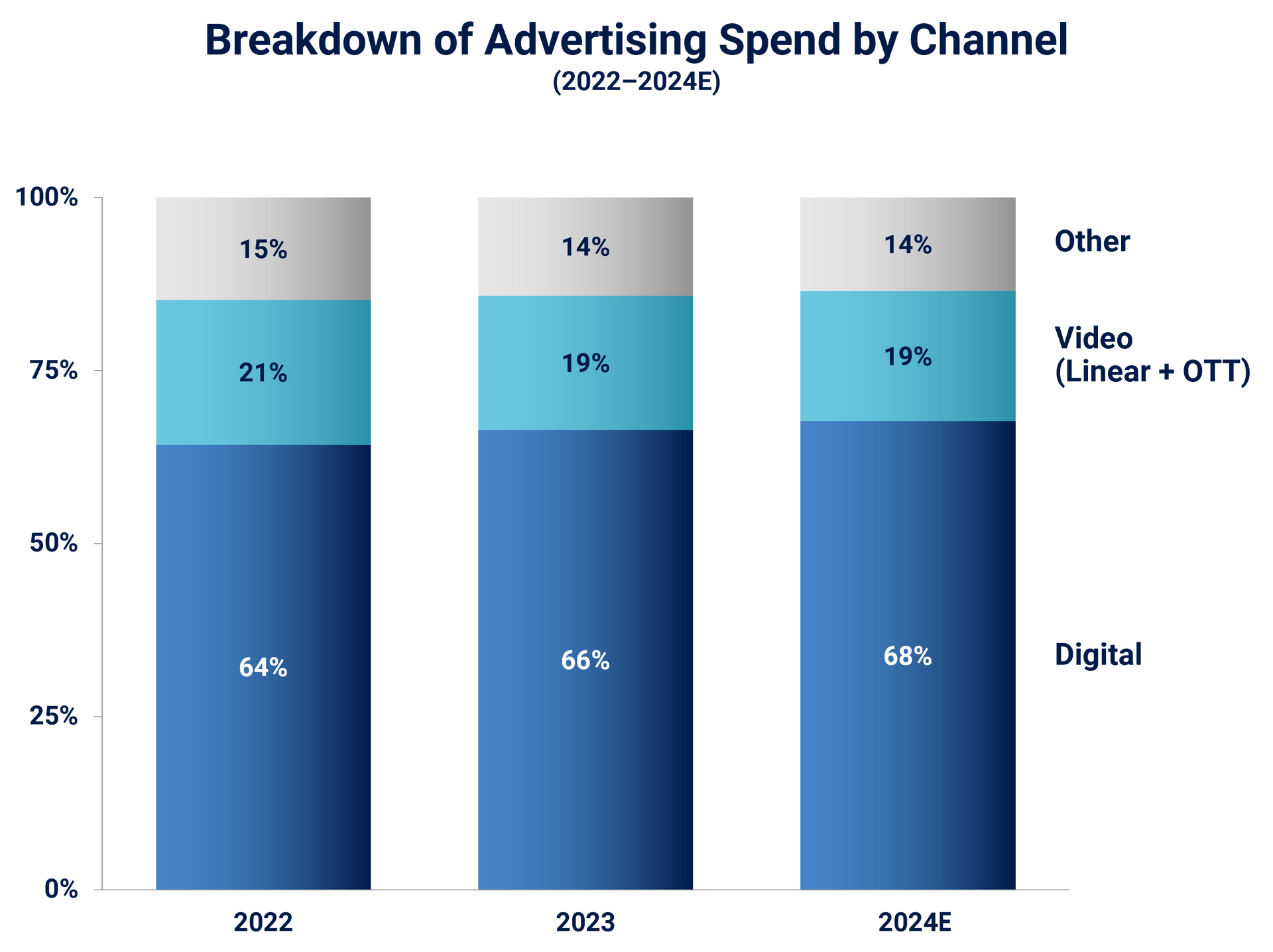

A secular trend that predates Covid has seen digital advertising steadily gaining a larger share of ad dollars at the expense of traditional methods such as linear television and out-of-home advertising. This shift is due to digital advertising’s proven effectiveness in reaching and engaging target audiences, the ability to enable real-time monitoring, and cost-effectiveness. Additionally, it aligns with consumer trends, reflecting where consumers are spending their time.

Currently, digital advertising accounts for nearly two-thirds of total ad budgets. These trends show no signs of slowing down, favoring digital media platforms as the shift away from traditional advertising continues. The ability for advertisers to reach a wider and more diverse audience, along with more targeted advertising, improved return on ad spend (ROAS), and enhanced reporting, further reinforces the use of digital advertising.

Where Advertising Dollars Are Going

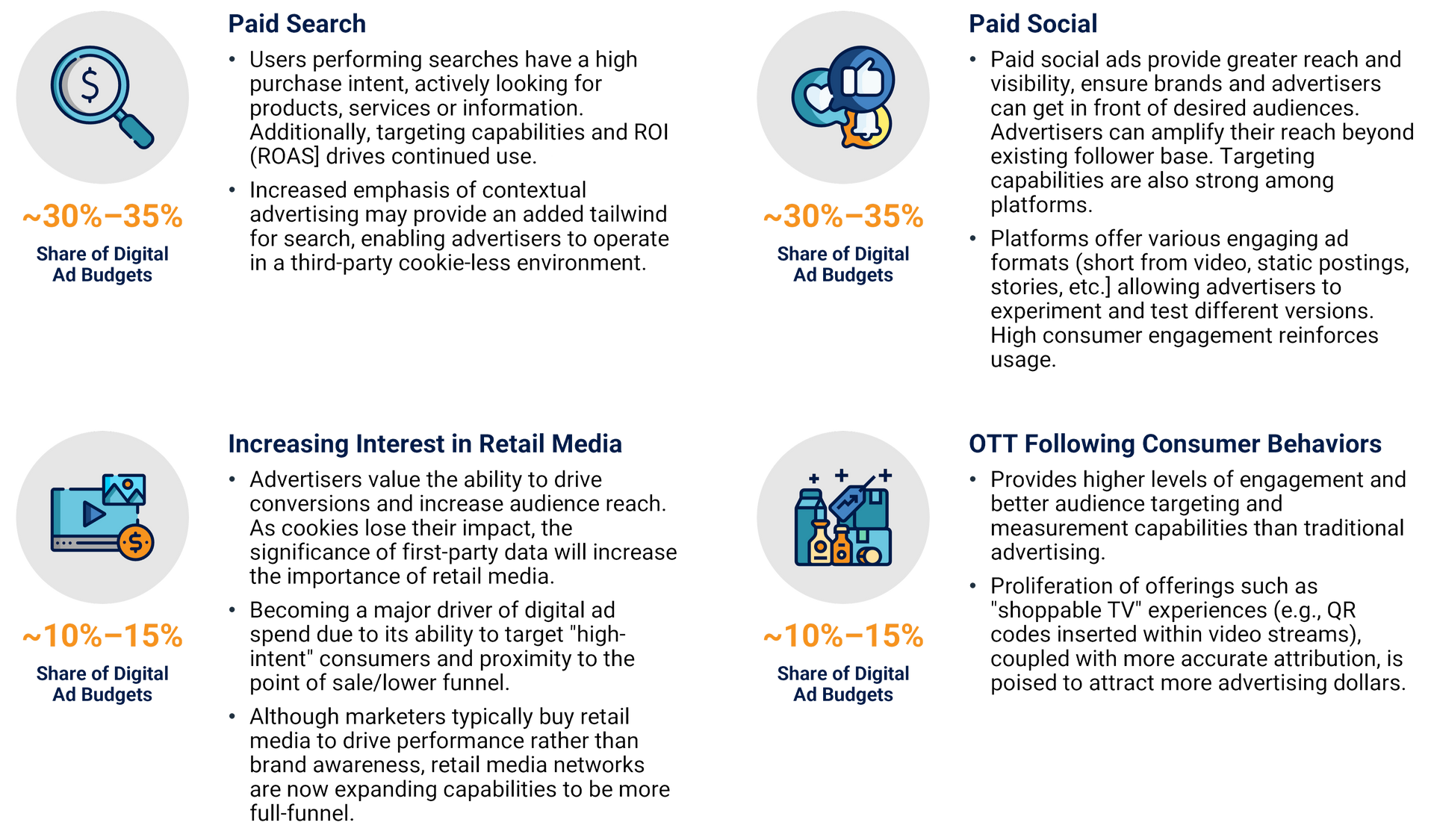

As brands and advertisers invest more in digital advertising, they are utilizing various digital channels to meet their objectives. This diversification not only broadens their reach but also enhances engagement by connecting with customers where they are most active. Additionally, it enables users to interact on platforms they find most comfortable.

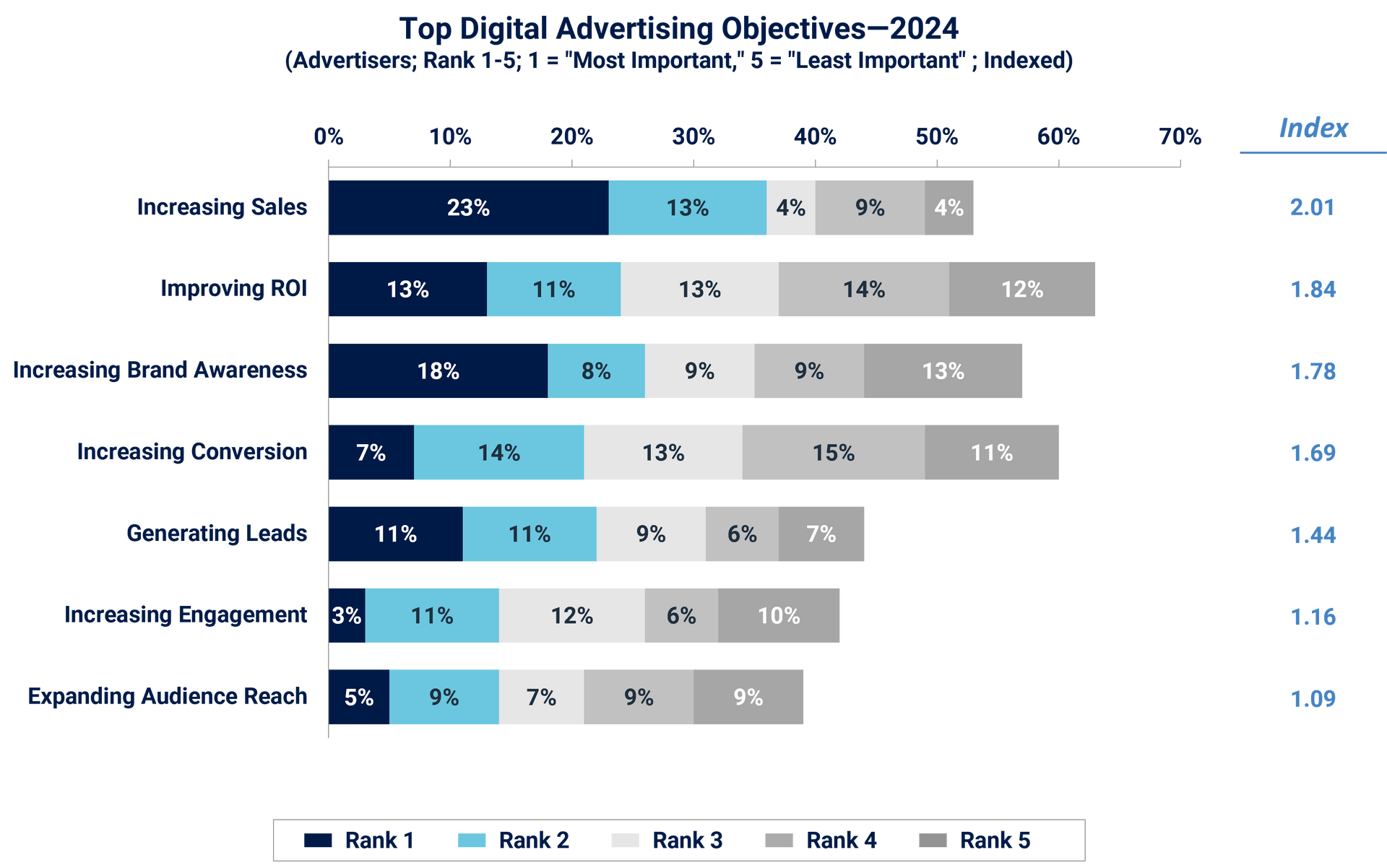

Advertisers are relying on established channels like paid social and paid search, while also exploring emerging channels such as OTT/CTV and retail media. During the uncertain market conditions of 2022-2023, ad budget growth was more modest—budgets were scrutinized more closely, leading advertisers to focus on driving conversions to increase sales and maximize ROAS.

This led advertisers to prioritize established digital channels such as paid social and paid search. They also leaned into growing channels that could fulfill advertisers' campaign objectives. For instance, with the ongoing decline in linear television viewership ratings, advertisers are reallocating funds from linear television to OTT/CTV. Furthermore, retail media has been a rapidly growing channel due to its alignment with the bottom of the sales funnel—ads yield better results the closer they are to the point of transaction.

Within each of these channels, established and scaling platforms will be prioritized, offering greater reach and often superior ad targeting capabilities for advertisers. However, as budgets expand, advertisers may have more interest in using secondary and tertiary platforms that cater to specific audiences as this approach can help advertisers expand their reach and achieve their advertising objectives.

Agency Fragmentation

Digital advertising is changing the dynamics between brands and advertising agencies. As digital advertising expands, brands are demanding a wider array of services, spanning content marketing, media buying and placement, email marketing, ecommerce, web design, public relations, and branding. Brands are increasingly diversifying their partnerships, moving away from a single provider model to partnering with multiple agencies that offer specific expertise. Concurrently, larger brands are internalizing more of these activities to cut costs and maintain domain knowledge.

The surge in digital advertising has spurred the growth of specialized digital agencies and consultancies. This has intensified competition and posed challenges to the traditional full-service agency model. These developments are leading to a fragmentation and diversification of spend and a decrease in managed ad budgets. Larger agencies, traditionally associated with higher fees, are seen as facing more challenges.

Despite these changes, there are areas where brands continue to rely on agencies. Brands still heavily rely on advertising agencies for ad placement/purchasing and media channel selection workflows. They often lack the economies of scale and technical expertise required for processes like programmatic ad buying and placement. Performance marketing agencies continue to be in demand as they can effectively tie clients’ marketing investments and ad campaigns to measurable performance. Similarly, agencies specializing in specific verticals (e.g., healthcare) may be better positioned.

AI’s Impact on Digital Advertising

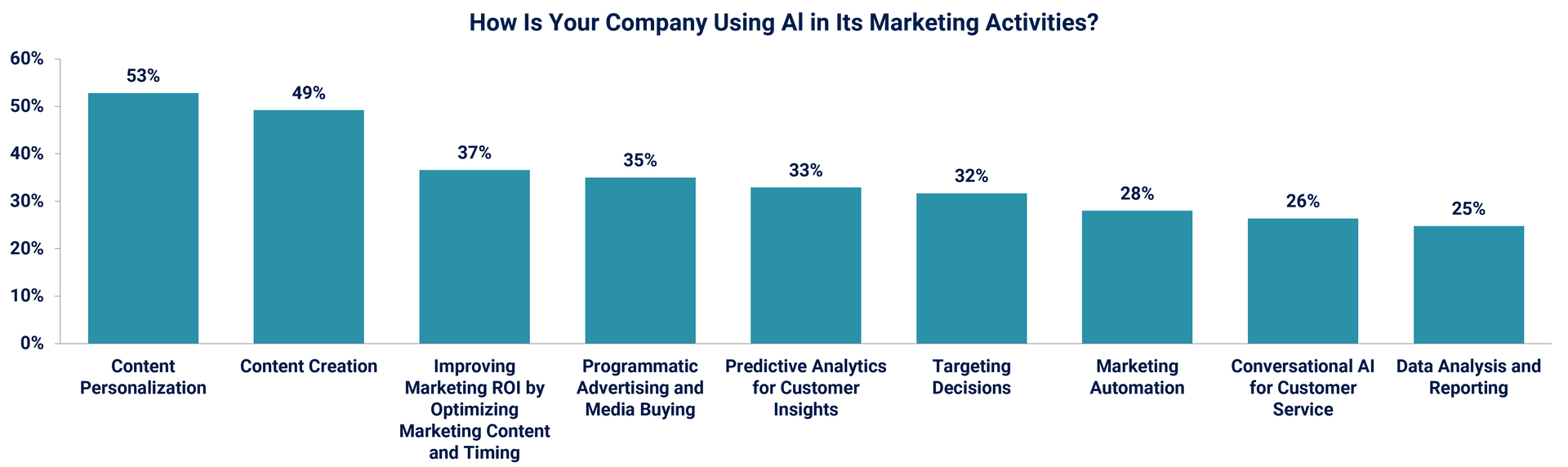

Digital platforms are incorporating AI into their advertising product offerings. The launch of Advantage+ by Meta and PerformanceMax by Google highlights the growing role of AI in AdTech, revolutionizing the way agencies and advertisers plan, manage, and optimize marketing campaigns. It’s expected that other platforms will follow suit in the coming months.

Currently, AI is embedded in tactical workflows, such as content personalization, creation, and automation. Tools like Meta’s Advantage+ allow advertisers to dynamically generate and test various ad creative combinations at scale, aiming to deliver more personalized and higher-performing ads. Furthermore, AI tools have automated core campaign workflows that were traditionally manual. However, the use of AI in programmatic advertising, media buying, predictive analytics, and customer insights is relatively lower.

While the use of AI is on the rise, it’s unlikely to drastically alter the relationship between brands and agencies in the short term. As AI capabilities advance, brands may increasingly rely on select agencies due to a potential lack of in-house expertise to leverage these tools and capabilities. However, agencies that fail to invest in and incorporate AI into their operations are likely to fall behind competitors who embrace these changes.

In conclusion, the digital advertising landscape is undergoing a substantial transformation. The resurgence of digital advertising in 2024, propelled by improving economic indicators and improved company performance, signals a promising outlook for the industry. These positive tailwinds are expected to renew investor activity in digital platforms, assets, and service providers.

The transition from traditional to digital advertising continues unabated, with digital platforms now accounting for nearly two-thirds of total ad budgets. This trend shows no signs of slowing down. Brands are diversifying their advertising strategies, leveraging a variety of digital channels to engage their target audiences. The growth of ad budgets is driving incremental spending creating opportunities for new and emerging platforms.

Alongside this shift, agency relationships are also evolving. Brands increasingly seeking specialized expertise and internalizing more activities. Despite these changes, agencies continue to play a vital role, particularly in areas requiring technical expertise and economies of scale. The fragmentation of agency spend is also creating opportunities for a wide range of service providers, offering organic and roll-up opportunities to scale revenue.

Investment candidates that align with these dynamics will be well-positioned to outperform the market and have a distinct competitive advantage. At Stax, our mission is to facilitate value-creation for our clients through our actionable, data-driven insights, gathered by our team of experienced consultants. To learn more about Stax and our services, visit www.stax.com or click here to contact us.