Share

Today’s M&A environment faces amplified risks and heightened investor conservativeness. Yet, competition for ‘A-grade’ assets remains fierce, driving wide and competitive auction processes and buoyed multiples. In this context, effective exit planning has become crucial for management teams and sponsors to prepare and position assets for sale, ensuring best-case transaction outcomes, a smooth transition of ownership, and accelerated value creation for the next sponsor.

As part of this preparation, sell-side market studies have emerged as an industry standard, offering significant benefits for both deal outcomes and strategic intelligence by helping:

- Sharpen market and asset positioning: Helps investors clearly understand the business’s place in the market, guiding thesis development, and encouraging early productive “leaning-in.” (At Stax, we regularly hear of clients passing on deals due to misalignment or misunderstanding of positioning.)

- Preempt buy-side diligence hurdles: Mirrors key diligence workstreams to highlight strengths, address potential red flags, and equip management with resources to prepare for and mitigate potential risks likely raised in buy-side diligence.

- Inform long-term value creation: Provides a solid research base that not only informs the business’s strategic planning but also accelerates strategic planning and growth for the next investor.

Why Exit Planning Starts the Day After Close

For sponsors, exit planning should begin the day after the deal closes. The sooner investors align around a long-term vision and roadmap to get there, the better positioned they are to create value and ultimately command a premium at exit.

Regular recalibration during the hold period is not optional, it’s essential. The ability to make well-informed adjustments, while staying focused on long-term value creation, separates reactive investments from resilient ones. By combining real-time market feedback with internal performance analysis, investors can refine strategic direction, redeploy resources, and reposition the story around emerging strengths. This proactive, iterative approach not only supports growth, but it also gives buyers confidence that the business is under capable stewardship.

When the time comes to exit, sponsors should be able to point to more than just top-line growth, they should be able to demonstrate how the company has evolved, where it has won, and why those wins matter.

Why a Buy-Side Lens is Essential Before You Sell

As an exit approaches, viewing a business through a buy-side lens shifts from a nice-to-have to a strategic imperative. Investment committees today have become increasingly discerning, leaning in hard on A-grade assets, and walking away early from anything that signals elevated risk or uncertainty.

To maximize outcomes and minimize surprises, management teams and sponsors must ask: What will buyers see when they look at us? And just as importantly, what might give them pause?

The Buy-side is Asking Different Questions – You Should Too

Customer metrics like Net Promoter Score (NPS) or retention data are commonly cited in sell-side narratives, but it’s critical to recognize how buyers interpret these numbers. Many of these indicators can be reflections of customer sentiment and attitude based on the most recent six months or less of engagement.

Internally generated perspectives (e.g., customer surveys) are naturally colored by long-term relationships and active adjustment or calibration (e.g., by sales reps, teams). In contrast, buy-side diligence teams will take an outsider’s view, probing disconnects, potential risks, or misalignment between messaging and market perception.

Clients often find incredible value in Stax’s deep experience advising hundreds of buy-side deals per year with fully outside-in research. We know what buyers ask, and more importantly, we know what flags get elevated to investment committees. From competitive positioning to pricing power, from customer loyalty to operational scalability, we help clients anticipate a deeper dive.

More Than Damage Control – It’s a Strategic Advantage

A preemptive buy-side diagnostic doesn’t just help surface risks; it creates time and clarity to address them. With enough lead time, some red flags can be mitigated entirely (depending on lead-time to processes), others can be reframed to provide valuable insight into strategic positioning for sale. In some cases, findings from a diagnostic reveal the opportunity to delay a sale by 8-12 months to address key risks proactively.

In other cases, it equips sponsors and bankers with a strong foundation of objective, sometimes brutally so, outside-in research. This not only helps eliminate potential surprises but also empowers management and banks with the intelligence to assuage unfounded risks and demonstrate proactive understanding and planful mitigation of real potential headwinds.

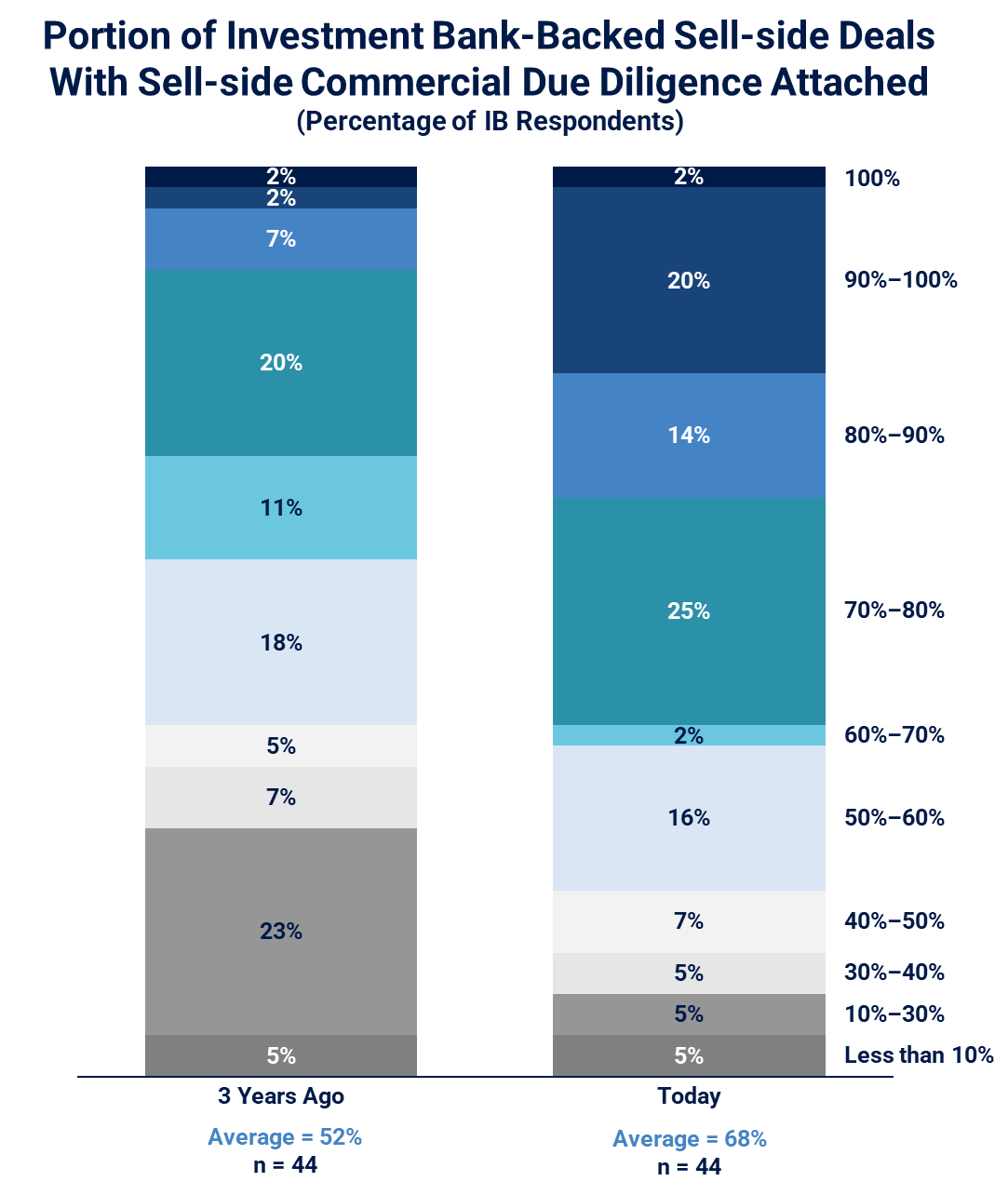

“5 years ago, sell-side Quality of Earnings became the standard. Now we are seeing the same thing play out with sell-side due diligences. Whether it’s a new market, or even founder-owned businesses, you need to have a market study. If you are unwilling to commission a market study, I need to assess as a banker if I want to take them on as a client. I’m interested in helping clients mitigate potholes and battleground issues, and the way to do that is with a sell-side market study. There are usually 4 key issues (outside of valuation) where the client will make money and get returns, 2–3 of those issues a market study will address.”

—Managing Director, US-based Investment Banker

“While sell-sides have been slower to adopt in the US relative to Europe, that is changing as US PE funds are becoming more specialized themselves and as deals are taking longer to close, there is increased value for a more tailored market study that is frontloaded in the process.”

—Managing Director, US-based Investment Banker

Value Creation Starts with a Plan– And VDD Must Prove It

A formal vendor due diligence (VDD) report must do more than outline performance. It should clearly demonstrate that a credible, actionable value creation (VC) plan is in place and can withstand investor scrutiny.

The most defensible VC narratives are rooted in a fundamentally strong business: those with a well-defined ideal customer profile (ICP), an intentional go-to-market strategy, and track record of growth across core markets. These attributes build investor confidence in the underling health of the platform.

“To generate higher returns in a competitive market with compressed multiples, operational improvements have become essential as financial engineering alone no longer delivers target returns. Enhanced value creation capabilities also provide a competitive advantage in sourcing and winning deals by demonstrating specific operational expertise to sellers.”

—Vice President, European Mid-Market PE

De-Risking Growth with Research-Backed Clarity

What sets a strong VDD apart is its ability to move beyond general aspiration. It should segment growth opportunities as “short-putts” versus “long-shots,” supported by data, which may include:

- Customer case studies

- Comparative needs assessments

- Quantified demand for cross-sell or product expansion opportunities

This research-backed segmentation lowers the inherent risk aperture, encouraging investors to lean in, and building a plan which they can build on rather than define from scratch.

The Flywheel: From Planning to Execution

Post close, the VC plan becomes the operating mandate. But to drive results, long-term strategies must be translated into specific, near-term actions.

Long-term planning informed by VDD must be actioned through near-term value creation steps which are specific, and rooted in the existing people, processes, capacity of the business, and newly accessible cash flows. A VDD-informed VC plan provides not only the vision but the credibility to execute, ensuring momentum doesn’t stall after the deal closes.

Key Takeaways to Prepare for Exit

- Exit readiness begins the day after close—not six months before sale.

- Buy-side diagnostics de-risk the narrative and drive stronger positioning.

- A well-structured VDD must prove not just performance—but a plan for future value.

Grant Thornton Stax has supported many of private equity’s most successful and enduring firms across the full investment lifecycle—from buy-side diligence and growth strategy to add-on M&A and exit planning.

Whether supporting a single deal or working across multiple investments, we’ve seen that the most successful sponsors are those willing to challenge their assumptions with deep, research-backed insights—and use that intelligence to guide growth from day one.