Share

From extraction, to processing, to transportation, the Oil & Gas supply chain is arguably the most complex of any industry. It is challenging for anyone to understand the complex interlinking of infrastructure, equipment, and processes required to bring the mission-critical energy resource into our homes. The same goes for Oil & Gas technology. Historically, the industry has not been on the leading edge of technology, especially for one that relies so heavily on it. However, the recent plunge in oil prices caused all players not only to rethink their standard operating procedures, but their use of technology as well.

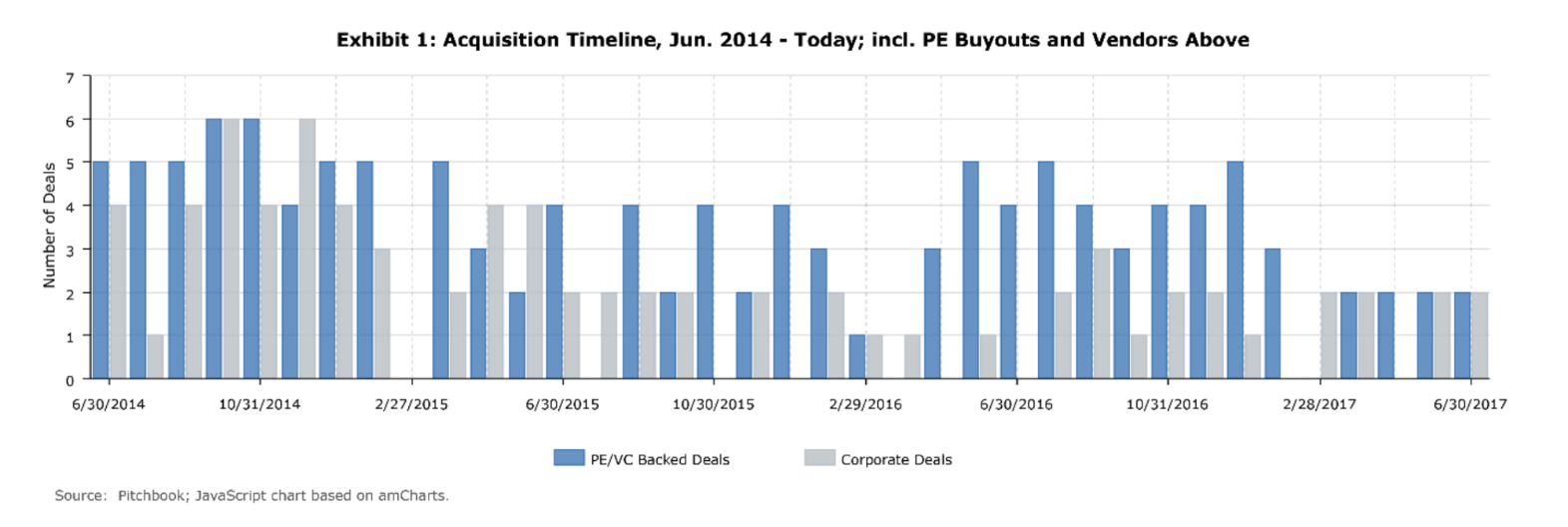

When oil prices were upwards of $100 per barrel and IT budgets were strong, decision makers would procure solutions without regard for their integration with other departments and systems. Spend on data and applications for their interpretation in support of new drilling and exploration was significant. Further, in the race to become the first truly end-to-end Oil & Gas software solution, entrenched vendors like Haliburton, Schlumberger, Weatherford, Baker Hughes, and IHS focused on expanding their offerings through acquisition.

Meanwhile, widespread challenges facing users such as the lack of intuitiveness and archaic feel of these “cobbled-together” products went unaddressed, resulting in patchwork offerings with inconsistent integration. This also compounded problems around disparate sources for the same data — an issue that for years has plagued operators through unsuccessful attempts to build a master data repository to store and distribute “one version of the truth” for key production metrics.

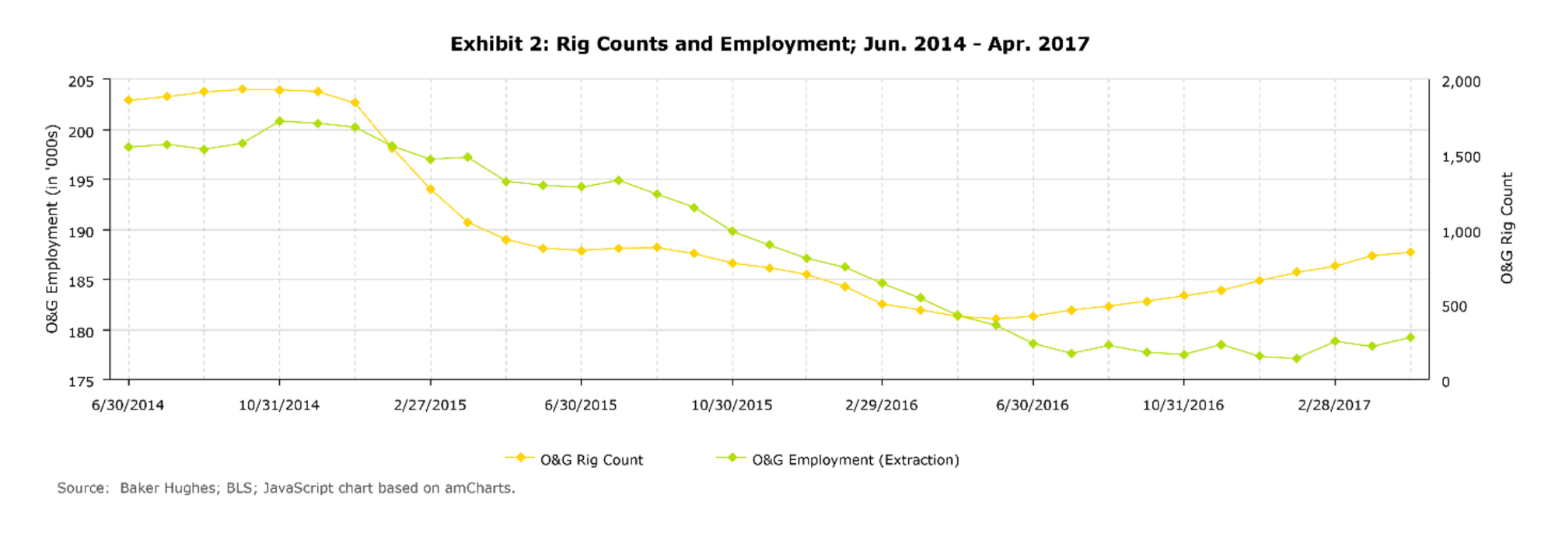

This increased importance of technology in the space has positive implications for outside investment. As prices flatten and rig counts begin to normalize, there is little movement in employment — operators are relying on technology more heavily now than ever before, enabling them to operate with a lower headcount.

Investors should closely monitor the race to comprehensiveness — the first vendor to offer a fully-integrated solution will surely spur significant interest from operators of all sizes. Further, there may be a need for operating expertise and funding, as we believe this vendor will likely be a new player with a fresh, technologically-innovative approach, versus an inorganic amalgamation of unrelated point-specific solutions.

Today’s Software Environment Traditionally, operators and outside investors primarily focused on drilling and exploration. But when the price of oil began to fall precipitously in the summer of 2014 and continued its descent over the next 18 months reaching levels not seen for nearly a decade and a half, operators were forced to freeze capital expenditures and optimize production from existing wells to remain solvent. This created a shift in focus from drilling more to drilling smarter, and caused operators to rethink their use of software.

More than ever operators need to improve and optimize how they effectively collect, monitor, and forecast production data. While the broad Oil & Gas market is large and complex, profitability for upstream companies is simple: how much does a well produce each month, and how much does it costs to operate? Until prices are no longer suppressed due to persisting oversupply concerns and return to pre-crash levels, operators will continue the reprioritization of new drilling activity and focus on profitably squeezing all that they can from existing wells for the foreseeable future.

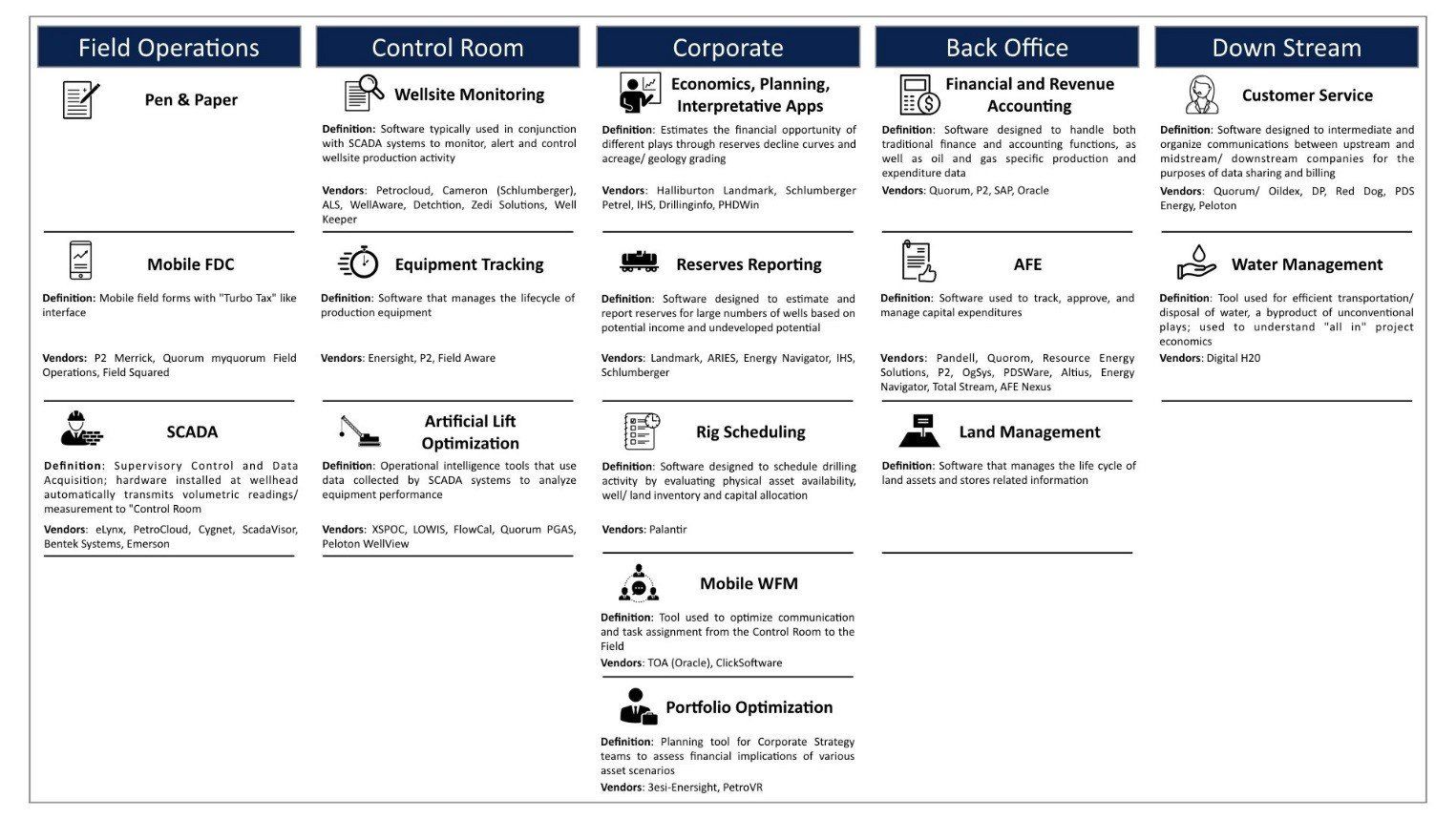

As of today, multiple software solutions are used to enable the flow of production data from the oilfield all the way up to the C-Suite. To inform prospective or current investors in the space, we have defined the Oil & Gas Production Software Ecosystem across five primary categories: Field Operations, Control Room, Corporate, Back Office, and Downstream.

The number of wells owned and operated by an upstream firm has implications for its technology focuses today and going forward. Today, about 85 percent of US upstream firms own/operate between 15 and 200 wells. The small firm count has trended downward since the 2014 price crash, as many were driven into bankruptcy. Prior to 2014, small firm counts had grown by as much as 12 percent year-over-year. If or when prices normalize, the long tail of small firms can be expected to get even longer.

For many of these small firms, products offered by the entrenched vendors previously mentioned are often too robust. Many of their additional modules are viewed as superfluous, unintuitive, and far too expensive. Less sophisticated operators prefer light, easy-to-use products that serve their specific needs. As legacy products mature and low-end operators rethink their IT strategies, there are opportunities for simple, low cost providers to win share. A multitude of new software offerings has emerged across all categories of the Ecosystem, engaging smaller firms with fresh approaches to existing challenges, lower price tags, and cloud-hosting, leading to significantly easier and cheaper implementation and maintenance.

Within the Control Room, current vendor dynamics in Wellsite Monitoring is representative of how low-end displacement is occurring among small operators. The preeminent vendors in Wellsite Monitoring are Weatherford, Cameron, and Halliburton. These providers traditionally cater to large customers by building out massive SCADA networks to distribute production data from the well. In the past only large firms could afford the full offering which included hardware for use at the wellsite, telemetry-based SCADA networks, and service contracts exceeding seven-figures. Cloud-based platforms — through partnerships with leading hardware and network providers — have emerged enabling small operators to capture and monitor production data at the wellhead, as opposed to slower, resource-intensive methods like pad and paper or mobile field data capture. Bottom line, Wellsite Monitoring solutions are not only for large operators anymore. As the growing small segment becomes more addressable, emerging vendors in the space are ripe for the picking.

This is one of many examples where large incumbents currently are not able to serve the entirety of the Oil & Gas market. This leads to the question, “How will these entrenched incumbents behave?” Will they start to acquire and roll-up smaller offerings? Will they create their own competing offerings? Or, will they allow smaller providers to penetrate the low-end market, so long as they do not encroach on core major and large independent customers? Based on the volume of strategic roll-ups by entrenched vendors in the past, this continued behavior should be expected. Indeed, prospective investors with a limited footprint in the space will face some competitive headwinds.

In summary, there are a few things investors can be certain of moving forward:

Since the price crash, technology has become a critical lever for profitability; as prices remain suppressed, technology strategy will continue to be a C-suite consideration for operators of all sizes. Operator budgets will prioritize software that optimizes production and profitability over drilling and exploration solutions. Across each category of the Oil & Gas Production Software Ecosystem, opportunities are being created as more small operators come online and solutions become more broadly addressable. There will be disruption of the larger incumbents by smaller low-end software players. Capturing new customers and disrupting larger vendors could lead to some consolidation or creation of competing low-end offerings.

Investors should keep these key trends top of mind when evaluating potential opportunities and must move fast, as the M&A landscape will be competitive. The solutions that are aligned to market trends and address prevalent user pain points will be attractive roll-ups to both incumbent vendors and outside investors alike.