Share

Divestitures, Carve-outs, and Private Equity

Corporations looking to sell assets and raise additional cash in Q2-Q4 2020, have a waiting set of buyers in private equity with substantial dry powder and a lot of cash is building with investors across the globe. Sellers will be significantly more successful with those exits and capital raises if they have the market and customer data to back up the potential value of the asset. With 25 years of working for large-cap/mid-cap PE and credit investors and a lot of management teams, including great successes within stressed situations, we think we have something to add to the conversation.

Why?

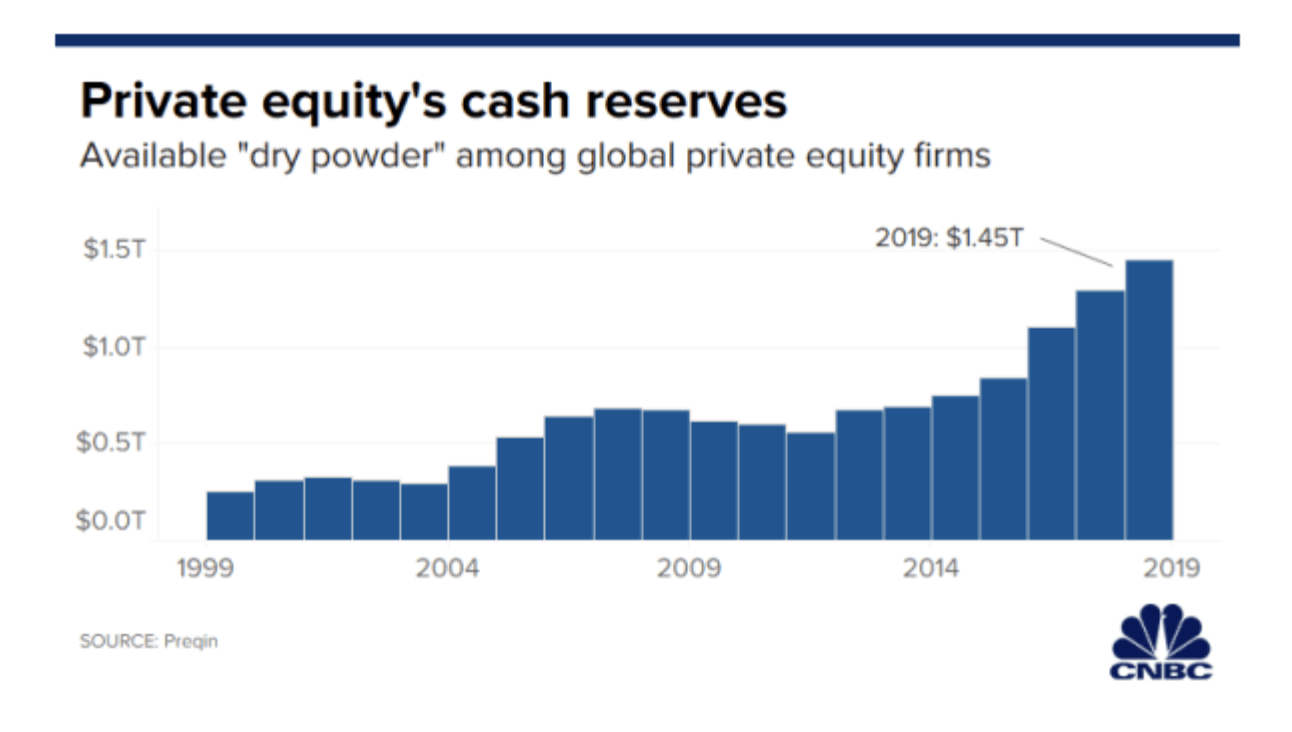

Private equity has $1.5T in cash to buy companies and provide credit as recently cited in CNBC. They are looking for good assets to buy and this includes companies with a balance sheet that might be challenged in the short term. Private equity firms are also juggling the opportunities they see in credits/loans coming to market that are discounted to the original price, possibly on assets they have seen before. And, PE firms are rapidly assessing their own portfolio companies that may need new equity or where they can buy discounted debt on companies they already own. So yes, PE has a lot of dry powder, but you will have to break through the noise to get them focused on your deal.

If you want to get sufficient attention to get serious bidders and either a reasonable price or better chance of closing in today’s market, you will need the following:

- Back up of historical data and performance, which can be extracted from internal systems.

- The market data, including TAM (Total Addressable Market), and the emerging landscape, including competitive positioning.

- Recent primary research with customers. Why they see the need or will continue to see the need, highlighting the resilience of the business. Also, how they are faring, when they will come back to sustainable strength and then to reasonable spend levels of normal market conditions.

- Growth opportunities given the current positioning and when markets return. This can include assets that can be grown, monetized, or leveraged either with more capital or when markets return.

You, the seller or company raising capital, need the facts to show potential investors that they can “invest now or wish you did.”

Why do you need a third party?

More than a third party, a firm that has street credibility with experienced investors, PE buyers, and lenders. Given the volume of work coming the way of PE firms, they will need a way to triage incoming deals and use their limited people resources to focus on what they think should be resilient companies. They need market data to know if your company is one of those, and they don’t have the hours in the day to do an initial deep dive on any company, without a good reason.

Statistically speaking private equity analysts, associates, senior associates, and half of the VPs were not in the workforce in the last recession, let alone owning assets. These individuals are exceptionally bright and analytical, they obtained significant hands-on experience early in their careers and are within broader teams that have plenty of battle scars. But we’re all in uncharted waters now. There is a lot for investors to sift through in terms of companies raising capital and for investment teams to get their arms around the rapidly changing dynamics in your market. They won’t have the time to take a deep dive into every opportunity that comes their way. To get your deal to the head of the line, you need a credible view of the market that lays things out – the good, the obvious questions, and the answers to the best that they can be answered. If a deal team can have some confidence that ‘there could be a there-there,’ the deal teams can go to their credit committee to request diligence resources to really dig into your deal.

In our experience on the buy side for 25 years with large-cap/mid-cap private equity and credit and debt funds, we know that even when a deal looks good, the lenders want a readout on our diligence and that will certainly increase this year. We also know which sell-side market reports investors trust and which they toss to the wayside. It pains us to see and hear of management teams rolling their eyes when questioned about a sell-side market study presented on their behalf, even if this is often a reason Stax is engaged on the buy-side. Sure, we understand being aggressive, but in current markets, that can just backfire because serious investors will be even more prudent with their time this year.

Shouldn’t the investment bank do this?

Sometimes they have enough data, it’s a niche business for a known set of buyers, or in a hot market, it isn’t required, nor is the independent view. Investment banks frequently bring in consulting firms and it is a good partnership. They do so because as an example, they aren’t staffed with teams to conduct a deep analysis on what we call “quality of customer revenue,” which includes analyzing customer spend, growth and churn, conducting the in-depth competitive analysis, and primary research to validate the TAM and company resiliency, competitive positioning, and voice of customer. And investment banks are the selling party, so the independent substantiation has great value. Is it always all easy? No – there is a normal tension, but it is usually highly productive in getting great results and a smooth process where management really has the data to back up claims, and better outcomes.

With corporate carve-outs, exit plans, and capital raises, we advise clients on more than the research plan and positioning. We help management and investment bankers have the facts, positives and headwinds, and prepare management with the data to tell their story so that the overall process is more effective. This leads to better participation, clearer and more focused discussions, and better chances for success.