Trash to Treasure: Investing in the Waste Management & Recycling Industry

Trash to Treasure: Investing in the Waste Management & Recycling Industry

Waste Management Market Landscape

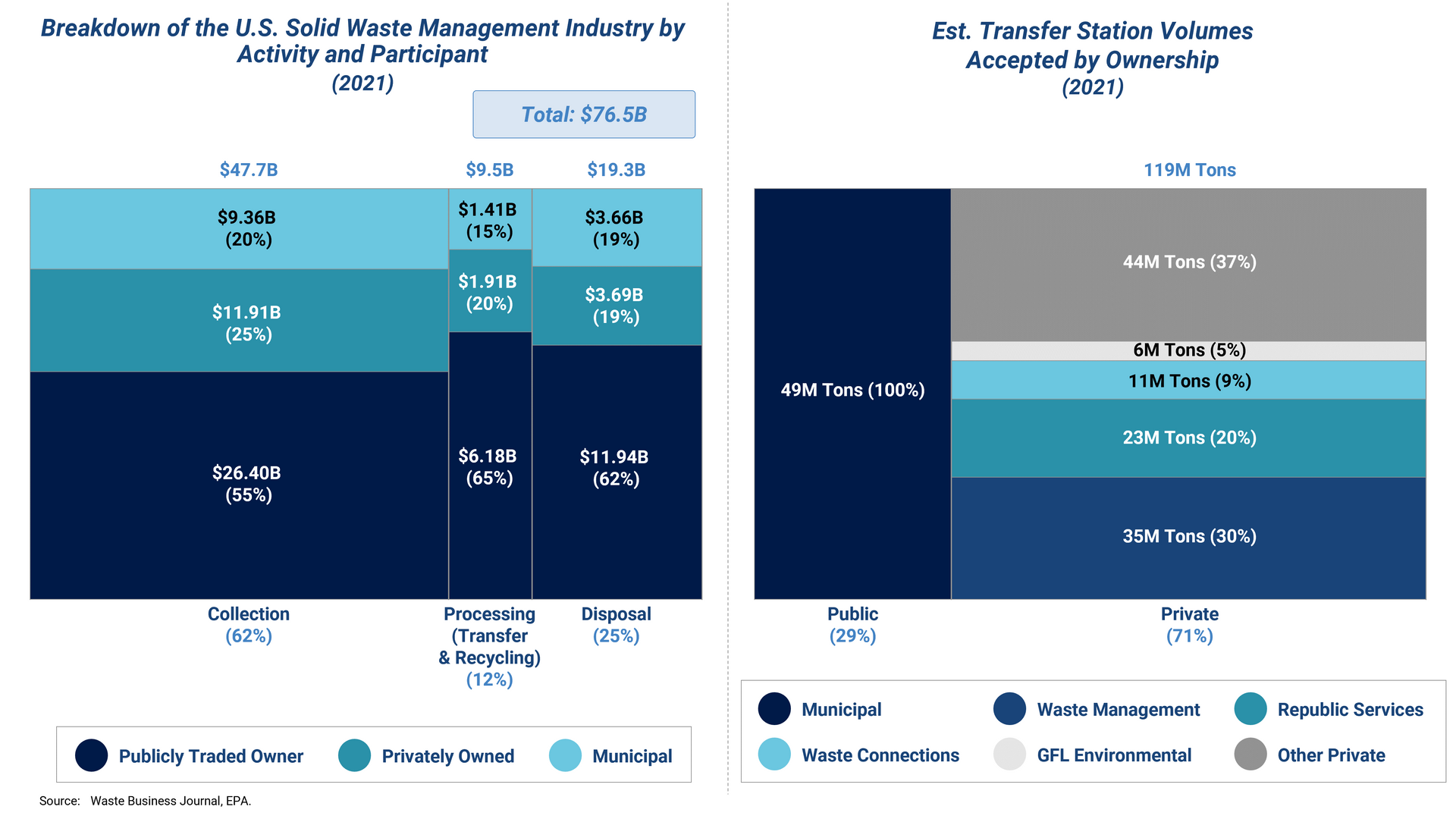

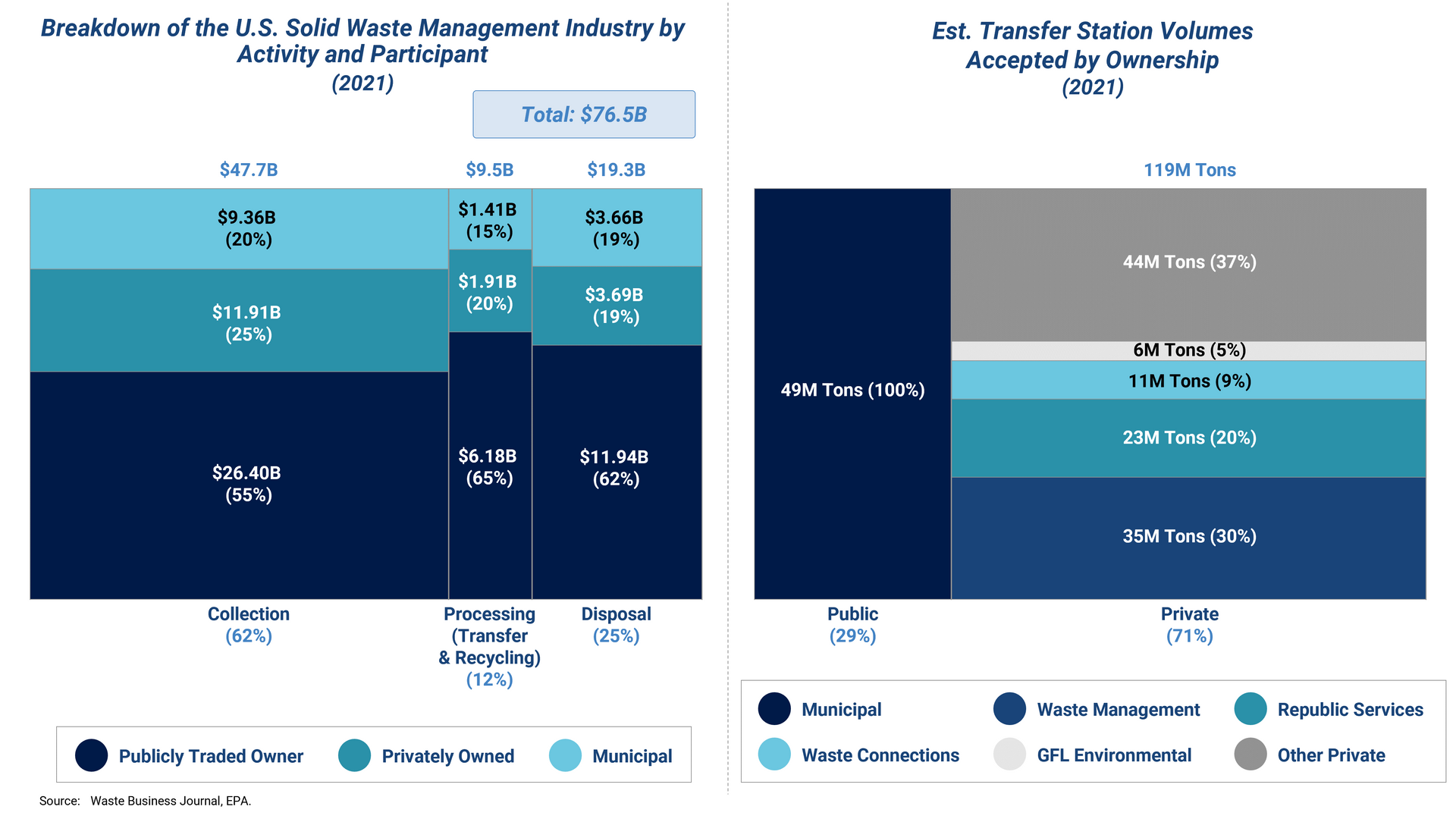

The market for solid waste management is vast. In 2023, participants earned more than $75B across collection, processing, and disposal activities—not including further revenue from “supporting” products and services (e.g., technology, consumables, equipment, etc.). Stax works with investors who are pursuing a range of strategies in this space. Our experience has provided us with insights for the overall market and value chain for waste management/recycling, as well as a framework for approaching the investment opportunity landscape.

Many would argue that waste management is a mature market–perhaps too mature to harbor significant investment opportunity. Leading players (Waste Management, Republic) have long since consolidated the activity chain…

Waste Management Market Landscape

The market for solid waste management is vast. In 2023, participants earned more than $75B across collection, processing, and disposal activities—not including further revenue from “supporting” products and services (e.g., technology, consumables, equipment, etc.). Stax works with investors who are pursuing a range of strategies in this space. Our experience has provided us with insights for the overall market and value chain for waste management/recycling, as well as a framework for approaching the investment opportunity landscape.

Many would argue that waste management is a mature market–perhaps too mature to harbor significant investment opportunity. Leading players (Waste Management, Republic) have long since consolidated the activity chain…

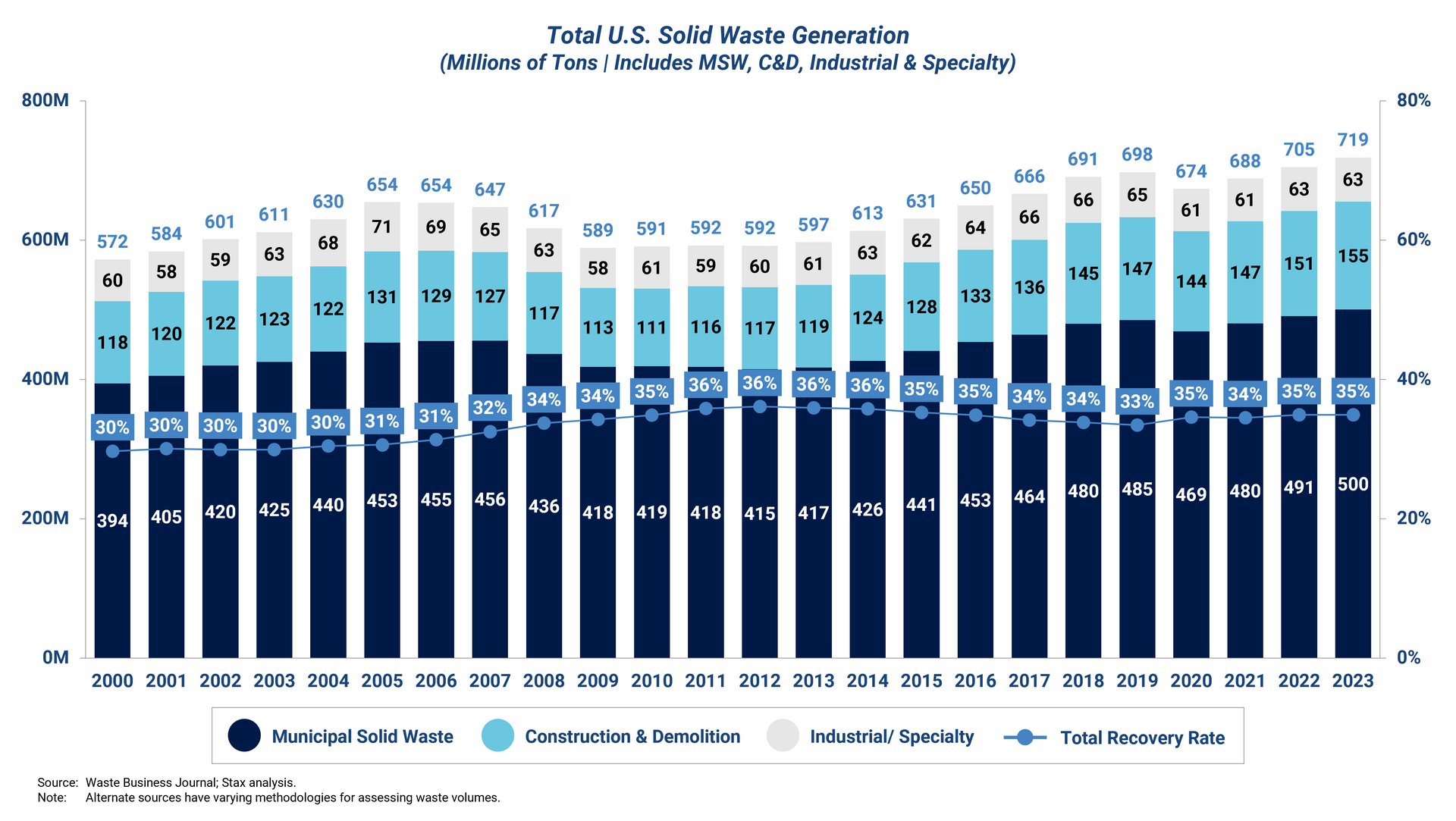

…and actual waste generation is steadily growing in the low single digits. Moreover, overall recovery rates (i.e., the percentage of volume that is recycled) have remained stubbornly unchanged for nearly two decades.

Diverse Opportunities Driving Continued Investor Interest

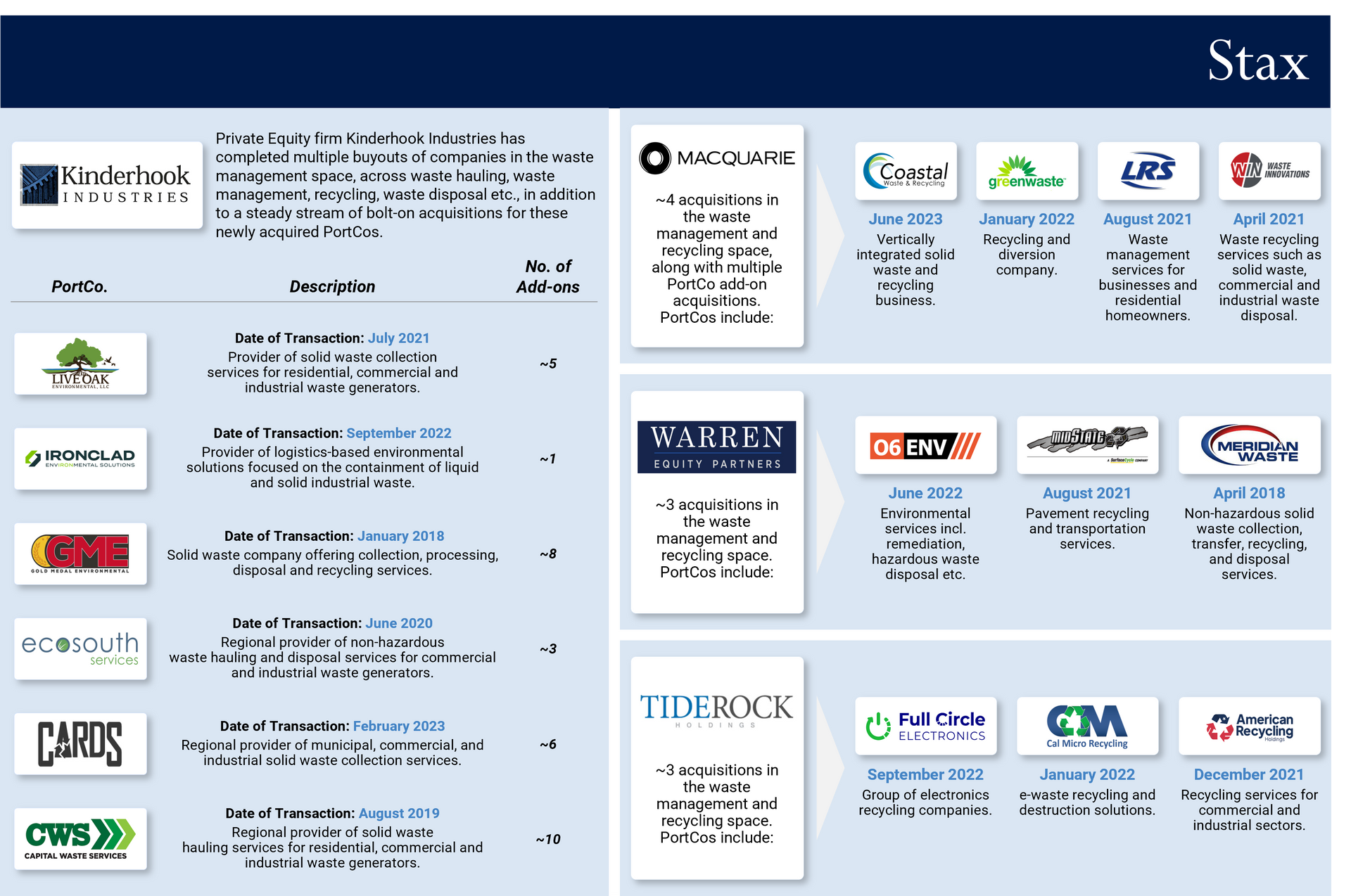

Nonetheless, private equity interest in the waste management space remains elevated, and we continue to see the development of new platforms. Notable recent acquisitions include buyouts completed by Kinderhook, Macquarie, Warren Equity Partners, and Tide Rock Holdings.

Investor interest is driven in part by the sheer size of the market. Even a modest amount of fragmentation in a market this large implies the presence of numerous investable assets. In addition, the breadth of the waste management value chain presents a surprising range of investment angles which often fly under the radar:

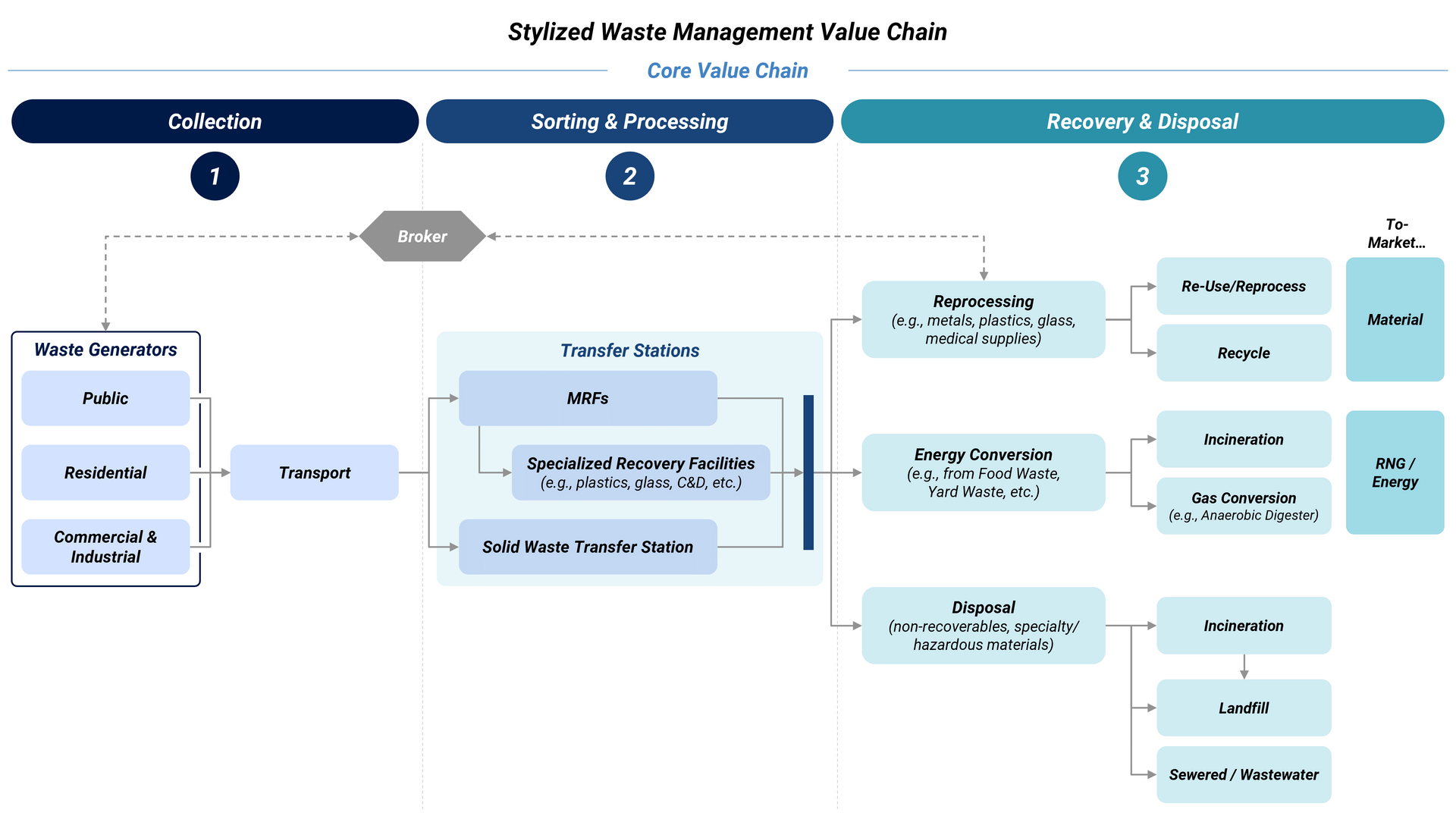

The “core” value chain is composed of three basic activities:

- Collection: Populated by route-based businesses that conduct scheduled or ad-hoc pick-ups from generators. Contracts are established with a range of end-customers (municipalities, commercial establishments, industrial sites, construction sites, etc.).

- Participants often specialize by waste stream (municipal solid waste, recycled materials, medical waste, chemicals / greases, environmental waste, etc.) given the need for different equipment, certifications, labor, and go-to-market strategies.

- Sorting & Processing: Intermediate facilities take custody of the waste or recycled material, isolate the waste streams, and direct them to the next destination. They take the form of transfer stations (municipal waste), material recovery facilities (recycling streams) and other specialized facilities.

- Recovery & Disposal: Waste materials are either disposed of (e.g., landfilled, incinerated) or reprocessed and recovered at specialized facilities. Especially with landfills, permitting new locations is notoriously difficult—positioning incumbent facility owners for growing pricing power over time.

When investors think of waste management, often they envision the geographic roll-up and vertical integration strategies which are prominent in the “core” value chain.

However, diverse business models found in upstream products and services offer other ways to play. For example, Stax has supported investor interest in assets ranging from manufacturers of collection truck lift arms to vendors of waste collection route optimization software. These “support” businesses benefit from exposure to a recession-resistant sector and favorable competitive dynamics.

While some of these assets are positioned for stable single digit growth—in line with underlying waste volumes—others are out in front of significant trends that are driving outsized demand for their offerings. A few examples include:

- Zero-Waste Initiatives: Corporate boardrooms and government agencies continue to push “Zero Waste” initiatives, with a long-term goal of reducing landfilled volumes, presenting opportunity for diversion/reverse logistics programs (e.g., ITAD), sorting & processing infrastructure, waste-to-energy (e.g., anaerobic digestion, RNG), and remanufactured products.

- Evolving Regulation: Regulatory trends span numerous topics—from state bottle laws and reimbursement rates to tightening rules around waste handling. Illustratively, the EPA’s roadmap to curtail PFAS contamination presents a major opportunity for remediation services and monitoring technologies.

- Automation & Efficiency:

Labor and energy costs are a major concern for operators in the collection, sorting, and disposal layer. Accordingly, there is growing interest in technologies that reduce cost, such as optical sorting equipment for MRFs, automated lift arms for collection trucks, and even support services like specialist staffing agencies.

Some of the more successful investment strategies Stax has supported in the space include these upstream businesses—whether they are mature, steady growers or assets benefiting from rapid adoption trends. We have also seen successes within the core value chain—particularly for collection, processing, and disposal assets focused on specialist waste streams and/or narrow geographies. We categorize these strategies into three overarching themes:

Overview: Assets that focus on more conscribed segments such as a specific region, specific waster stream, or other specific market segments.

Reasons to believe:

- Roll up potential.

- Specialized and/or smaller assets may see less competition from diversified strategies, improving investment conditions.

- Narrowly focused specialists may have more right to synergistically extend their offering within their customer base than less-focused peers.

Examples:

- Medical Waste Collections Services

- Hazardous Waste Landfill Operator

- Beverage Destruction Services

Overview: Slower organic growth assets which focus on supporting or enablement services, solutions, or infrastructure for the waste management industry.

Reasons to believe:

- There is an extensive set of edge-assets which support providers across the value chain, and which see less competition for acquisition from strategics (i.e., traditional players typically prefer being customers vs integrating).

- Selling into a consolidated customer base with similar needs implies room to build platforms, rolling in similar assets or extending offerings.

Examples:

- Dumpster Manufacturer

- Manufacturer of Baling Wire for Recyclers

- Tank Cleaning Services

Overview: Assets that have offerings aligned to emerging technologies and trends such as zero waste, gas recapture/environmental health, and automation.

Reasons to believe:

- Spend allocation will continue to shift within waste management in response to emerging and continuing trends driven by corporate ESG, regulations, and labor constraints.

Examples:

- Route Management Software

- Manufacturer of Novel Landfill Cover Materials

- Manufacturer of Automated Sortation Equipment

Conclusion

We believe the solid waste management industry continues to present substantial, attractive opportunities to investors despite a relatively consolidated environment and limited growth in waste generation. Our team at Stax is experienced in a variety of industries, including Business Services and Industrials, with specializations across niche subsectors. To learn more about our expertise, or if you’re interested in investing with Stax, visit www.stax.com or click here to contact us directly.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy