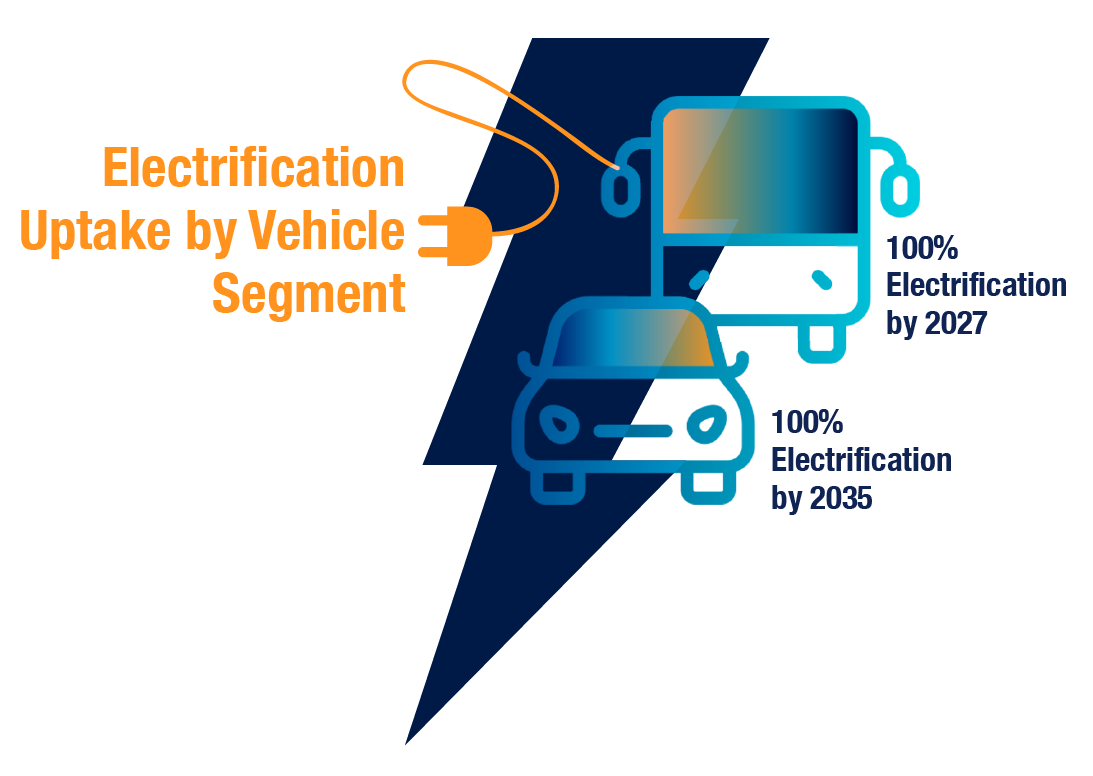

Furthermore, the global EV battery market is undergoing transformations. Historically, the primary demand for EV batteries came from private car and SUV manufacturers. However, there is now a growing demand from public transit and shared mobility companies. The EU Federation for Transport and Environment predicts all buses in the EU will be electrified by 2027, as opposed cars which is expected to reach 100% electrification by 2035. Which places the full electrification of cars 8 years behind buses in the EU. Cities worldwide are prioritizing eco-friendly public transit and shared mobility. For instance, India is promoting the adoption of electric buses in its public transport networks, with ambitious plans to deploy 50,000 electric buses nationwide within five years. Market projections suggest that the Global Electric Bus Market could reach $121.2B by 2030.

Charging Forward: The Electrifying Rise and Ripple of the U.S. EV Ecosystem

Charging Forward: The Electrifying Rise and Ripple of the U.S. EV Ecosystem

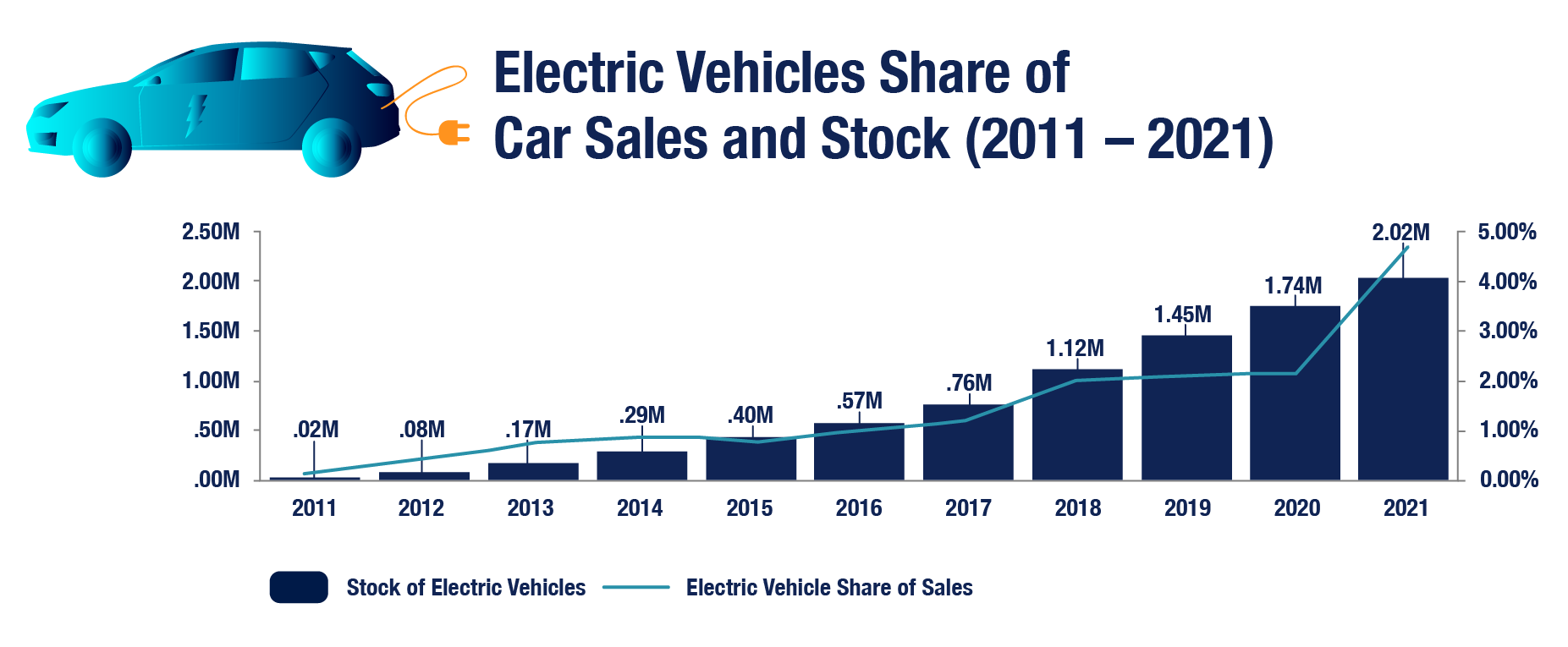

From Niche-to-Norm: A Decade of Dynamic EV Growth

Electric vehicles (EVs) are gaining significant traction in the U.S. automotive market. Every passing year sees a surge in their popularity, with projections estimating by 2034 EVs could represent 40% to 50% of all vehicles on the road. From 2011–2021, the EV market experienced an impressive CAGR of 36% in sales, while the stock of electric vehicles grew at an even more substantial CAGR of 49%.

Powering the Shift: Why Consumers are Plugging into the EV Trend

Numerous factors are steering consumers towards electric vehicles. Recent surveys, including a 2021 YouGov poll and a 2021 CarMax survey, highlighted environmental protection as a top reason for considering EVs. Many car owners view EVs as a significant advancement in reducing harmful emissions.

The growing diversity of EV models also adds to their appeal. With a more extensive range expected to be unveiled by 2024, consumers, particularly those interested in larger vehicles like SUVs and pickup trucks, now find EVs more attractive. Additionally, advancements in technology have mitigated previous concerns related to EVs. Research by the EPA indicates that from 2011 to 2021, the maximum range of an EV surged by 330%, substantially reducing the "range anxiety" once associated with these vehicles. As a result, this has sparked interest even among consumers who frequently travel long distances and were previously hesitant about EV adoption.

Furthermore, potential cost savings are making EVs more attractive. Reports from 2020 indicated EV owners could save around $4,700 on fuel over the first seven years, a fact further underscored by rising fuel costs in the U.S.

The Ripple Beyond the Road: How EVs are Energizing the Value Chain

The growing enthusiasm for EVs extends beyond just the vehicles themselves. It has spurred growth potential across the entire EV value chain, spanning segments like lithium supply, battery manufacturing, and the broader EV manufacturing process.

Over the next 5 to 7 years, these segments are poised for growth, with projected CAGRs of 20.4% for lithium supply, 19.9% for battery manufacturing, and 13.7% for EV manufacturing. Several trends are influencing these value chain components, making it crucial for investors to stay well-informed about them.

For instance, beyond the surge in EV demand, there's a growing preference for energy storage solutions linked to renewable energy production. This trend is expected to significantly benefit lithium supply companies, a vital component of the EV value chain. According to the U.S. Energy Information Administration (EIA), both production and consumption of renewable energy reached record highs in 2021. Driven primarily by solar and wind energy, U.S. renewable energy consumption is predicted to approach approximately 22 quads by 2030. The U.S. Department of Energy forecasts that the annual energy storage market for stationary and transportation sectors will quadruple by 2030.

Lastly, a collaborative spirit is being embraced by EV manufacturers. They are collaborating to develop a unified charging network that allows various vehicle brands to share charging stations. Since Tesla currently dominates the U.S. EV charging infrastructure, seven automakers united in July 2023 to establish a company that would create a shared EV charging network in the U.S., intending to challenge Tesla's predominance and leverage Biden administration subsidies. This collaborative venture intends to roll out 30,000 chargers across North America, targeting major highways and urban centers. Such collaborations aim to further improve the EV ecosystem and make it more user-friendly, ultimately driving greater EV adoption.

Investment Ignition: Navigating Opportunities in the EV Ecosystem

Given these developments, the EV value chain offers a plethora of opportunities for private equity firms and corporate investors. However, making informed investment decisions requires a thorough understanding of various facets.

Potential investors must appreciate the environmental implications of EV manufacturing and the intricacies of its supply chain. Crucial areas for consideration include anticipating regulatory shifts, grasping public sentiment, evaluating reputational risks, assessing scalability of emerging EV players versus industry veterans, and understanding differentiation in a market flooded with globally renowned brands.

Moreover, while the current regulatory environment is boosting EV demand, potential pitfalls, such as market saturation and elevated transaction prices, cannot be overlooked. Rigorous due diligence becomes paramount in such a landscape, ensuring investments are not made at inflated prices in a potentially overheated market.

In conclusion, in the ever-evolving EV industry, which offers a myriad of investment opportunities, it is essential for private equity firms and corporate investors to be equipped with comprehensive knowledge. Engaging management consultants to conduct thorough due diligence becomes crucial to navigate this dynamic and promising market effectively.

Stax, a global strategy consulting firm, has extensive experience in the EV market where our team of experts has led numerous diligences for clients. To learn more about Stax, our services, and expertise, visit www.stax.com or contact us by clicking here.

-

Sources

- “Charging into the Future: The Transition to Electric Vehicles,” U.S. Bureau of Labor Statistics, Apr. 2014.

- “US EV Sales 2022,” Counterpoint Research, Feb. 2022.

- “Model Year 2021 Electric Vehicle with the Longest Range,” U.S. Department of Energy, Jan. 2022.

- “Electric Vehicle Ownership Costs,” Consumer Reports, Oct. 2020.

- “Top US Lithium Stocks,” Investing News, Aug. 2021.

- “Lithium Metal Market Analysis,” Markets and Markets, Dec. 2022.

- “Energy Storage Market Report 2020,” U.S. Department of Energy, Dec. 2020.

- “Electric Vehicle Battery Market Overview,” Markets and Markets, Jan. 2023.

- “Electric Vehicle Market Trends,” Markets and Markets, Nov. 2022.

- “US Energy Facts,” U.S. Energy Information Administration, Jan. 2021.

- “US Renewable Energy Factsheet,” University of Michigan, Jun. 2021.

- “Battery Metals Demand from Electrifying Passenger Transport,” Transport & Environment, Jul. 2023.

- “Electric Vehicle Battery Recycling Market Trends,” Precedence Research, Mar. 2022.

- “Growing Demand for EVs and The Future of the Industry,” Driivz, May 2022.

- “In Challenge to Tesla, Automakers Launch US EV Charging Network,” Reuters, Jul. 26, 2023.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy