Share

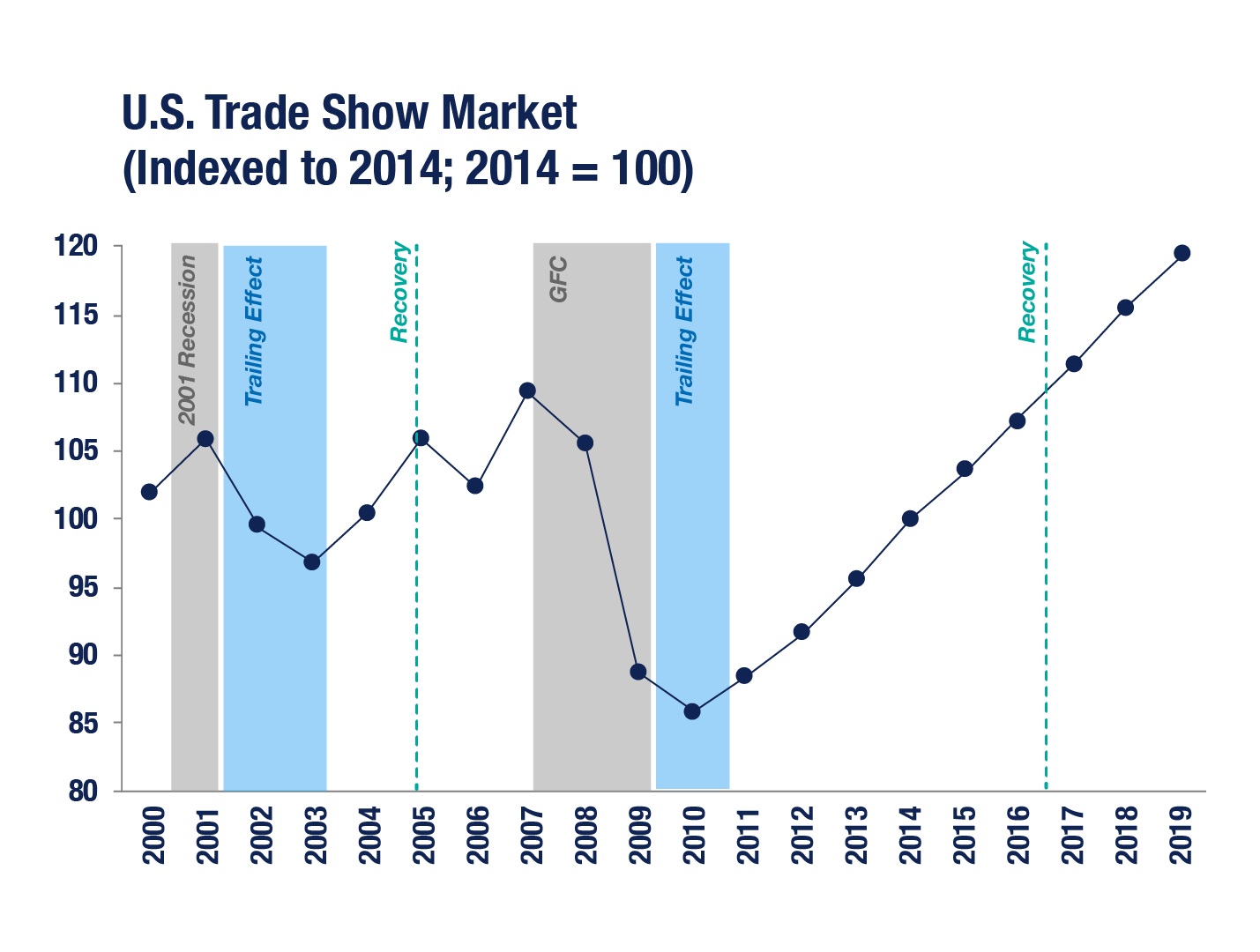

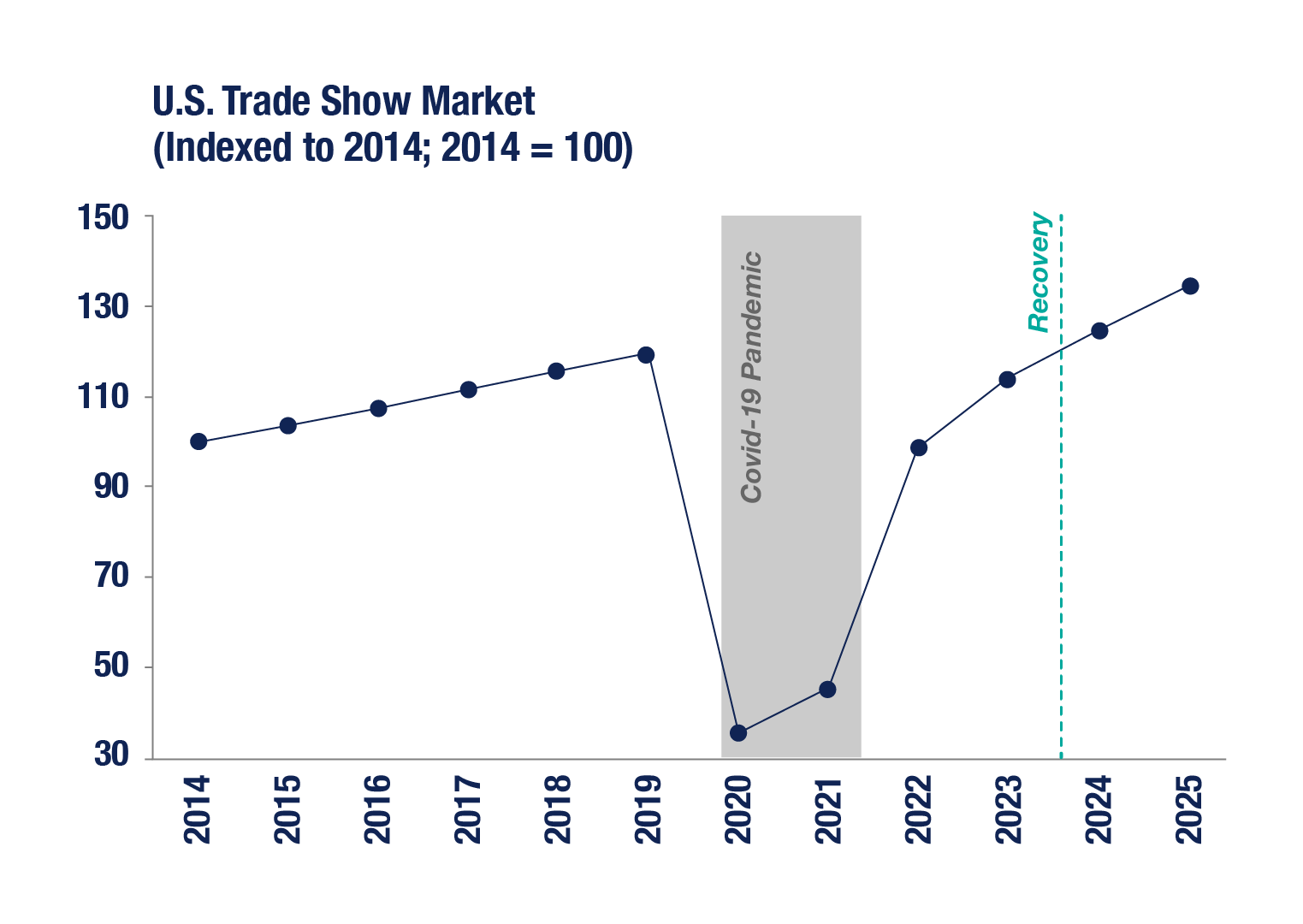

The events industry typically follows underlying economic indicators. Historically, the U.S. trade show market declined during the early 2000s recession and the Great Financial Crisis; it took 3-4 years for the market to recover from the 2001 recession, and nearly a decade to recover from the 2008 recession. That said, amid discussions of a potential recession, Covid’s unique influence on this market over the last three years may see mitigated impact given latent demand from cancelled events and renewed appreciation for in-person interactions. This is true of all B2B event types, with companies keen to reconnect with suppliers and customers after prolonged restrictions, and the unique value of face-to-face proven once again.

Stax has built up a wealth of data on the recessionary impact on various types of events, spanning different countries and end-markets. This dataset has been accumulated through decades of in-depth research serving as trusted advisors to stakeholders across the events ecosystem.

Historical Recessionary Impact

The influence of economic fluctuations on the events market is a well-established pattern that generally follows GDP. This impact operates as a trailing indicator due to the extended planning timelines for events. Consequently, during economic downturns, event spend tends to be one of the last areas where cutbacks are made. Conversely, when the economy starts to recover, it often takes some time for event spending to bounce back. This trend has been consistently observed during the historical context of different recessions.

Early 2000s Recession (2001)

The exhibition market declined by a net 9% between 2001 and 2003 (compared to a GDP net growth of 8%). The market reached 2001 levels by 2005.

Great Financial Crisis (2008-2009)

The Great Financial Crisis (GFC) of 2008 also left its mark on the event industry. The trade show market encountered a decline of ~3% in 2008, followed by a more significant decline of ~16% in 2009, as companies sought to reduce expenditures on activities deemed non-essential, including travel and events-based marketing. This contraction affected all sectors, although government and healthcare sectors displayed relatively greater resilience. It took nearly a decade for the market to fully recover from the aftermath of the recession.

Covid-19 Pandemic (2020)

The outbreak of Covid presented an unprecedented challenge to the events industry. The trade show market experienced a sharp decline of ~70% between 2019 and 2020 due to restrictions on in-person gatherings, mandated by both governments and corporations. Based on Stax analysis of event-level data, trade shows were impacted significantly more compared to other event formats such as corporate events, owing to their scale and relative dispensability in a health and cost-conscious environment.

In the wake of the pandemic, the events market has shown resilience. While virtual events acted as temporary substitutes, they could not fully replace the value of in-person gatherings. The strong resurgence of face-to-face events since Covid-driven restrictions have been lifted is testament to the superior ROI compared to virtual events. The market has demonstrated a healthy recovery trajectory, anticipated to recover to 2019 levels by 2024.

Predicted Recessionary Impact

The potential impact of a recession on the events industry remains a topic of discussion, with the anticipation that the market could experience a slowdown. However, it is worth noting that the impact might be less pronounced than historical trends would suggest due to the unique influence of the pandemic.

Specifically, the market is still seeing latent demand, which is driving companies to pursue their events agenda despite potential recessionary concerns. This is also augmented by the renewed appreciation for the value of in-person events, given the extended hiatus. Further, in light of the market's unpredictability during Covid, companies are currently more at ease with navigating uncertain market dynamics. The prevailing sentiment is one of “wait-and-see,” rather than pulling back on budgets pre-maturely.

Still, certain segments of the market will show greater resilience than others. Certain event sizes and types will be prioritized over others given budget cuts. For example, larger, “must-attend” events are expected to see greater resilience compared to mid-sized/smaller events. Furthermore, while participation levels may be maintained, companies spend at events may decline in the form of reduced sponsorship, booth spend, etc.

The post-recession recovery trajectory of events is significantly influenced by the markets they serve. Here are some key insights:

- Pharmaceuticals/Biotechnology Companies: These industries are unlikely to significantly reduce their events spend. Historically, their end-markets have shown resilience during economic downturns (e.g., consistent 3-5% YoY growth rates during the Great Financial Crisis). Additionally, events play a pivotal role in their go-to-market strategies.

- Government and Non-Profit Organizations: They tend to maintain their event attendance during recessions because their clientele values in-person interactions, making it a priority for them.

- Tech Companies: While not inherently recession-resistant, larger tech corporations strategically approach events. They see events as opportunities to demonstrate stability and market presence, even in challenging economic times. This approach helps alleviate potential concerns among customers and the market, reinforcing confidence and continuity.

Stax’s Experience in Events

Stax is the global leader in strategy consulting for the events industry. Our mission is to create value for our clients across the events ecosystem and guide transformation.

With a 30-year track record, Stax offers strategic support to corporates and private equity firms across the events landscape. Stax is the go-to strategic advisor for the world’s leading organizers, venues, service providers, event tech, and investors, offering support for transactions and value creation. Our work is rooted in market and customer understanding, enriched by our unrivalled expertise across the events sector. Additionally, we also publish the annual Globex report, widely recognized as the definitive resource on market dynamics by international organizers and investors.