Repatriation for Education: A Tax-Reform Game Changer

Repatriation for Education: A Tax-Reform Game Changer

Allowing U.S. companies to repatriate their profits in a tax-free manner – if used for job-related education – would drive far more national value than the tax-repatriation policy currently being proposed by Congress. History has proven and Wall Street has already declared that with the current repatriation proposals, which range from a 10 percent to-14.5 percent tax rate paid over several years, we’ll see little in terms of job creation and mixed results in terms of long-term shareholder value.

Cheap repatriation schemes have resulted primarily in share buybacks and one-time dividends, creating almost no jobs and or real new investment in the United States. Instead, tax-free repatriation for education should be added to the current tax bill as an alternative option for companies to utilize.

Our economy and U.S. companies need skilled talent more than cash. Structured correctly, this kind of corporate-directed tax benefit for education can deliver greater long-term value to U.S. companies and shareholders, more value to our economy and more and better jobs than previous repatriation initiatives, which did little of any of the above. With $2.7 trillion in total potential to repatriate, we can create a massive long-term benefit for job growth and our education infrastructure (i.e., program development, number of educators, etc.) as well as improve our companies and strengthen our workforce.

Of the $2.7 trillion in un-repatriated profits, more than half of the funds are held by just 50 companies. The companies span industries and include Apple, Pfizer, Microsoft, GE, IBM, Johnson & Johnson, Merck, Exxon, Google, Citigroup, Honeywell, Caterpillar and HP. Many of these companies are also big proponents for improving American education and expanding visas to bring talent to the U.S. Indeed, the U.S. business community at large agrees on the need for more talented workers, with 46 percent of U.S. employers having a difficult time filling jobs. A survey of CIOs in the U.S. reported that 64 percent of IT leaders in the U.S. said that skills shortages were holding them back.

To solve this problem, companies should be permitted to repatriate some of their money tax-free and deploy those funds tax-free over four years if used for job-related education and training. To qualify for the tax break, the amount would have to exceed the average of the company’s prior three years of spending on training and education and should be used for non-executive training. The money could be used for anything from technical and engineering education to providing scholarships for high school students and post-secondary education, whether management-oriented or vocationally oriented. For current employees, training could be provided on advanced manufacturing, general workforce technology skills, IT, marketing, sales and service and product development.

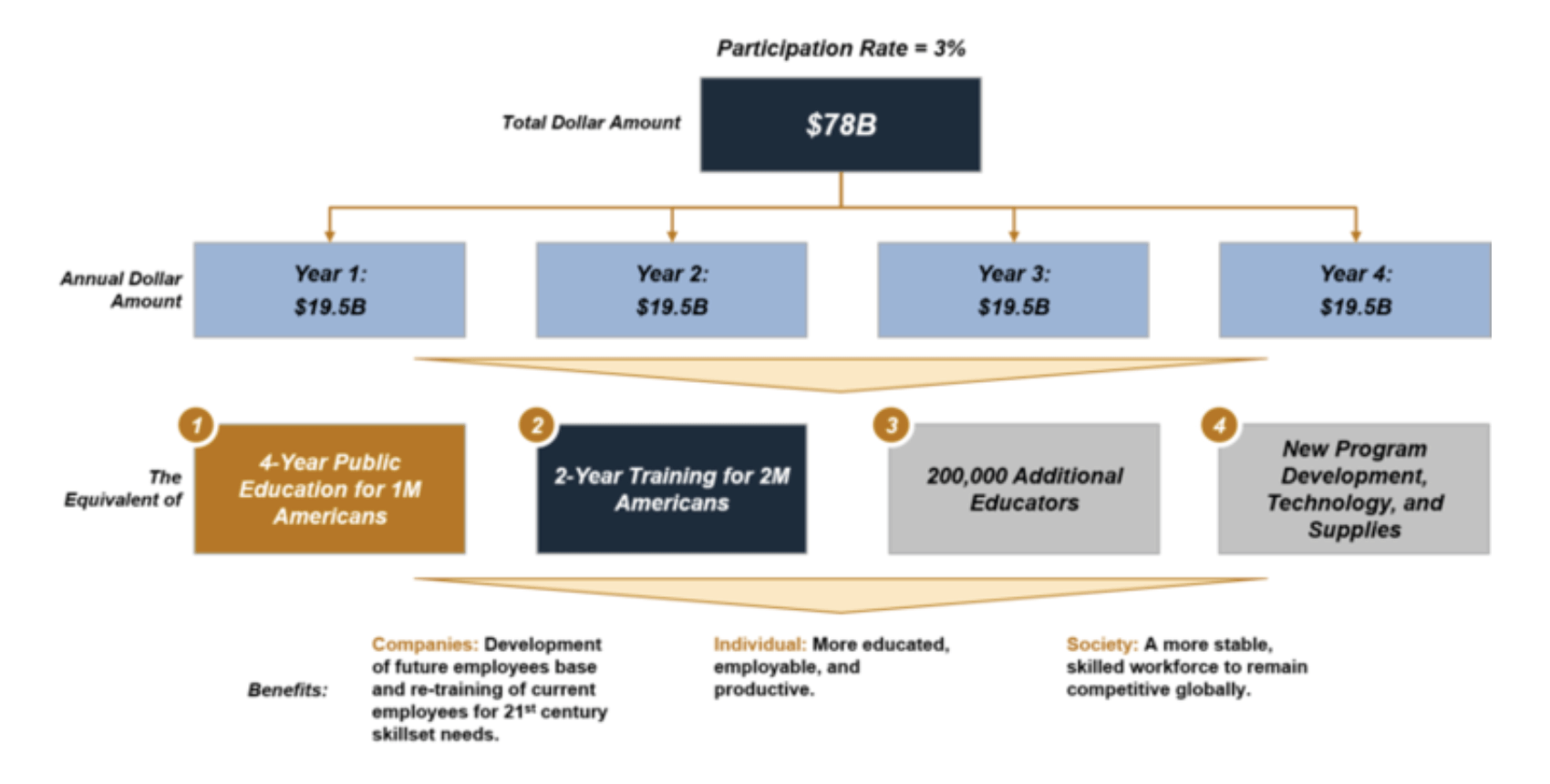

Here is some perspective on the impact businesses could have on American education and the economy, even with low participation. For starters, a 3 percent participation rate would be equivalent to $78 billion and 18 times the size of Race to the Top and equivalent to 5.5 percent of the entire U.S. student loan debt load. Now, imagine if that was a corporate investment that students knew would be paid back? A 3 percent participation rate would be the equivalent of infusing the following into the skills-based education infrastructure over four years:

The benefits to corporations are many. Companies need more skilled talent for organic growth. Capital is cheap, yet talent and skills are scarce. If companies don’t hire, they might lag the markets. If they hire people who are not yet prepared, that drags down current teams and performance and creates a difficult working atmosphere. Companies can recruit more from overseas, but that takes time and adds cost. If companies can’t fill the jobs, they outsource the whole function overseas, requiring a short-term reduction in profits for transitioning the work and loss of efficiency for the hope of a longer-term gain. Wouldn’t it be better to invest in getting it right in the U.S.?

Another major benefit for the companies with un-repatriated profits is the potential to improve their workforces who are aging or have aging skill sets and are in need of updated training or re-training.

On a national basis, if we can keep our older population working for more years, they’ll contribute more to Social Security and the tax base while drawing less from it. People who are engaged and productive need fewer health care resources, helping us manage another national cost that draws from corporate tax dollars and individual taxes. According to Fox Business, the average 50-year-old has less than $60,000 saved for retirement and more than 50 percent of Baby Boomers have less than $100,000 saved for retirement. Further, a substantial percentage of the retired population relies almost entirely on social security for their income, including 47 percent of single seniors and 22 percent of married seniors. There is no avoiding this simple math. With more people educated and having relevant skills, working longer, saving more and paying taxes, it will save our nation precious tax dollars and improve the economy.

Finally, a good number of the companies with the biggest hoards of cash to repatriate already sponsor education in a variety of manners and have proven willing to move their assets to capitalize on the value of education. GE’s relocation to Boston to be near world-class universities is just one example. These companies and their shareholders should embrace the opportunity to invest in their employees and potential employees, creating an easier path to passage for this legislation.

We have a chance to bring back funds, educate our workforce, build up our economy and strengthen our future. What could be more re-patriotic than this?

Rafi Musher is the CEO of Stax.

Read More

All Rights Reserved | Stax LLC | Powered by Flypaper | Privacy Policy